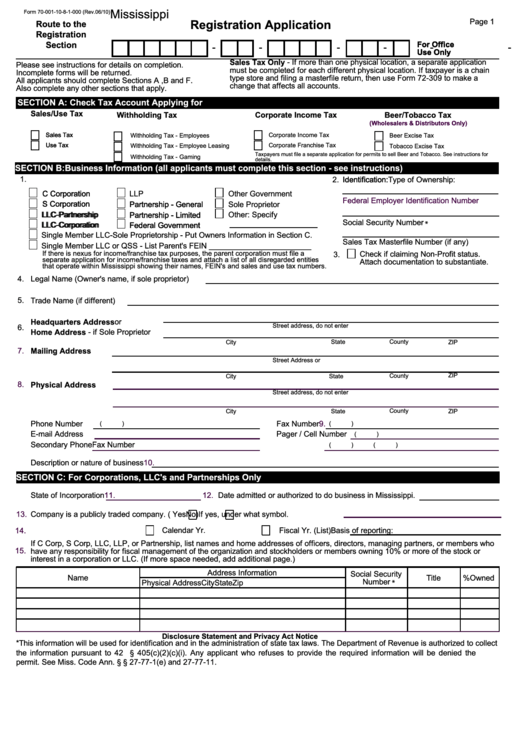

Form 70-001-10-8-1-000 - Registration Application Form - State Of Missisippi

ADVERTISEMENT

Mississippi

Form 70-001-10-8-1-000 (Rev.06/10)

Page 1

Registration Application

Route to the

Registration

For Office

For Office

Section

-

-

-

-

-

-

Use Only

Use Only

Sales Tax Only - If more than one physical location, a separate application

Please see instructions for details on completion.

must be completed for each different physical location. If taxpayer is a chain

Incomplete forms will be returned.

type store and filing a masterfile return, then use Form 72-309 to make a

All applicants should complete Sections A ,B and F.

change that affects all accounts.

Also complete any other sections that apply.

SECTION A: Check Tax Account Applying for

Sales/Use Tax

Withholding Tax

Corporate Income Tax

Beer/Tobacco Tax

(Wholesalers & Distributors Only)

Sales Tax

Sales Tax

Corporate Income Tax

Beer Excise Tax

Withholding Tax - Employees

Use Tax

Use Tax

Corporate Franchise Tax

Withholding Tax - Employee Leasing

Tobacco Excise Tax

Taxpayers must file a separate application for permits to sell Beer and Tobacco. See instructions for

Withholding Tax - Gaming

details.

SECTION B: Business Information (all applicants must complete this section - see instructions)

1.

Type of Ownership:

2.

Identification:

Identification:

C Corporation

C Corporation

LLP

Other Government

Federal Employer Identification Number

S Corporation

S Corporation

Partnership - General

Partnership - General

Sole Proprietor

LLC-Partnership

LLC-Partnership

Partnership - Limited

Partnership - Limited

Other: Specify

Social Security Number

*

LLC-Corporation

LLC-Corporation

Federal Government

Federal Government

Single Member LLC-Sole Proprietorship - Put Owners Information in Section C.

Sales Tax Masterfile Number (if any)

Single Member LLC or QSS - List Parent's FEIN ________________________

If there is nexus for income/franchise tax purposes, the parent corporation must file a

Check if claiming Non-Profit status.

3.

separate application for income/franchise taxes and attach a list of all disregarded entities

Attach documentation to substantiate.

that operate within Mississippi showing their names, FEIN's and sales and use tax numbers.

4.

Legal Name (Owner's name, if sole proprietor)

5.

Trade Name (if different)

Headquarters Address or

Street address, do not enter P.O.Box.

6.

Home Address - if Sole Proprietor

State

County

ZIP

City

7.

Mailing Address

Street Address or P.O.Box

ZIP

City

County

State

8.

Physical Address

Street address, do not enter P.O.Box.

County

City

State

ZIP

9.

Phone Number

Fax Number

(

)

(

)

Pager / Cell Number

E-mail Address

(

)

Secondary Phone

Fax Number

(

)

(

)

10.

Description or nature of business

SECTION C: For Corporations, LLC's and Partnerships Only

11.

State of Incorporation

12.

Date admitted or authorized to do business in Mississippi.

13.

Company is a publicly traded company. ( Yes

No

)

If yes, under what symbol.

Calendar Yr.

14.

Basis of reporting:

Fiscal Yr. (List)

If C Corp, S Corp, LLC, LLP, or Partnership, list names and home addresses of officers, directors, managing partners, or members who

15.

have any responsibility for fiscal management of the organization and stockholders or members owning 10% or more of the stock or

interest in a corporation or LLC. (If more space needed, add additional page.)

Address Information

Social Security

Name

Title

%Owned

Number

Physical Address

City

State

Zip

*

Disclosure Statement and Privacy Act Notice

*This information will be used for identification and in the administration of state tax laws. The Department of Revenue is authorized to collect

the information pursuant to 42 U.S.C. § 405(c)(2)(c)(i). Any applicant who refuses to provide the required information will be denied the

permit. See Miss. Code Ann. § § 27-77-1(e) and 27-77-11.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2

![Form 72-440-10-8-1-000 - Rider (sales, Use, Income, Franchise, Withholding, And Special Fuel [diesel Fuel] Tax Bond) Form Form 72-440-10-8-1-000 - Rider (sales, Use, Income, Franchise, Withholding, And Special Fuel [diesel Fuel] Tax Bond) Form](https://data.formsbank.com/pdf_docs_html/244/2440/244084/page_1_thumb.png)