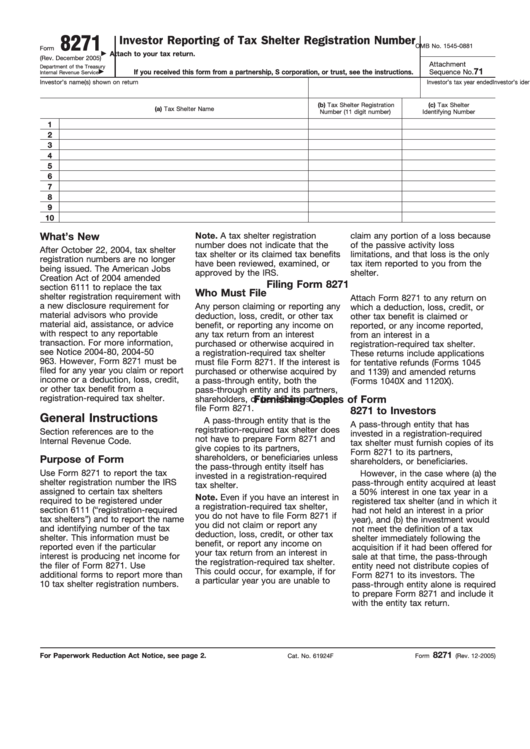

8271

Investor Reporting of Tax Shelter Registration Number

OMB No. 1545-0881

Form

Attach to your tax return.

(Rev. December 2005)

Attachment

Department of the Treasury

71

If you received this form from a partnership, S corporation, or trust, see the instructions.

Sequence No.

Internal Revenue Service

Investor’s name(s) shown on return

Investor’s identifying number

Investor’s tax year ended

(b) Tax Shelter Registration

(c) Tax Shelter

(a) Tax Shelter Name

Number (11 digit number)

Identifying Number

1

2

3

4

5

6

7

8

9

10

What’s New

Note. A tax shelter registration

claim any portion of a loss because

number does not indicate that the

of the passive activity loss

After October 22, 2004, tax shelter

tax shelter or its claimed tax benefits

limitations, and that loss is the only

registration numbers are no longer

have been reviewed, examined, or

tax item reported to you from the

being issued. The American Jobs

approved by the IRS.

shelter.

Creation Act of 2004 amended

Filing Form 8271

section 6111 to replace the tax

Who Must File

shelter registration requirement with

Attach Form 8271 to any return on

a new disclosure requirement for

Any person claiming or reporting any

which a deduction, loss, credit, or

material advisors who provide

deduction, loss, credit, or other tax

other tax benefit is claimed or

material aid, assistance, or advice

benefit, or reporting any income on

reported, or any income reported,

with respect to any reportable

any tax return from an interest

from an interest in a

transaction. For more information,

purchased or otherwise acquired in

registration-required tax shelter.

see Notice 2004-80, 2004-50 I.R.B.

a registration-required tax shelter

These returns include applications

963. However, Form 8271 must be

must file Form 8271. If the interest is

for tentative refunds (Forms 1045

filed for any year you claim or report

purchased or otherwise acquired by

and 1139) and amended returns

income or a deduction, loss, credit,

a pass-through entity, both the

(Forms 1040X and 1120X).

or other tax benefit from a

pass-through entity and its partners,

registration-required tax shelter.

shareholders, or beneficiaries must

Furnishing Copies of Form

file Form 8271.

8271 to Investors

General Instructions

A pass-through entity that is the

A pass-through entity that has

registration-required tax shelter does

Section references are to the

invested in a registration-required

not have to prepare Form 8271 and

Internal Revenue Code.

tax shelter must furnish copies of its

give copies to its partners,

Form 8271 to its partners,

shareholders, or beneficiaries unless

Purpose of Form

shareholders, or beneficiaries.

the pass-through entity itself has

Use Form 8271 to report the tax

However, in the case where (a) the

invested in a registration-required

shelter registration number the IRS

pass-through entity acquired at least

tax shelter.

assigned to certain tax shelters

a 50% interest in one tax year in a

Note. Even if you have an interest in

required to be registered under

registered tax shelter (and in which it

a registration-required tax shelter,

section 6111 (“registration-required

had not held an interest in a prior

you do not have to file Form 8271 if

tax shelters”) and to report the name

year), and (b) the investment would

you did not claim or report any

and identifying number of the tax

not meet the definition of a tax

deduction, loss, credit, or other tax

shelter. This information must be

shelter immediately following the

benefit, or report any income on

reported even if the particular

acquisition if it had been offered for

your tax return from an interest in

interest is producing net income for

sale at that time, the pass-through

the registration-required tax shelter.

the filer of Form 8271. Use

entity need not distribute copies of

This could occur, for example, if for

additional forms to report more than

Form 8271 to its investors. The

a particular year you are unable to

10 tax shelter registration numbers.

pass-through entity alone is required

to prepare Form 8271 and include it

with the entity tax return.

8271

For Paperwork Reduction Act Notice, see page 2.

Cat. No. 61924F

Form

(Rev. 12-2005)

1

1