Form Mf-202 - Liquefied Petroleum Motor Fuel Tax Return - Kansas Department Of Revenue

ADVERTISEMENT

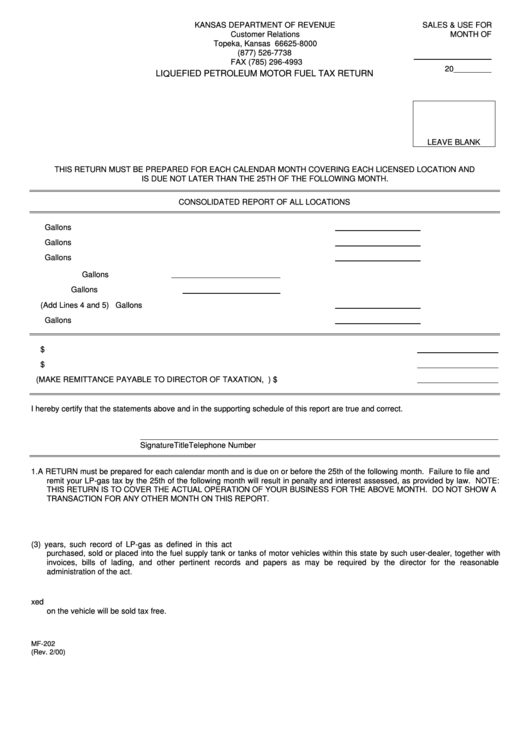

KANSAS DEPARTMENT OF REVENUE

SALES & USE FOR

Customer Relations

MONTH OF

Topeka, Kansas 66625-8000

(877) 526-7738

FAX (785) 296-4993

20

LIQUEFIED PETROLEUM MOTOR FUEL TAX RETURN

LEAVE BLANK

THIS RETURN MUST BE PREPARED FOR EACH CALENDAR MONTH COVERING EACH LICENSED LOCATION AND

IS DUE NOT LATER THAN THE 25TH OF THE FOLLOWING MONTH.

CONSOLIDATED REPORT OF ALL LOCATIONS

1. Beginning Inventory ............................................................................................

Gallons

2. Purchased or Acquired .......................................................................................

Gallons

3. Non-Taxable Sales-Use......................................................................................

Gallons

4. Tax Computed on Mileage Basis

Gallons

5. Taxable sales-users on gallon basis

Gallons

6. Total Taxable Sales-Use (Add Lines 4 and 5) ....................................................

Gallons

7. Closing Inventory ................................................................................................

Gallons

8. Amount of tax due at

...............................................................

$

9. Penalty and interest

....................................................

$

10. Total amount due (MAKE REMITTANCE PAYABLE TO DIRECTOR OF TAXATION, L.P.G.) ..........

$

I hereby certify that the statements above and in the supporting schedule of this report are true and correct.

Signature

Title

Telephone Number

1.

A RETURN must be prepared for each calendar month and is due on or before the 25th of the following month. Failure to file and

remit your LP-gas tax by the 25th of the following month will result in penalty and interest assessed, as provided by law. NOTE:

THIS RETURN IS TO COVER THE ACTUAL OPERATION OF YOUR BUSINESS FOR THE ABOVE MONTH. DO NOT SHOW A

TRANSACTION FOR ANY OTHER MONTH ON THIS REPORT.

2.

COMPLETE SCHEDULE ON REVERSE SIDE - Sales to Tax Paid Licensed Dealer-Users.

3.

UNLAWFUL SALES. See K.S.A. 79-3493 of the Liquefied Petroleum Motor Fuel Tax Law.

4.

EACH USER-DEALER shall maintain and keep for a period of three (3) years, such record of LP-gas as defined in this act

purchased, sold or placed into the fuel supply tank or tanks of motor vehicles within this state by such user-dealer, together with

invoices, bills of lading, and other pertinent records and papers as may be required by the director for the reasonable

administration of the act.

5.

Accurate mileage records must be maintained for all vehicles on which the tax is computed on mileage basis for three years.

6.

Sales of LP-gas to special prepaid permit user or to the holder of LP-gas special mileage permit who have special decals affixed

on the vehicle will be sold tax free.

MF-202

(Rev. 2/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1