Form 2848-Me - Power Of Attorney And Declaration Of Representative - Maine Revenue Services

ADVERTISEMENT

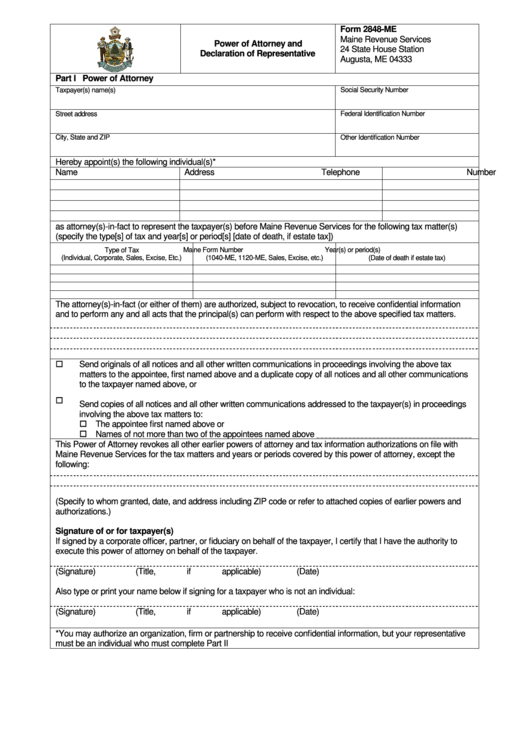

Form 2848-ME

Maine Revenue Services

Power of Attorney and

24 State House Station

Declaration of Representative

Augusta, ME 04333

Part I Power of Attorney

Taxpayer(s) name(s)

Social Security Number

Street address

Federal Identification Number

City, State and ZIP

Other Identification Number

Hereby appoint(s) the following individual(s)*

Name

Address

Telephone Number

as attorney(s)-in-fact to represent the taxpayer(s) before Maine Revenue Services for the following tax matter(s)

(specify the type[s] of tax and year[s] or period[s] [date of death, if estate tax])

Type of Tax

Maine Form Number

Year(s) or period(s)

(Individual, Corporate, Sales, Excise, Etc.)

(1040-ME, 1120-ME, Sales, Excise, etc.)

(Date of death if estate tax)

The attorney(s)-in-fact (or either of them) are authorized, subject to revocation, to receive confidential information

and to perform any and all acts that the principal(s) can perform with respect to the above specified tax matters.

Send originals of all notices and all other written communications in proceedings involving the above tax

matters to the appointee, first named above and a duplicate copy of all notices and all other communications

to the taxpayer named above, or

Send copies of all notices and all other written communications addressed to the taxpayer(s) in proceedings

involving the above tax matters to:

The appointee first named above or

Names of not more than two of the appointees named above

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

This Power of Attorney revokes all other earlier powers of attorney and tax information authorizations on file with

Maine Revenue Services for the tax matters and years or periods covered by this power of attorney, except the

following:

(Specify to whom granted, date, and address including ZIP code or refer to attached copies of earlier powers and

authorizations.)

Signature of or for taxpayer(s)

If signed by a corporate officer, partner, or fiduciary on behalf of the taxpayer, I certify that I have the authority to

execute this power of attorney on behalf of the taxpayer.

(Signature)

(Title, if applicable)

(Date)

Also type or print your name below if signing for a taxpayer who is not an individual:

(Signature)

(Title, if applicable)

(Date)

*You may authorize an organization, firm or partnership to receive confidential information, but your representative

must be an individual who must complete Part II

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2