Instructions For Form 433-A - 2005

ADVERTISEMENT

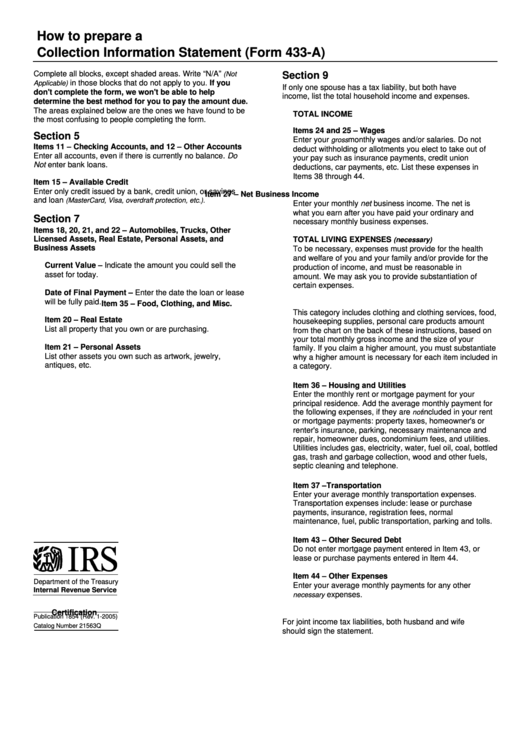

How to prepare a

Collection Information Statement (Form 433-A)

Complete all blocks, except shaded areas. Write “N/A”

(Not

Section 9

in those blocks that do not apply to you. If you

Applicable)

If only one spouse has a tax liability, but both have

don't complete the form, we won't be able to help

income, list the total household income and expenses.

determine the best method for you to pay the amount due.

The areas explained below are the ones we have found to be

TOTAL INCOME

the most confusing to people completing the form.

Items 24 and 25 – Wages

Section 5

Enter your

monthly wages and/or salaries. Do not

gross

Items 11 – Checking Accounts, and 12 – Other Accounts

deduct withholding or allotments you elect to take out of

Enter all accounts, even if there is currently no balance. Do

your pay such as insurance payments, credit union

Not enter bank loans.

deductions, car payments, etc. List these expenses in

Items 38 through 44.

Item 15 – Available Credit

Enter only credit issued by a bank, credit union, or savings

Item 27 – Net Business Income

and loan

(MasterCard, Visa, overdraft protection, etc.).

Enter your monthly net business income. The net is

what you earn after you have paid your ordinary and

Section 7

necessary monthly business expenses.

Items 18, 20, 21, and 22 – Automobiles, Trucks, Other

Licensed Assets, Real Estate, Personal Assets, and

TOTAL LIVING EXPENSES

(necessary)

Business Assets

To be necessary, expenses must provide for the health

and welfare of you and your family and/or provide for the

Current Value – Indicate the amount you could sell the

production of income, and must be reasonable in

asset for today.

amount. We may ask you to provide substantiation of

certain expenses.

Date of Final Payment – Enter the date the loan or lease

will be fully paid.

Item 35 – Food, Clothing, and Misc.

This category includes clothing and clothing services, food,

Item 20 – Real Estate

housekeeping supplies, personal care products amount

List all property that you own or are purchasing.

from the chart on the back of these instructions, based on

your total monthly gross income and the size of your

Item 21 – Personal Assets

family. If you claim a higher amount, you must substantiate

List other assets you own such as artwork, jewelry,

why a higher amount is necessary for each item included in

antiques, etc.

a category.

Item 36 – Housing and Utilities

Enter the monthly rent or mortgage payment for your

principal residence. Add the average monthly payment for

the following expenses, if they are

included in your rent

not

or mortgage payments: property taxes, homeowner's or

renter's insurance, parking, necessary maintenance and

repair, homeowner dues, condominium fees, and utilities.

Utilities includes gas, electricity, water, fuel oil, coal, bottled

gas, trash and garbage collection, wood and other fuels,

septic cleaning and telephone.

Item 37 –Transportation

Enter your average monthly transportation expenses.

Transportation expenses include: lease or purchase

payments, insurance, registration fees, normal

maintenance, fuel, public transportation, parking and tolls.

Item 43 – Other Secured Debt

Do not enter mortgage payment entered in Item 43, or

lease or purchase payments entered in Item 44.

Item 44 – Other Expenses

Department of the Treasury

Enter your average monthly payments for any other

Internal Revenue Service

expenses.

necessary

Certification

Publication 1854 (Rev. 1-2005)

For joint income tax liabilities, both husband and wife

Catalog Number 21563Q

should sign the statement.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2