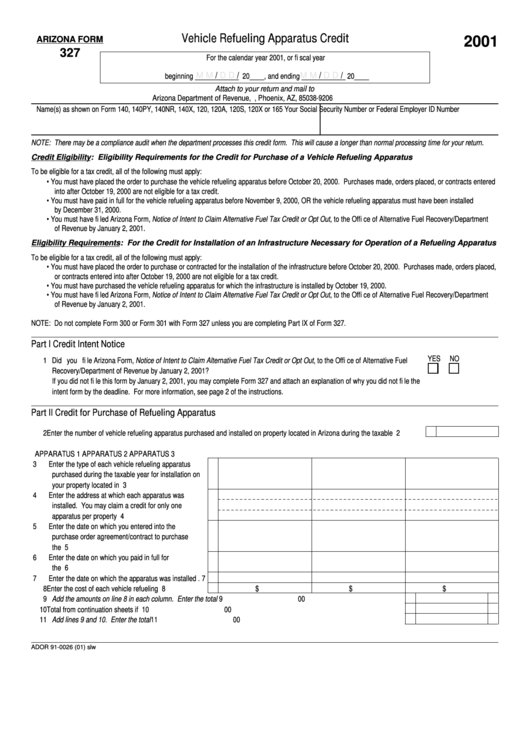

Vehicle Refueling Apparatus Credit

2001

ARIZONA FORM

327

For the calendar year 2001, or fi scal year

/

/

/

/

beginning ____________ 20____, and ending ____________ 20____

M M

D D

M M

D D

Attach to your return and mail to

Arizona Department of Revenue, P.O. Box 29206, Phoenix, AZ, 85038-9206

Name(s) as shown on Form 140, 140PY, 140NR, 140X, 120, 120A, 120S, 120X or 165

Your Social Security Number or Federal Employer ID Number

NOTE: There may be a compliance audit when the department processes this credit form. This will cause a longer than normal processing time for your return.

Credit Eligibility: Eligibility Requirements for the Credit for Purchase of a Vehicle Refueling Apparatus

To be eligible for a tax credit, all of the following must apply:

• You must have placed the order to purchase the vehicle refueling apparatus before October 20, 2000. Purchases made, orders placed, or contracts entered

into after October 19, 2000 are not eligible for a tax credit.

• You must have paid in full for the vehicle refueling apparatus before November 9, 2000, OR the vehicle refueling apparatus must have been installed

by December 31, 2000.

• You must have fi led Arizona Form, Notice of Intent to Claim Alternative Fuel Tax Credit or Opt Out, to the Offi ce of Alternative Fuel Recovery/Department

of Revenue by January 2, 2001.

Eligibility Requirements: For the Credit for Installation of an Infrastructure Necessary for Operation of a Refueling Apparatus

To be eligible for a tax credit, all of the following must apply:

• You must have placed the order to purchase or contracted for the installation of the infrastructure before October 20, 2000. Purchases made, orders placed,

or contracts entered into after October 19, 2000 are not eligible for a tax credit.

• You must have purchased the vehicle refueling apparatus for which the infrastructure is installed by October 19, 2000.

• You must have fi led Arizona Form, Notice of Intent to Claim Alternative Fuel Tax Credit or Opt Out, to the Offi ce of Alternative Fuel Recovery/Department

of Revenue by January 2, 2001.

NOTE: Do not complete Form 300 or Form 301 with Form 327 unless you are completing Part IX of Form 327.

Part I

Credit Intent Notice

YES

NO

1 Did you fi le Arizona Form, Notice of Intent to Claim Alternative Fuel Tax Credit or Opt Out, to the Offi ce of Alternative Fuel

Recovery/Department of Revenue by January 2, 2001?....................................................................................................................

If you did not fi le this form by January 2, 2001, you may complete Form 327 and attach an explanation of why you did not fi le the

intent form by the deadline. For more information, see page 2 of the instructions.

Part II

Credit for Purchase of Refueling Apparatus

2 Enter the number of vehicle refueling apparatus purchased and installed on property located in Arizona during the taxable year...

2

APPARATUS 1

APPARATUS 2

APPARATUS 3

3 Enter the type of each vehicle refueling apparatus

purchased during the taxable year for installation on

your property located in Arizona .................................

3

4 Enter the address at which each apparatus was

installed. You may claim a credit for only one

apparatus per property ...............................................

4

5 Enter the date on which you entered into the

purchase order agreement/contract to purchase

the apparatus..............................................................

5

6 Enter the date on which you paid in full for

the apparatus..............................................................

6

7 Enter the date on which the apparatus was installed .

7

8 Enter the cost of each vehicle refueling apparatus.....

8 $

$

$

9 Add the amounts on line 8 in each column. Enter the total ...................................................................................................

9

00

10 Total from continuation sheets if applicable ............................................................................................................................

10

00

11 Add lines 9 and 10. Enter the total.........................................................................................................................................

11

00

Continued...

ADOR 91-0026 (01) slw

1

1 2

2 3

3