Claim For Refund Of Sales Or Use Tax Paid During Sales Tax Holiday Form West Virginia State Tax Department

ADVERTISEMENT

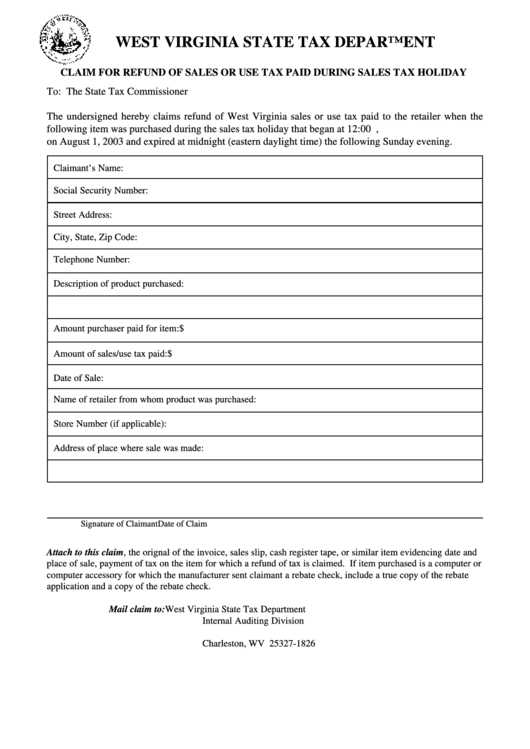

WEST VIRGINIA STATE TAX DEPARTMENT

CLAIM FOR REFUND OF SALES OR USE TAX PAID DURING SALES TAX HOLIDAY

To: The State Tax Commissioner

The undersigned hereby claims refund of West Virginia sales or use tax paid to the retailer when the

following item was purchased during the sales tax holiday that began at 12:00 a.m. eastern daylight time,

on August 1, 2003 and expired at midnight (eastern daylight time) the following Sunday evening.

Claimant’s Name:

Social Security Number:

Street Address:

City, State, Zip Code:

Telephone Number:

Description of product purchased:

Amount purchaser paid for item:

$

Amount of sales/use tax paid:

$

Date of Sale:

Name of retailer from whom product was purchased:

Store Number (if applicable):

Address of place where sale was made:

Signature of Claimant

Date of Claim

Attach to this claim, the orignal of the invoice, sales slip, cash register tape, or similar item evidencing date and

place of sale, payment of tax on the item for which a refund of tax is claimed. If item purchased is a computer or

computer accessory for which the manufacturer sent claimant a rebate check, include a true copy of the rebate

application and a copy of the rebate check.

Mail claim to:

West Virginia State Tax Department

Internal Auditing Division

P.O. Box 1826

Charleston, WV 25327-1826

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1