Instructions For Quarterly Contribution Report, Form Wvuc-A-154

ADVERTISEMENT

WVUC-A-154i

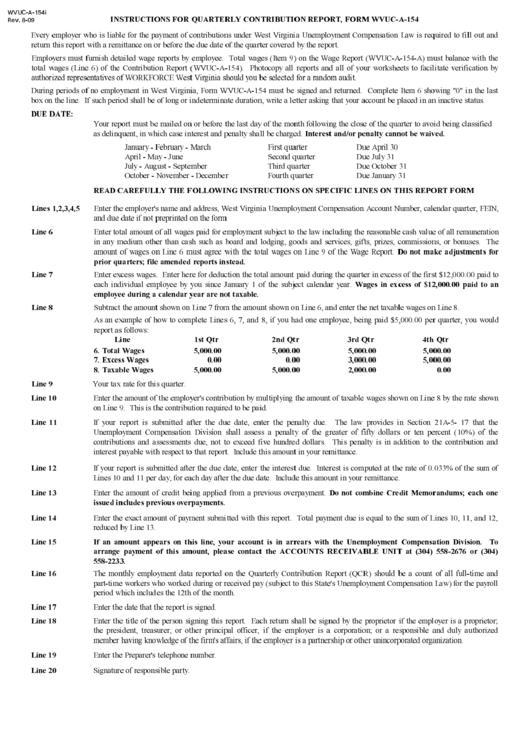

INSTRUCTIONS FOR QUARTERLY CONTRIBUTION REPORT, FORM WVUC-A-154

Rev. 8-09

Every employer who is liable for the payment of contributions under West Virginia Unemployment Compensation Law is required to fill out and

return this report with a remittance on or before the due date of the quarter covered by the report.

Employers must furnish detailed wage reports by employee. Total wages (Item 9) on the Wage Report (WVUC-A-154-A) must balance with the

total wages (Line 6) of the Contribution Report (WVUC-A-154). Photocopy all reports and all of your worksheets to facilitate verification by

authorized representatives of WORKFORCE West Virginia should you be selected for a random audit.

During periods of no employment in West Virginia, Form WVUC-A-154 must be signed and returned. Complete Item 6 showing "0" in the last

box on the line. If such period shall be of long or indeterminate duration, write a letter asking that your account be placed in an inactive status.

DUE DATE:

Your report must be mailed on or before the last day of the month following the close of the quarter to avoid being classified

Interest and/or penalty cannot be waived.

as delinquent, in which case interest and penalty shall be charged.

January - February - March

First quarter

Due April 30

April - May - June

Second quarter

Due July 31

July - August - September

Third quarter

Due October 31

October - November - December

Fourth quarter

Due January 31

READ CAREFULLY THE FOLLOWING INSTRUCTIONS ON SPECIFIC LINES ON THIS REPORT FORM

Lines 1,2,3,4,5

Enter the employer's name and address, West Virginia Unemployment Compensation Account Number, calendar quarter, FEIN,

and due date if not preprinted on the form

Line 6

Enter total amount of all wages paid for employment subject to the law including the reasonable cash value of all remuneration

in any medium other than cash such as board and lodging, goods and services, gifts, prizes, commissions, or bonuses. The

Do not make adjustments for

amount of wages on Line 6 must agree with the total wages on Line 9 of the Wage Report.

prior quarters; file amended reports instead.

Line 7

Enter excess wages. Enter here for deduction the total amount paid during the quarter in excess of the first $12,000.00 paid to

Wages in excess of $12,000.00 paid to an

each individual employee by you since January 1 of the subject calendar year.

employee during a calendar year are not taxable.

Line 8

Subtract the amount shown on Line 7 from the amount shown on Line 6, and enter the net taxable wages on Line 8.

As an example of how to complete Lines 6, 7, and 8, if you had one employee, being paid $5,000.00 per quarter, you would

report as follows:

Line

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

6. Total Wages

5,000.00

5,000.00

5,000.00

5,000.00

7. Excess Wages

0.00

0.00

3,000.00

5,000.00

8. Taxable Wages

5,000.00

5,000.00

2,000.00

0.00

Line 9

Your tax rate for this quarter.

Line 10

Enter the amount of the employer's contribution by multiplying the amount of taxable wages shown on Line 8 by the rate shown

on Line 9. This is the contribution required to be paid.

Line 11

If your report is submitted after the due date, enter the penalty due. The law provides in Section 21A-5- 17 that the

Unemployment Compensation Division shall assess a penalty of the greater of fifty dollars or ten percent (10%) of the

contributions and assessments due, not to exceed five hundred dollars. This penalty is in addition to the contribution and

interest payable with respect to that report. Include this amount in your remittance.

Line 12

If your report is submitted after the due date, enter the interest due. Interest is computed at the rate of 0.033% of the sum of

Lines 10 and 11 per day, for each day after the due date. Include this amount in your remittance.

Line 13

Do not combine Credit Memorandums; each one

Enter the amount of credit being applied from a previous overpayment.

issued includes previous overpayments.

Line 14

Enter the exact amount of payment submitted with this report. Total payment due is equal to the sum of Lines 10, 11, and 12,

reduced by Line 13.

Line 15

If an amount appears on this line, your account is in arrears with the Unemployment Compensation Division. To

arrange payment of this amount, please contact the ACCOUNTS RECEIVABLE UNIT at (304) 558-2676 or (304)

558-2233.

Line 16

The monthly employment data reported on the Quarterly Contribution Report (QCR) should be a count of all full-time and

part-time workers who worked during or received pay (subject to this State's Unemployment Compensation Law) for the payroll

period which includes the 12th of the month.

Line 17

Enter the date that the report is signed.

Line 18

Enter the title of the person signing this report. Each return shall be signed by the proprietor if the employer is a proprietor;

the president, treasurer, or other principal officer, if the employer is a corporation; or a responsible and duly authorized

member having knowledge of the firm's affairs, if the employer is a partnership or other unincorporated organization.

Line 19

Enter the Preparer's telephone number.

Line 20

Signature of responsible party.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1