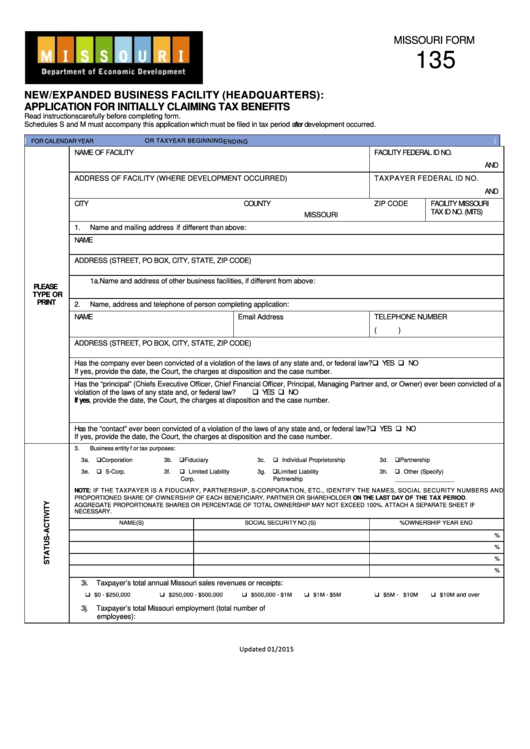

MISSOURI FORM

135

NEW/EXPANDED BUSINESS FACILITY (HEADQUARTERS):

APPLICATION FOR INITIALLY CLAIMING TAX BENEFITS

Read instructions carefully before completing form.

Schedules S and M must accompany this application which must be filed in tax period after development occurred.

OR TA X Y EAR BEGINNING

FOR CALENDAR Y EAR

ENDING

NAME OF FACILITY

FACILITY FEDERAL ID NO.

AND

ADDRESS OF FACILITY (WHERE DEVELOPMENT OCCURRED)

TAXPAYER FEDERAL ID NO.

AND

CITY

COUNTY

ZIP CODE

FACILITY MISSOURI

TAX ID NO. ( MITS)

MISSOURI

Name and mailing address if different than above:

1.

NAME

ADDRESS (STREET, PO BOX, CITY, STATE, ZIP CODE)

1a. Name and address of other business facilities, if different from above:

PLEASE

TYPE OR

PRINT

2.

Name, address and telephone of person completing application:

NAME

Email Address

TELEPHONE NUMBER

(

)

ADDRESS (STREET, PO BOX, CITY, STATE, ZIP CODE)

YES NO

Has the company ever been convicted of a violation of the laws of any state and, or federal law?

If yes, provide the date, the Court, the charges at disposition and the case number.

Has the “principal” (Chiefs Executive Offi c er, Chief Financial Offi c er, Principal, Managing Partner and, or Owner) ever been convi c ted of a

YES NO

violation of the laws of any state and, or federal law?

If yes, provide the date, the Court, the charges at disposition and the case number.

YES NO

Has the “contact” ever been convicted of a violation of the laws of any state and, or federal law?

If yes, provide the date, the Court, the charges at disposition and the case number.

3.

Business entity f or tax purposes:

Corporation

Fiduciary

Indiv idual Proprietorship

Partnership

3a.

3b.

3c.

3d.

S-Corp.

Limited Liability

Limited Liability

Other (Specify)

3e.

3f.

3g.

3h.

Corp.

Partnership

_______ _____ ______

NOTE: IF THE TAXPAY ER IS A FIDUCIARY , PARTNERSHIP, S-CORPORATION, ETC., IDENTIFY THE NAMES, SOCIAL SECURITY NUMBERS AND

PROPORTIONED SHARE OF OWNERSHIP OF EACH BENEFICIARY , PARTNER OR SHAREHOLDER ON THE LAS T D AY OF THE TAX PERIOD.

AGGREGA TE PROPOR TIONATE SHARES OR PERCENTAGE OF TO TAL OWNERSHIP MAY NOT E XCEED 100%. ATTACH A SEPARA TE SHEE T IF

NECESSARY .

NAME(S)

SOCIAL SECURITY NO.(S)

%OWNERSHIP Y EAR END

%

%

%

%

3i.

Taxpayer’s total annual Missouri sales revenues or receipts:

$0 - $250,000

$250,000 - $500,000

$500,000 - $1M

$1M - $5M

$5M - $10M

$10M and ov er

3j.

Taxpayer’s total Missouri employment (total number of

employees):

Updated 01/2015

1

1 2

2 3

3 4

4