Form E-500e - Utility And Liquor Sales And Use Tax Booklet Instructions

ADVERTISEMENT

7-15

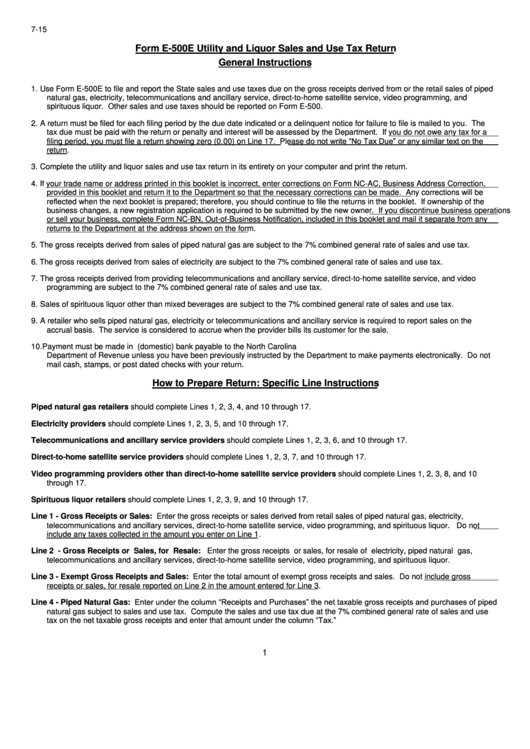

Form E-500E Utility and Liquor Sales and Use Tax Return

General Instructions

1.

Use Form E-500E to file and report the State sales and use taxes due on the gross receipts derived from or the retail sales of piped

natural gas, electricity, telecommunications and ancillary service, direct-to-home satellite service, video programming, and

spirituous liquor. Other sales and use taxes should be reported on Form E-500.

2.

A return must be filed for each filing period by the due date indicated or a delinquent notice for failure to file is mailed to you. The

tax due must be paid with the return or penalty and interest will be assessed by the Department. If you do not owe any tax for a

filing period, you must file a return showing zero (0.00) on Line 17. Please do not write “No Tax Due” or any similar text on the

return.

3.

Complete the utility and liquor sales and use tax return in its entirety on your computer and print the return.

4.

If your trade name or address printed in this booklet is incorrect, enter corrections on Form NC-AC, Business Address Correction,

provided in this booklet and return it to the Department so that the necessary corrections can be made. Any corrections will be

reflected when the next booklet is prepared; therefore, you should continue to file the returns in the booklet. If ownership of the

business changes, a new registration application is required to be submitted by the new owner. If you discontinue business operations

or sell your business, complete Form NC-BN, Out-of-Business Notification, included in this booklet and mail it separate from any

returns to the Department at the address shown on the form.

5.

The gross receipts derived from sales of piped natural gas are subject to the 7% combined general rate of sales and use tax.

6.

The gross receipts derived from sales of electricity are subject to the 7% combined general rate of sales and use tax.

7.

The gross receipts derived from providing telecommunications and ancillary service, direct-to-home satellite service, and video

programming are subject to the 7% combined general rate of sales and use tax.

8.

Sales of spirituous liquor other than mixed beverages are subject to the 7% combined general rate of sales and use tax.

9.

A retailer who sells piped natural gas, electricity or telecommunications and ancillary service is required to report sales on the

accrual basis. The service is considered to accrue when the provider bills its customer for the sale.

10. Payment must be made in U.S. dollars by check or money order drawn on a U.S. (domestic) bank payable to the North Carolina

Department of Revenue unless you have been previously instructed by the Department to make payments electronically. Do not

mail cash, stamps, or post dated checks with your return.

How to Prepare Return: Specific Line Instructions

Piped natural gas retailers should complete Lines 1, 2, 3, 4, and 10 through 17.

Electricity providers should complete Lines 1, 2, 3, 5, and 10 through 17.

Telecommunications and ancillary service providers should complete Lines 1, 2, 3, 6, and 10 through 17.

Direct-to-home satellite service providers should complete Lines 1, 2, 3, 7, and 10 through 17.

Video programming providers other than direct-to-home satellite service providers should complete Lines 1, 2, 3, 8, and 10

through 17.

Spirituous liquor retailers should complete Lines 1, 2, 3, 9, and 10 through 17.

Line 1 - Gross Receipts or Sales: Enter the gross receipts or sales derived from retail sales of piped natural gas, electricity,

telecommunications and ancillary services, direct-to-home satellite service, video programming, and spirituous liquor. Do not

include any taxes collected in the amount you enter on Line 1.

Line 2 - Gross Receipts or Sales, for Resale: Enter the gross receipts or sales, for resale of electricity, piped natural gas,

telecommunications and ancillary services, direct-to-home satellite service, video programming, and spirituous liquor.

Line 3 - Exempt Gross Receipts and Sales: Enter the total amount of exempt gross receipts and sales. Do not include gross

receipts or sales, for resale reported on Line 2 in the amount entered for Line 3.

Line 4 - Piped Natural Gas: Enter under the column “Receipts and Purchases” the net taxable gross receipts and purchases of piped

natural gas subject to sales and use tax. Compute the sales and use tax due at the 7% combined general rate of sales and use

tax on the net taxable gross receipts and enter that amount under the column “Tax.”

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3