Form E-Afr.gfe - Audited Financial Report Filing Requirement Form - Guidelines For Exemptions

ADVERTISEMENT

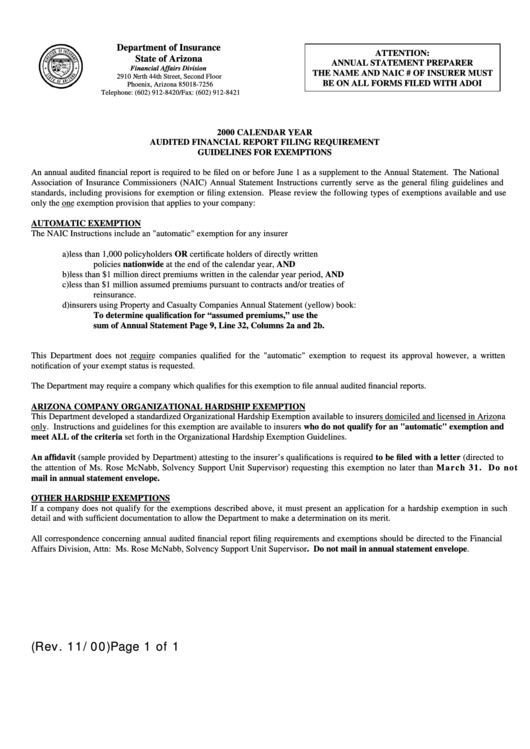

Department of Insurance

ATTENTION:

State of Arizona

ANNUAL STATEMENT PREPARER

Financial Affairs Division

THE NAME AND NAIC # OF INSURER MUST

2910 North 44th Street, Second Floor

BE ON ALL FORMS FILED WITH ADOI

Phoenix, Arizona 85018-7256

Telephone: (602) 912-8420/Fax: (602) 912-8421

2000 CALENDAR YEAR

AUDITED FINANCIAL REPORT FILING REQUIREMENT

GUIDELINES FOR EXEMPTIONS

An annual audited financial report is required to be filed on or before June 1 as a supplement to the Annual Statement. The National

Association of Insurance Commissioners (NAIC) Annual Statement Instructions currently serve as the general filing guidelines and

standards, including provisions for exemption or filing extension. Please review the following types of exemptions available and use

only the one exemption provision that applies to your company:

AUTOMATIC EXEMPTION

The NAIC Instructions include an "automatic" exemption for any insurer having....

a)

less than 1,000 policyholders OR certificate holders of directly written

policies nationwide at the end of the calendar year, AND

b)

less than $1 million direct premiums written in the calendar year period, AND

c)

less than $1 million assumed premiums pursuant to contracts and/or treaties of

reinsurance.

d)

insurers using Property and Casualty Companies Annual Statement (yellow) book:

To determine qualification for “assumed premiums,” use the

sum of Annual Statement Page 9, Line 32, Columns 2a and 2b.

This Department does not require companies qualified for the "automatic" exemption to request its approval however, a written

notification of your exempt status is requested.

The Department may require a company which qualifies for this exemption to file annual audited financial reports.

ARIZONA COMPANY ORGANIZATIONAL HARDSHIP EXEMPTION

This Department developed a standardized Organizational Hardship Exemption available to insurers domiciled and licensed in Arizona

only. Instructions and guidelines for this exemption are available to insurers who do not qualify for an "automatic" exemption and

meet ALL of the criteria set forth in the Organizational Hardship Exemption Guidelines.

An affidavit (sample provided by Department) attesting to the insurer’s qualifications is required to be filed with a letter (directed to

the attention of Ms. Rose McNabb, Solvency Support Unit Supervisor) requesting this exemption no later than March 31. Do not

mail in annual statement envelope.

OTHER HARDSHIP EXEMPTIONS

If a company does not qualify for the exemptions described above, it must present an application for a hardship exemption in such

detail and with sufficient documentation to allow the Department to make a determination on its merit.

All correspondence concerning annual audited financial report filing requirements and exemptions should be directed to the Financial

Affairs Division, Attn: Ms. Rose McNabb, Solvency Support Unit Supervisor. Do not mail in annual statement envelope.

E-AFR.GFE (Rev. 11/00)

Page 1 of 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1