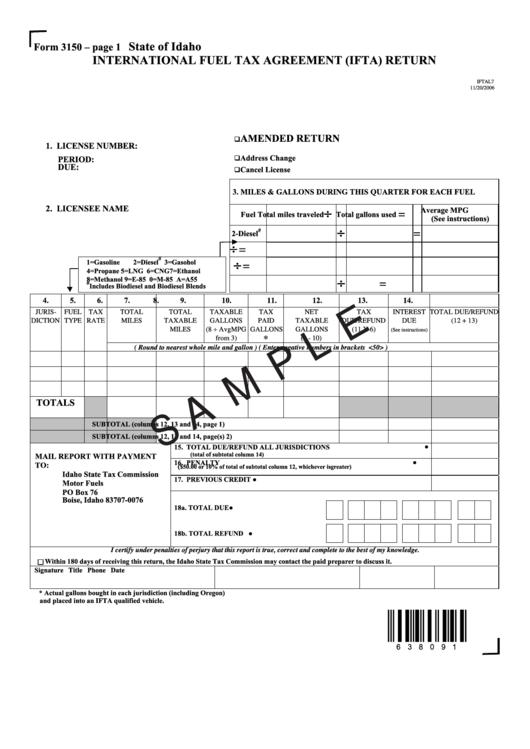

Form 3150 - International Fuel Tax Agreement (Ifta) Return - Sample - 2006

ADVERTISEMENT

State of Idaho

Form 3150 – page 1

INTERNATIONAL FUEL TAX AGREEMENT (IFTA) RETURN

IFTAL7

11/20/2006

AMENDED RETURN

1. LICENSE NUMBER:

PERIOD:

Address Change

DUE:

Cancel License

3. MILES & GALLONS DURING THIS QUARTER FOR EACH FUEL

2. LICENSEE NAME

÷

Average MPG

=

Fuel

Total miles traveled

Total gallons used

(See instructions)

÷

=

#

2-Diesel

÷

=

#

÷

1=Gasoline

2=Diesel

3=Gasohol

=

4=Propane

5=LNG

6=CNG7=Ethanol

÷

8=Methanol

9=E-85

0=M-85 A=A55

=

#

Includes Biodiesel and Biodiesel Blends

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

JURIS-

FUEL

TAX

TOTAL

TOTAL

TAXABLE

TAX

NET

TAX

INTEREST

TOTAL DUE/REFUND

DICTION

TYPE

RATE

MILES

TAXABLE

GALLONS

PAID

TAXABLE

DUE/REFUND

DUE

(12 + 13)

(8 ÷ AvgMPG

MILES

GALLONS

GALLONS

(11 X 6)

(See instructions)

from 3)

*

(9 - 10)

( Round to nearest whole mile and gallon )

( Enter negative numbers in brackets i.e. <50> )

TOTALS

SUBTOTAL (columns 12, 13 and 14, page 1)

SUBTOTAL (columns 12, 13 and 14, page(s) 2)

15. TOTAL DUE/REFUND ALL JURISDICTIONS

●

(total of subtotal column 14)

MAIL REPORT WITH PAYMENT

16. PENALTY

TO:

●

(

$50.00 or 10% of total of subtotal column 12, whichever is greater)

Idaho State Tax Commission

Motor Fuels

17. PREVIOUS CREDIT

●

PO Box 76

Boise, Idaho 83707-0076

18a. TOTAL DUE ................................................. ●

18b. TOTAL REFUND ......................................... ●

I certify under penalties of perjury that this report is true, correct and complete to the best of my knowledge.

Within 180 days of receiving this return, the Idaho State Tax Commission may contact the paid preparer to discuss it.

Signature

Title

Phone

Date

* Actual gallons bought in each jurisdiction (including Oregon)

and placed into an IFTA qualified vehicle.

{`q¢}

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2