Instructions For Michigan Multiple Tobacco Products Tax Schedules Sheet

ADVERTISEMENT

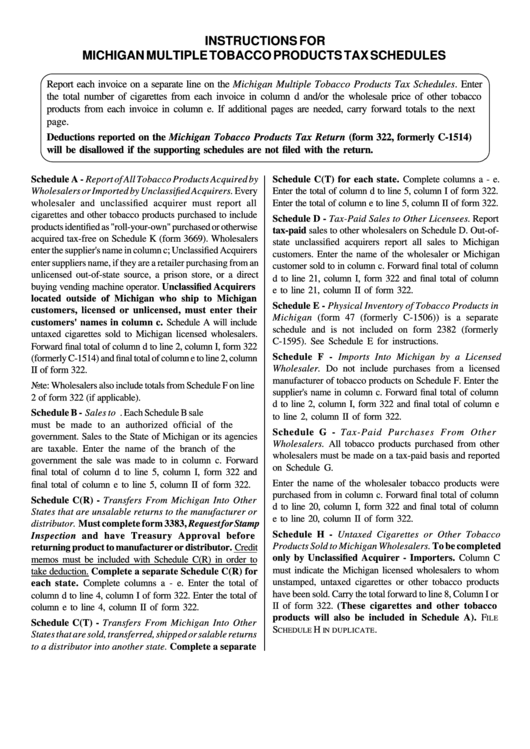

INSTRUCTIONS FOR

MICHIGAN MULTIPLE TOBACCO PRODUCTS TAX SCHEDULES

Report each invoice on a separate line on the Michigan Multiple Tobacco Products Tax Schedules. Enter

the total number of cigarettes from each invoice in column d and/or the wholesale price of other tobacco

products from each invoice in column e. If additional pages are needed, carry forward totals to the next

page.

Deductions reported on the Michigan Tobacco Products Tax Return (form 322, formerly C-1514)

will be disallowed if the supporting schedules are not filed with the return.

Schedule A - Report of All Tobacco Products Acquired by

Schedule C(T) for each state. Complete columns a - e.

Wholesalers or Imported by Unclassified Acquirers. Every

Enter the total of column d to line 5, column I of form 322.

wholesaler and unclassified acquirer must report all

Enter the total of column e to line 5, column II of form 322.

cigarettes and other tobacco products purchased to include

Schedule D - Tax-Paid Sales to Other Licensees. Report

products identified as "roll-your-own" purchased or otherwise

tax-paid sales to other wholesalers on Schedule D. Out-of-

acquired tax-free on Schedule K (form 3669). Wholesalers

state unclassified acquirers report all sales to Michigan

enter the supplier's name in column c; Unclassified Acquirers

customers. Enter the name of the wholesaler or Michigan

enter suppliers name, if they are a retailer purchasing from an

customer sold to in column c. Forward final total of column

unlicensed out-of-state source, a prison store, or a direct

d to line 21, column I, form 322 and final total of column

buying vending machine operator. Unclassified Acquirers

e to line 21, column II of form 322.

located outside of Michigan who ship to Michigan

Schedule E - Physical Inventory of Tobacco Products in

customers, licensed or unlicensed, must enter their

Michigan (form 47 (formerly C-1506)) is a separate

customers' names in column c. Schedule A will include

schedule and is not included on form 2382 (formerly

untaxed cigarettes sold to Michigan licensed wholesalers.

C-1595). See Schedule E for instructions.

Forward final total of column d to line 2, column I, form 322

Schedule F - Imports Into Michigan by a Licensed

(formerly C-1514) and final total of column e to line 2, column

Wholesaler. Do not include purchases from a licensed

II of form 322.

manufacturer of tobacco products on Schedule F. Enter the

Note: Wholesalers also include totals from Schedule F on line

supplier's name in column c. Forward final total of column

2 of form 322 (if applicable).

d to line 2, column I, form 322 and final total of column e

Schedule B - Sales to U.S. Agencies. Each Schedule B sale

to line 2, column II of form 322.

must be made to an authorized official of the U.S.

Schedule G - Tax-Paid Purchases From Other

government. Sales to the State of Michigan or its agencies

Wholesalers. All tobacco products purchased from other

are taxable. Enter the name of the branch of the U.S.

wholesalers must be made on a tax-paid basis and reported

government the sale was made to in column c. Forward

on Schedule G.

final total of column d to line 5, column I, form 322 and

Enter the name of the wholesaler tobacco products were

final total of column e to line 5, column II of form 322.

purchased from in column c. Forward final total of column

Schedule C(R) - Transfers From Michigan Into Other

d to line 20, column I, form 322 and final total of column

States that are unsalable returns to the manufacturer or

e to line 20, column II of form 322.

distributor. Must complete form 3383, Request for Stamp

Schedule H - Untaxed Cigarettes or Other Tobacco

Inspection and have Treasury Approval before

Products Sold to Michigan Wholesalers. To be completed

returning product to manufacturer or distributor. Credit

only by Unclassified Acquirer - Importers. Column C

memos must be included with Schedule C(R) in order to

must indicate the Michigan licensed wholesalers to whom

take deduction. Complete a separate Schedule C(R) for

unstamped, untaxed cigarettes or other tobacco products

each state. Complete columns a - e. Enter the total of

have been sold. Carry the total forward to line 8, Column I or

column d to line 4, column I of form 322. Enter the total of

II of form 322. (These cigarettes and other tobacco

column e to line 4, column II of form 322.

products will also be included in Schedule A). F

ILE

Schedule C(T) - Transfers From Michigan Into Other

S

H

.

CHEDULE

IN DUPLICATE

States that are sold, transferred, shipped or salable returns

to a distributor into another state. Complete a separate

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1