Production Restoration Project Application And Reporting Instructions Sheet

ADVERTISEMENT

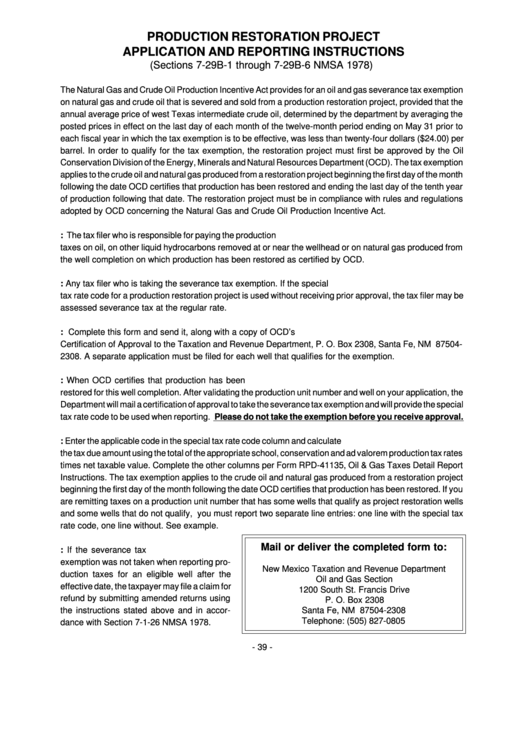

PRODUCTION RESTORATION PROJECT

APPLICATION AND REPORTING INSTRUCTIONS

(Sections 7-29B-1 through 7-29B-6 NMSA 1978)

The Natural Gas and Crude Oil Production Incentive Act provides for an oil and gas severance tax exemption

on natural gas and crude oil that is severed and sold from a production restoration project, provided that the

annual average price of west Texas intermediate crude oil, determined by the department by averaging the

posted prices in effect on the last day of each month of the twelve-month period ending on May 31 prior to

each fiscal year in which the tax exemption is to be effective, was less than twenty-four dollars ($24.00) per

barrel. In order to qualify for the tax exemption, the restoration project must first be approved by the Oil

Conservation Division of the Energy, Minerals and Natural Resources Department (OCD). The tax exemption

applies to the crude oil and natural gas produced from a restoration project beginning the first day of the month

following the date OCD certifies that production has been restored and ending the last day of the tenth year

of production following that date. The restoration project must be in compliance with rules and regulations

adopted by OCD concerning the Natural Gas and Crude Oil Production Incentive Act.

1. Who may use the severance tax exemption: The tax filer who is responsible for paying the production

taxes on oil, on other liquid hydrocarbons removed at or near the wellhead or on natural gas produced from

the well completion on which production has been restored as certified by OCD.

2. Who must file the application: Any tax filer who is taking the severance tax exemption. If the special

tax rate code for a production restoration project is used without receiving prior approval, the tax filer may be

assessed severance tax at the regular rate.

3. How and where to file the application: Complete this form and send it, along with a copy of OCD’s

Certification of Approval to the Taxation and Revenue Department, P. O. Box 2308, Santa Fe, NM 87504-

2308. A separate application must be filed for each well that qualifies for the exemption.

4. When to apply for the severance tax exemption: When OCD certifies that production has been

restored for this well completion. After validating the production unit number and well on your application, the

Department will mail a certification of approval to take the severance tax exemption and will provide the special

tax rate code to be used when reporting. Please do not take the exemption before you receive approval.

5. How to take the exemption: Enter the applicable code in the special tax rate code column and calculate

the tax due amount using the total of the appropriate school, conservation and ad valorem production tax rates

times net taxable value. Complete the other columns per Form RPD-41135, Oil & Gas Taxes Detail Report

Instructions. The tax exemption applies to the crude oil and natural gas produced from a restoration project

beginning the first day of the month following the date OCD certifies that production has been restored. If you

are remitting taxes on a production unit number that has some wells that qualify as project restoration wells

and some wells that do not qualify, you must report two separate line entries: one line with the special tax

rate code, one line without. See example.

Mail or deliver the completed form to:

6. Claim for refund: If the severance tax

exemption was not taken when reporting pro-

New Mexico Taxation and Revenue Department

duction taxes for an eligible well after the

Oil and Gas Section

effective date, the taxpayer may file a claim for

1200 South St. Francis Drive

refund by submitting amended returns using

P. O. Box 2308

the instructions stated above and in accor-

Santa Fe, NM 87504-2308

Telephone: (505) 827-0805

dance with Section 7-1-26 NMSA 1978.

- 39 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1