Instructions For Completing The Enclosed Quarterly Report Form, For Washington Workers' Compensation

ADVERTISEMENT

Instructions for completing

the enclosed Quarterly Report

* for Washington workers’ compensation

Step

IMPORTANT:

If your business currently has optional workers’ compensation coverage for

Employer’s

Then...

owners, partners, corporate officers, or LLC members, include these hours in your calculation.

WA Unified Business Identifier (UBI):

Quarterly Report

A

Enter your subtotal in Box 7 and add any other charges .

Enter in Column 3 the total gross payroll for all workers in the

PO Box 34022

appropriate class code.

for Workers’ Compensation

L&I Account ID:

When your report is ready, send it to us with your check made

Seattle WA 98124-1022

B

(Continued)

Enter in Column 4 the total worker hours for the quarter in each

out to L&I, using the enclosed envelope. Make a copy for

yourself.

class code.

Your business currently has optional workers’ compensation coverage

C

Multiply the total hours worked in each class code by the rate in Column 5.

for owners, partners, corporate officers, or LLC members.

D

If marked yes, remember to report their hours on this form.

Write the premium owed for each class code in Column 6.

Continue entering worker hours to calculate the premiums you owe this quarter. Instructions are enclosed.

=

1

2

3

4

5

6

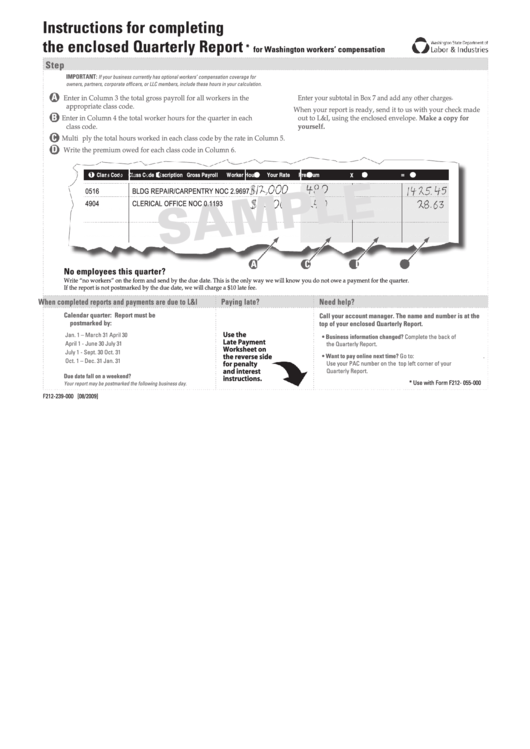

Class Code

Class Code Description

Gross Payroll

Worker Hours

X

Your Rate

Premium

0516

BLDG REPAIR/CARPENTRY NOC

2.9697

4904

CLERICAL OFFICE NOC

0.1193

D

A

B

C

No employees this quarter?

Write “no workers” on the form and send by the due date. This is the only way we will know you do not owe a payment for the quarter.

If the report is not postmarked by the due date, we will charge a $10 late fee.

Paying late?

When completed reports and payments are due to L&I

Need help?

Calendar quarter:

Report must be

Call your account manager. The name and number is at the

postmarked by:

top of your enclosed Quarterly Report.

Jan. 1 – March 31

April 30

Use the

• Business information changed? Complete the back of

Late Payment

April 1 - June 30

July 31

the Quarterly Report.

Worksheet on

July 1 - Sept. 30

Oct. 31

• Want to pay online next time? Go to: quarterlyreports.LNI.wa.gov .

the reverse side

Oct. 1 – Dec. 31

Jan. 31

Use your PAC number on the top left corner of your

for penalty

Quarterly Report.

and interest

Due date fall on a weekend?

instructions.

* Use with Form F212- 055-000

Your report may be postmarked the following business day.

F212-239-000 [08/2009]

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2