Form 433-A - How To Prepare Form 433-A - West Virginia State Tax Department

ADVERTISEMENT

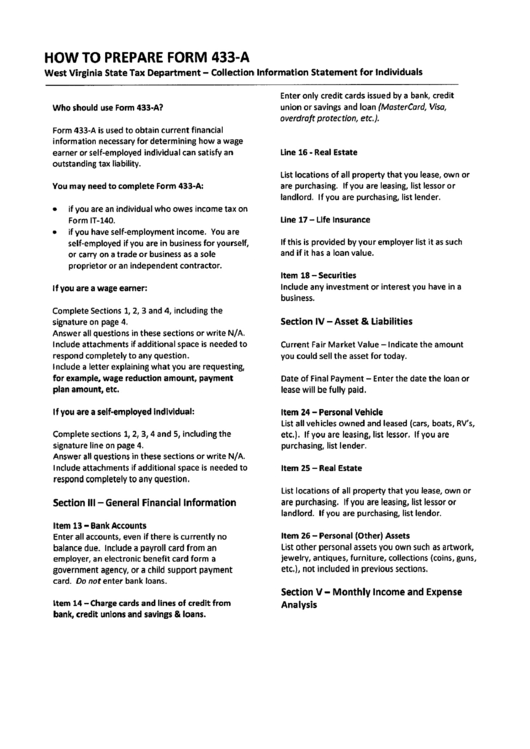

HOW TO PREPARE FORM 433-A

West Virginia State Tax Department - Collection Information Statement for Individuals

Enter only credit cards issued by a bank, credit

union or savings and loan {MasterCard, Visa,

overdraft protection, etc.).

Who should use Form 433-A?

Form 433-A is used to obtain current financial

information necessary for determining how a wage

earner or self-employed individual can satisfy an

outstanding tax liability.

You may need to complete Form 433-A:

•

if you are an individual who owes income tax on

Form IT-140.

•

if you have self-employment income. You are

self-employed if you are in business for yourself,

or carry on a trade or business as a sole

proprietor or an independent contractor.

If you are a wage earner:

Complete Sections 1, 2, 3 and 4, including the

signature on page 4.

Answer all questions in these sections or write N/A.

Include attachments if additional space is needed to

respond completely to any question.

Include a letter explaining what you are requesting,

for example, wage reduction amount, payment

plan amount, etc.

If you are a self-employed individual:

Complete sections 1, 2, 3,4 and 5, including the

signature line on page 4.

Answer all questions in these sections or write N/A.

Include attachments if additional space is needed to

respond completely to any question.

Section III - General Financial Information

Item 13 - Bank Accounts

Enter all accounts, even if there is currently no

balance due. Include a payroll card from an

employer, an electronic benefit card form a

government agency, or a child support payment

card. Do nor enter bank loans.

Item 14 - Charge cards and lines of credit from

bank, credit unions and savings & loans.

Line 16 • Real Estate

List locations of all property that you lease, own or

are purchasing. If you are leasing, list lessor or

landlord. If you are purchasing, list lender.

Line 17 - Life Insurance

If this is provided by your employer list it as such

and if it has a loan value.

Item 18-Securities

Include any investment or interest you have in a

business.

Section IV - Asset & Liabilities

Current Fair Market Value - Indicate the amount

you could sell the asset for today.

Date of Final Payment - Enter the date the loan or

lease will be fully paid.

Item 24 - Personal Vehicle

List all vehicles owned and leased (cars, boats, RV's,

etc.). If you are leasing, list lessor. If you are

purchasing, list lender.

Item 25 - Real Estate

List locations of all property that you lease, own or

are purchasing. If you are leasing, list lessor or

landlord. If you are purchasing, list lendor.

Item 26 - Personal (Other) Assets

List other personal assets you own such as artwork,

jewelry, antiques, furniture, collections (coins, guns,

etc.), not included in previous sections.

Section V - Monthly Income and Expense

Analysis

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6