Form Mf-012 - Information And Instructions

ADVERTISEMENT

Return to Form

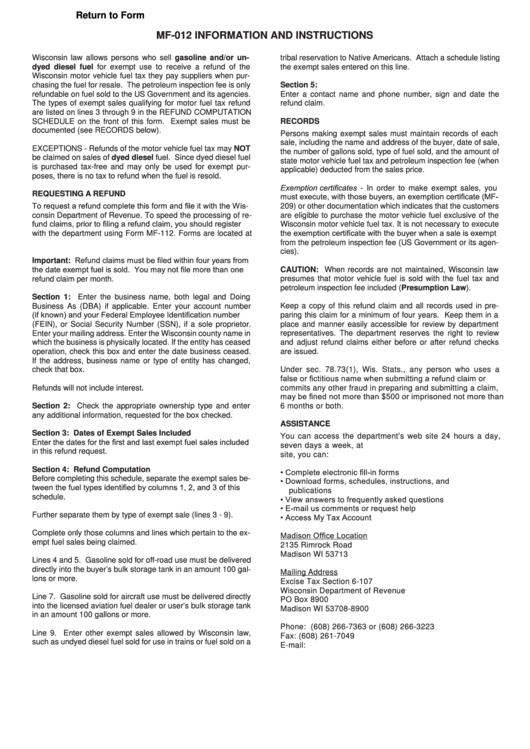

MF-012 INFORMATION AND INSTRUCTIONS

Wisconsin law allows persons who sell gasoline and/or un-

tribal reservation to Native Americans. Attach a schedule listing

dyed diesel fuel for exempt use to receive a refund of the

the exempt sales entered on this line.

Wisconsin motor vehicle fuel tax they pay suppliers when pur-

chasing the fuel for resale. The petroleum inspection fee is only

Section 5:

refundable on fuel sold to the US Government and its agencies.

Enter a contact name and phone number, sign and date the

The types of exempt sales qualifying for motor fuel tax refund

refund claim.

are listed on lines 3 through 9 in the REFUND COMPUTATION

SCHEDULE on the front of this form. Exempt sales must be

RECORDS

documented (see RECORDS below).

Persons making exempt sales must maintain records of each

sale, including the name and address of the buyer, date of sale,

EXCEPTIONS - Refunds of the motor vehicle fuel tax may NOT

the number of gallons sold, type of fuel sold, and the amount of

be claimed on sales of dyed diesel fuel. Since dyed diesel fuel

state motor vehicle fuel tax and petroleum inspection fee (when

is purchased tax-free and may only be used for exempt pur-

applicable) deducted from the sales price.

poses, there is no tax to refund when the fuel is resold.

Exemption certificates - In order to make exempt sales, you

REQUESTING A REFUND

must execute, with those buyers, an exemption certificate (MF-

To request a refund complete this form and file it with the Wis-

209) or other documentation which indicates that the customers

consin Department of Revenue. To speed the processing of re-

are eligible to purchase the motor vehicle fuel exclusive of the

fund claims, prior to filing a refund claim, you should register

Wisconsin motor vehicle fuel tax. It is not necessary to execute

the exemption certificate with the buyer when a sale is exempt

with the department using Form MF-112. Forms are located at

from the petroleum inspection fee (US Government or its agen-

cies).

Important: Refund claims must be filed within four years from

the date exempt fuel is sold. You may not file more than one

CAUTION: When records are not maintained, Wisconsin law

refund claim per month.

presumes that motor vehicle fuel is sold with the fuel tax and

petroleum inspection fee included (Presumption Law).

Section 1: Enter the business name, both legal and Doing

Business As (DBA) if applicable. Enter your account number

Keep a copy of this refund claim and all records used in pre-

(if known) and your Federal Employee Identification number

paring this claim for a minimum of four years. Keep them in a

(FEIN), or Social Security Number (SSN), if a sole proprietor.

place and manner easily accessible for review by department

Enter your mailing address. Enter the Wisconsin county name in

representatives. The department reserves the right to review

which the business is physically located. If the entity has ceased

and adjust refund claims either before or after refund checks

operation, check this box and enter the date business ceased.

are issued.

If the address, business name or type of entity has changed,

check that box.

Under sec. 78.73(1), Wis. Stats., any person who uses a

false or fictitious name when submitting a refund claim or

Refunds will not include interest.

commits any other fraud in preparing and submitting a claim,

may be fined not more than $500 or imprisoned not more than

Section 2: Check the appropriate ownership type and enter

6 months or both.

any additional information, requested for the box checked.

ASSISTANCE

Section 3: Dates of Exempt Sales Included

You can access the department’s web site 24 hours a day,

Enter the dates for the first and last exempt fuel sales included

seven days a week, at From this web

in this refund request.

site, you can:

Section 4: Refund Computation

• Complete electronic fill-in forms

Before completing this schedule, separate the exempt sales be-

• Download forms, schedules, instructions, and

tween the fuel types identified by columns 1, 2, and 3 of this

publications

schedule.

• View answers to frequently asked questions

• E-mail us comments or request help

Further separate them by type of exempt sale (lines 3 - 9).

• Access My Tax Account

Complete only those columns and lines which pertain to the ex-

Madison Office Location

empt fuel sales being claimed.

2135 Rimrock Road

Madison WI 53713

Lines 4 and 5. Gasoline sold for off-road use must be delivered

directly into the buyer’s bulk storage tank in an amount 100 gal-

Mailing Address

lons or more.

Excise Tax Section 6-107

Wisconsin Department of Revenue

Line 7. Gasoline sold for aircraft use must be delivered directly

PO Box 8900

into the licensed aviation fuel dealer or user’s bulk storage tank

Madison WI 53708-8900

in an amount 100 gallons or more.

Phone: (608) 266-7363 or (608) 266-3223

Line 9. Enter other exempt sales allowed by Wisconsin law,

Fax: (608) 261-7049

such as undyed diesel fuel sold for use in trains or fuel sold on a

E-mail: excise@revenue.wi.gov

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1