Form Mt11 - Instructions Sheet

ADVERTISEMENT

2003 Taconite Production Report

Filing requirements

producer’s three-year production average by

Minerals tax office

the tax rate. The 2003 tax rate is $2.103 per

You must file a Minnesota taconite produc-

taxable ton.

tion report, Form MT11, if you produce

Call 218-744-7420

iron ore concentrate, taconite pellets,

We will notify you of the total tax due by

taconite chips or fines. All reports must be

February 16.

Minnesota Relay 711 (

)

TTY

filed on a calendar year basis.

Payment

Software-generated forms

For 2003, 50 percent of the payment is due

Our street address:

If you use your own software, the informa-

February 24 and 50 percent is due

Minnesota Revenue,

tion must be in the same format as our own

August 24. Payments are made to the county

612 Pierce St. Eveleth, MN 55734

MT11 form.

auditors and the Iron Range Resources and

Our web address

Rehabilitation Board (IRRRB).

Due dates

All payments must be made electronically

Form MT11

by a funds transfer as defined in

We’ll provide this information in other

Form MT11 must be filed on or before

formats upon request to persons with

MS 336.4A-104.

February 1.

disabilities.

Distribution of tax

The U.S. postmark date, or date recorded or

marked by a designated delivery service, is

The production tax is distributed to the

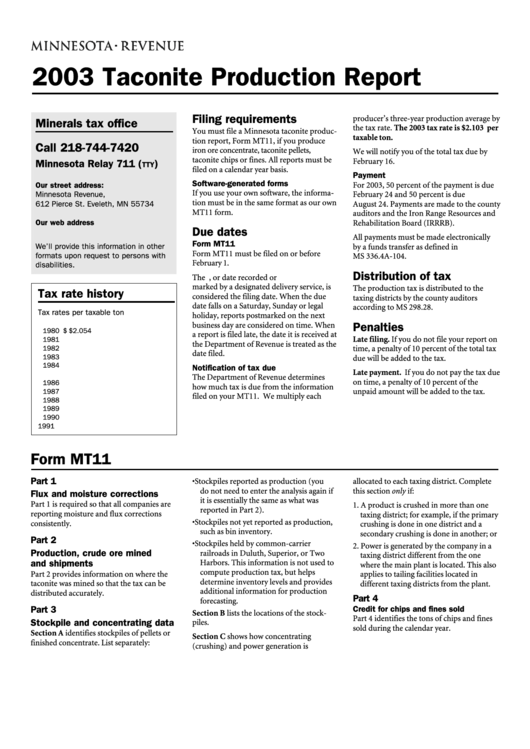

Tax rate history

considered the filing date. When the due

taxing districts by the county auditors

date falls on a Saturday, Sunday or legal

according to MS 298.28.

Tax rates per taxable ton

holiday, reports postmarked on the next

business day are considered on time. When

Penalties

1980 .... $1.733

1992 .... $2.054

a report is filed late, the date it is received at

Late filing. If you do not file your report on

1981 ...... 1.916

1993 ...... 2.054

the Department of Revenue is treated as the

1982 ...... 2.078

1994 ...... 2.054

time, a penalty of 10 percent of the total tax

date filed.

1983 ...... 2.047

1995 ...... 2.054

due will be added to the tax.

1984 ...... 2.107

1996 ...... 2.094

Notification of tax due

Late payment. If you do not pay the tax due

1985 ...... 2.048

1997...... 2.141

The Department of Revenue determines

on time, a penalty of 10 percent of the

1986 ...... 1.900

1998 ...... 2.141

how much tax is due from the information

unpaid amount will be added to the tax.

1987 ...... 1.900

1999 ...... 2.141

filed on your MT11. We multiply each

1988 ...... 1.900

2000 ...... 2.173

1989 ...... 1.975

2001 ...... 2.103

1990 ...... 1.975

2002 ...... 2.103

1991 ...... 2.054

2003 ...... 2.103

Form MT11

Part 1

• Stockpiles reported as production (you

allocated to each taxing district. Complete

do not need to enter the analysis again if

this section

if:

Flux and moisture corrections

it is essentially the same as what was

Part 1 is required so that all companies are

1. A product is crushed in more than one

reported in Part 2).

reporting moisture and flux corrections

taxing district; for example, if the primary

• Stockpiles not yet reported as production,

consistently.

crushing is done in one district and a

such as bin inventory.

secondary crushing is done in another; or

Part 2

• Stockpiles held by common-carrier

2. Power is generated by the company in a

Production, crude ore mined

railroads in Duluth, Superior, or Two

taxing district different from the one

Harbors. This information is not used to

and shipments

where the main plant is located. This also

compute production tax, but helps

Part 2 provides information on where the

applies to tailing facilities located in

determine inventory levels and provides

taconite was mined so that the tax can be

different taxing districts from the plant.

additional information for production

distributed accurately.

Part 4

forecasting.

Credit for chips and fines sold

Part 3

Section B lists the locations of the stock-

Part 4 identifies the tons of chips and fines

Stockpile and concentrating data

piles.

sold during the calendar year.

Section A identifies stockpiles of pellets or

Section C shows how concentrating

finished concentrate. List separately:

(crushing) and power generation is

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1