Form Scc607/807 - Instructions To Form Scc607/807

ADVERTISEMENT

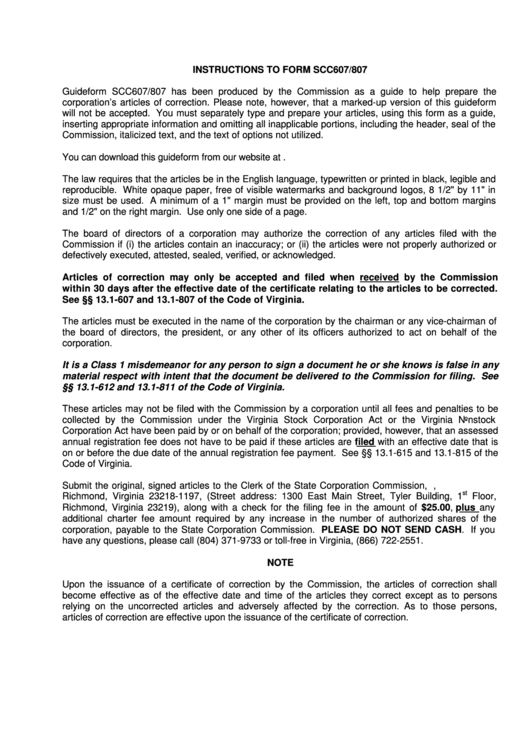

INSTRUCTIONS TO FORM SCC607/807

Guideform SCC607/807 has been produced by the Commission as a guide to help prepare the

corporation’s articles of correction. Please note, however, that a marked-up version of this guideform

will not be accepted. You must separately type and prepare your articles, using this form as a guide,

inserting appropriate information and omitting all inapplicable portions, including the header, seal of the

Commission, italicized text, and the text of options not utilized.

You can download this guideform from our website at

The law requires that the articles be in the English language, typewritten or printed in black, legible and

reproducible. White opaque paper, free of visible watermarks and background logos, 8 1/2" by 11" in

size must be used. A minimum of a 1" margin must be provided on the left, top and bottom margins

and 1/2" on the right margin. Use only one side of a page.

The board of directors of a corporation may authorize the correction of any articles filed with the

Commission if (i) the articles contain an inaccuracy; or (ii) the articles were not properly authorized or

defectively executed, attested, sealed, verified, or acknowledged.

Articles of correction may only be accepted and filed when received by the Commission

within 30 days after the effective date of the certificate relating to the articles to be corrected.

See §§ 13.1-607 and 13.1-807 of the Code of Virginia.

The articles must be executed in the name of the corporation by the chairman or any vice-chairman of

the board of directors, the president, or any other of its officers authorized to act on behalf of the

corporation.

It is a Class 1 misdemeanor for any person to sign a document he or she knows is false in any

material respect with intent that the document be delivered to the Commission for filing. See

§§ 13.1-612 and 13.1-811 of the Code of Virginia.

These articles may not be filed with the Commission by a corporation until all fees and penalties to be

collected by the Commission under the Virginia Stock Corporation Act or the Virginia Nonstock

Corporation Act have been paid by or on behalf of the corporation; provided, however, that an assessed

annual registration fee does not have to be paid if these articles are filed with an effective date that is

on or before the due date of the annual registration fee payment. See §§ 13.1-615 and 13.1-815 of the

Code of Virginia.

Submit the original, signed articles to the Clerk of the State Corporation Commission, P.O. Box 1197,

st

Richmond, Virginia 23218-1197, (Street address: 1300 East Main Street, Tyler Building, 1

Floor,

Richmond, Virginia 23219), along with a check for the filing fee in the amount of $25.00, plus any

additional charter fee amount required by any increase in the number of authorized shares of the

corporation, payable to the State Corporation Commission. PLEASE DO NOT SEND CASH. If you

have any questions, please call (804) 371-9733 or toll-free in Virginia, (866) 722-2551.

NOTE

Upon the issuance of a certificate of correction by the Commission, the articles of correction shall

become effective as of the effective date and time of the articles they correct except as to persons

relying on the uncorrected articles and adversely affected by the correction. As to those persons,

articles of correction are effective upon the issuance of the certificate of correction.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1