Projected Statement Form Of Business Or Professional Activties

ADVERTISEMENT

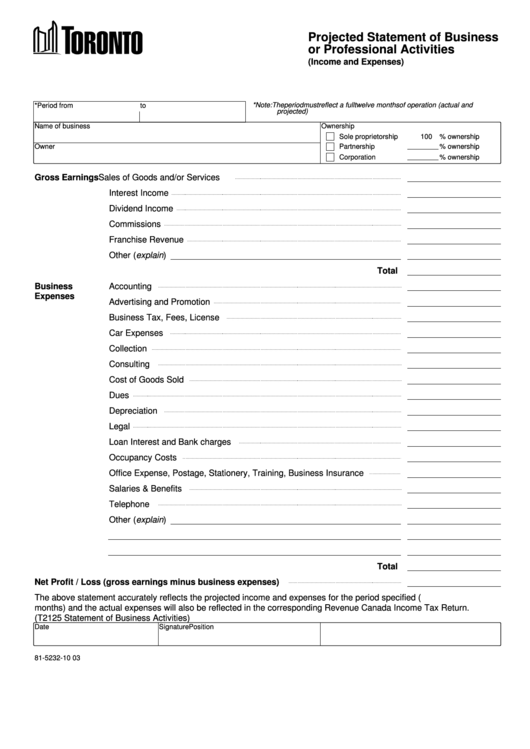

Projected Statement of Business

or Professional Activities

(Income and Expenses)

*Period from

to

*Note: The period must reflect a full twelve months of operation (actual and

projected)

Name of business

Ownership

Sole proprietorship

100

% ownership

Owner

Partnership

% ownership

Corporation

% ownership

Gross Earnings

Sales of Goods and/or Services

Interest Income

Dividend Income

Commissions

Franchise Revenue

Other (explain )

Total

Business

Accounting

Expenses

Advertising and Promotion

Business Tax, Fees, License

Car Expenses

Collection

Consulting

Cost of Goods Sold

Dues

Depreciation

Legal

Loan Interest and Bank charges

Occupancy Costs

Office Expense, Postage, Stationery, Training, Business Insurance

Salaries & Benefits

Telephone

Other (explain )

Total

Net Profit / Loss (gross earnings minus business expenses)

The above statement accurately reflects the projected income and expenses for the period specified (i.e. a full twelve

months) and the actual expenses will also be reflected in the corresponding Revenue Canada Income Tax Return.

(T2125 Statement of Business Activities)

Date

Signature

Position

81-5232-10 03

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1