Form Dcc-90d - Sample Of Verification Of Employment And Wages

ADVERTISEMENT

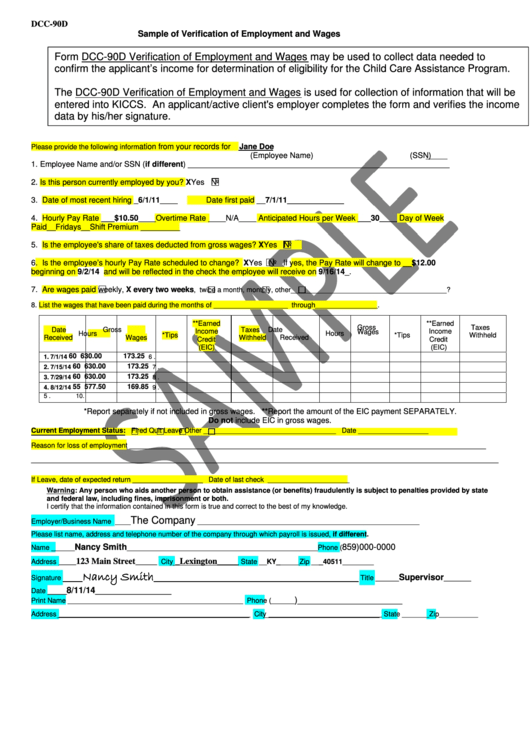

DCC-90D

Sample of Verification of Employment and Wages

Form DCC-90D Verification of Employment and Wages may be used to collect data needed to

confirm the applicant’s income for determination of eligibility for the Child Care Assistance Program.

The DCC-90D Verification of Employment and Wages is used for collection of information that will be

entered into KICCS. An applicant/active client's employer completes the form and verifies the income

data by his/her signature.

ation from your records for

Jane Doe

Please provide the following inform

(Employee Name)

(SSN)

1. Employee Name and/or SSN (if different) ____________________________________________________________

2. Is this person currently employed by you? XYes

No

3. Date of most recent hiring _6/1/11____

Date first paid __7/1/11_____________

4. Hourly Pay Rate ___$10.50____ Overtime Rate ____N/A____ Anticipated Hours per Week ___30____ Day of Week

Paid__Fridays__Shift Premium _________

5. Is the employee's share of taxes deducted from gross wages? XYes

No

6. Is the employee’s hourly Pay Rate scheduled to change? XYes

No If yes, the Pay Rate will change to __$12.00

beginning on 9/2/14 and will be reflected in the check the employee will receive on 9/16/14_.

7. Are wages paid

weekly, X every two weeks

,

twice a month,

monthly,

other________________________________________?

8. List the wages that have been paid during the months of ___________________ through________________.

**Earned

**Earned

Gross

Taxes

Date

Gross

Taxes

Date

Income

Income

Hours

Hours

*Tips

Wages

*Tips

Withheld

Received

Wages

Withheld

Received

Credit

Credit

(EIC)

(EIC)

60

630.00

173.25

1. 7/1/14

6.

60

630.00

173.25

2. 7/15/14

7.

60

630.00

173.25

3. 7/29/14

8.

55

577.50

169.85

4. 8/12/14

9.

5.

10.

*Report separately if not included in gross wages. **Report the amount of the EIC payment SEPARATELY.

Do not include EIC in gross wages.

Current Employment Status:

Fired

Quit

Leave

Other __________________________________ Date __________________

___________________________________________________________________________

Reason for loss of employment

________________________________________________________________________________________________________________________

If Leave, date of expected return __________________ Date of last check _____________________

Warning: Any person who aids another person to obtain assistance (or benefits) fraudulently is subject to penalties provided by state

and federal law, including fines, imprisonment or both.

I certify that the information contained in this form is true and correct to the best of my knowledge.

The Company

Employer/Business Name ____

_________________________________________________________

Please list name, address and telephone number of the company through which payroll is issued, if different.

Nancy Smith

859)000-0000

Name ______

_________________________________________________ Phone (

____123 Main Street_____

_Lexington_____

Address

City

State __KY______Zip ___40511________

____Nancy Smith__________________________________________

Supervisor

Signature

Title ______

_______

____8/11/14________________

Date

)______________________

Print Name _____________________________________________ Phone (______

____________________________________________

__________________________

Address

City

State _______Zip__________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1