Form Eft-1 - Electronic Funds Transfer (Eft)

ADVERTISEMENT

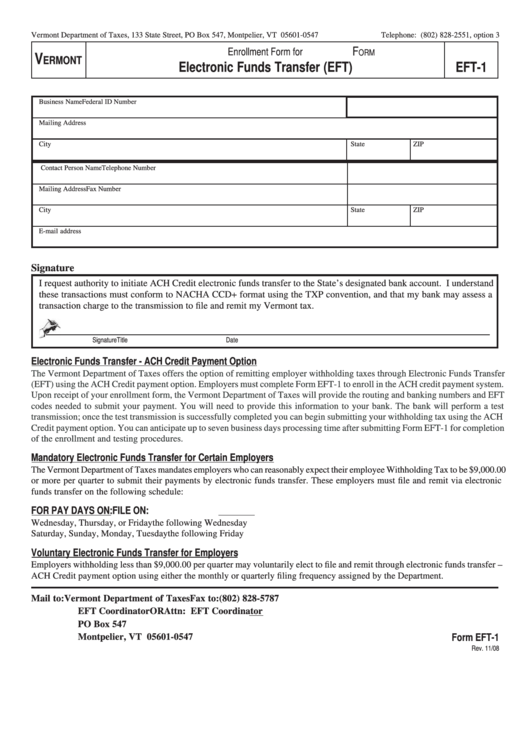

Vermont Department of Taxes, 133 State Street, PO Box 547, Montpelier, VT 05601-0547

Telephone: (802) 828-2551, option 3

F

Enrollment Form for

ORM

V

ERMONT

Electronic Funds Transfer (EFT)

EFT-1

Business Name

Federal ID Number

Mailing Address

City

State

ZIP

Contact Person Name

Telephone Number

Mailing Address

Fax Number

City

State

ZIP

E-mail address

Signature

I request authority to initiate ACH Credit electronic funds transfer to the State’s designated bank account. I understand

these transactions must conform to NACHA CCD+ format using the TXP convention, and that my bank may assess a

transaction charge to the transmission to file and remit my Vermont tax.

Signature

Title

Date

Electronic Funds Transfer - ACH Credit Payment Option

The Vermont Department of Taxes offers the option of remitting employer withholding taxes through Electronic Funds Transfer

(EFT) using the ACH Credit payment option. Employers must complete Form EFT-1 to enroll in the ACH credit payment system.

Upon receipt of your enrollment form, the Vermont Department of Taxes will provide the routing and banking numbers and EFT

codes needed to submit your payment. You will need to provide this information to your bank. The bank will perform a test

transmission; once the test transmission is successfully completed you can begin submitting your withholding tax using the ACH

Credit payment option. You can anticipate up to seven business days processing time after submitting Form EFT-1 for completion

of the enrollment and testing procedures.

Mandatory Electronic Funds Transfer for Certain Employers

The Vermont Department of Taxes mandates employers who can reasonably expect their employee Withholding Tax to be $9,000.00

or more per quarter to submit their payments by electronic funds transfer. These employers must file and remit via electronic

funds transfer on the following schedule:

FOR PAY DAYS ON:

FILE ON:

Wednesday, Thursday, or Friday

the following Wednesday

Saturday, Sunday, Monday, Tuesday

the following Friday

Voluntary Electronic Funds Transfer for Employers

Employers withholding less than $9,000.00 per quarter may voluntarily elect to file and remit through electronic funds transfer –

ACH Credit payment option using either the monthly or quarterly filing frequency assigned by the Department.

Mail to:

Vermont Department of Taxes

Fax to:

(802) 828-5787

EFT Coordinator

OR

Attn: EFT Coordinator

PO Box 547

Montpelier, VT 05601-0547

Form EFT-1

Rev. 11/08

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1