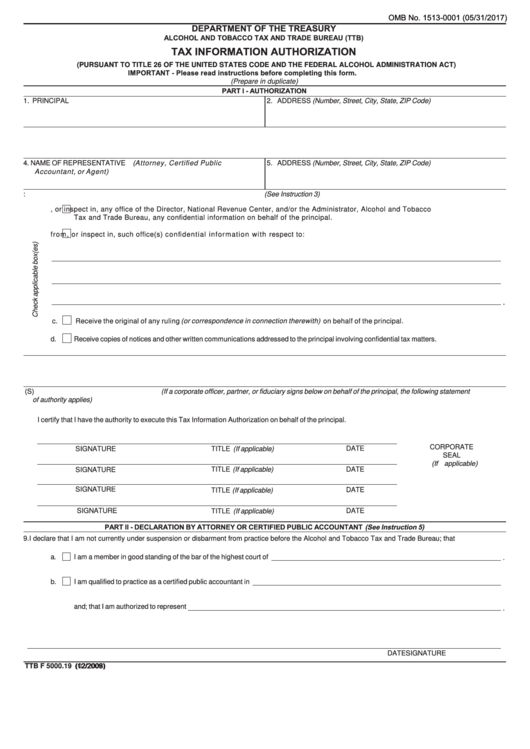

OMB No. 1513-0001 (05/31/2017)

DEPARTMENT OF THE TREASURY

ALCOHOL AND TOBACCO TAX AND TRADE BUREAU (TTB)

TAX INFORMATION AUTHORIZATION

(PURSUANT TO TITLE 26 OF THE UNITED STATES CODE AND THE FEDERAL ALCOHOL ADMINISTRATION ACT)

IMPORTANT - Please read instructions before completing this form.

(Prepare in duplicate)

PART I - AUTHORIZATION

1. PRINCIPAL

2. ADDRESS (Number, Street, City, State, ZIP Code)

3. BUSINESS IN WHICH ENGAGED

5. ADDRESS (Number, Street, City, State, ZIP Code)

4. NAME OF REPRESENTATIVE (Attorney, Certified Public

Accountant, or Agent)

6. THE ABOVE-NAMED REPRESENTATIVE IS HEREBY AUTHORIZED TO: (See Instruction 3)

a.

Receive from, or inspect in, any office of the Director, National Revenue Center, and/or the Administrator, Alcohol and Tobacco

Tax and Trade Bureau, any confidential information on behalf of the principal.

b.

Receive from, or inspect in, such office(s) confidential information with respect to:

.

c.

Receive the original of any ruling (or correspondence in connection therewith) on behalf of the principal.

d.

Receive copies of notices and other written communications addressed to the principal involving confidential tax matters.

7. THE SIGNATURE OF THE REPRESENTATIVE HEREBY AUTHORIZED TO RECEIVE CONFIDENTIAL INFORMATION

8. SIGNATURE OF OR FOR PRINCIPAL(S) (If a corporate officer, partner, or fiduciary signs below on behalf of the principal, the following statement

of authority applies)

I certify that I have the authority to execute this Tax Information Authorization on behalf of the principal.

CORPORATE

DATE

SIGNATURE

TITLE (If applicable)

SEAL

(If applicable)

SIGNATURE

TITLE (If applicable)

DATE

SIGNATURE

TITLE (If applicable)

DATE

SIGNATURE

TITLE (If applicable)

DATE

PART II - DECLARATION BY ATTORNEY OR CERTIFIED PUBLIC ACCOUNTANT (See Instruction 5)

9. I declare that I am not currently under suspension or disbarment from practice before the Alcohol and Tobacco Tax and Trade Bureau; that

.

a.

I am a member in good standing of the bar of the highest court of

b.

I am qualified to practice as a certified public accountant in

.

and; that I am authorized to represent

SIGNATURE

DATE

TTB F 5000.19 (02/2008)

(12/2009)

1

1