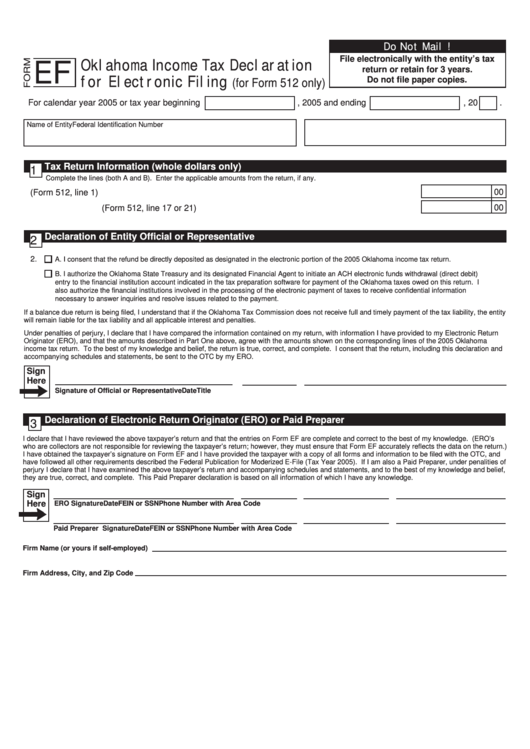

Form Ef - Oklahoma Income Tax Declaration For Electronic Filing (For Form 512 Only) 2005

ADVERTISEMENT

Do Not Mail !

File electronically with the entity’s tax

Oklahoma Income Tax Declaration

EF

return or retain for 3 years.

Do not file paper copies.

for Electronic Filing

(for Form 512 only)

For calendar year 2005 or tax year beginning

, 2005 and ending

, 20

.

Name of Entity

Federal Identification Number

Tax Return Information (whole dollars only)

1

Complete the lines (both A and B). Enter the applicable amounts from the return, if any.

00

1. Form 512

A. Oklahoma taxable income (Form 512, line 1) .....................................................

00

B. Refund or balance due (Form 512, line 17 or 21) ...............................................

Declaration of Entity Official or Representative

2

2.

A. I consent that the refund be directly deposited as designated in the electronic portion of the 2005 Oklahoma income tax return.

B. I authorize the Oklahoma State Treasury and its designated Financial Agent to initiate an ACH electronic funds withdrawal (direct debit)

entry to the financial institution account indicated in the tax preparation software for payment of the Oklahoma taxes owed on this return. I

also authorize the financial institutions involved in the processing of the electronic payment of taxes to receive confidential information

necessary to answer inquiries and resolve issues related to the payment.

If a balance due return is being filed, I understand that if the Oklahoma Tax Commission does not receive full and timely payment of the tax liability, the entity

will remain liable for the tax liability and all applicable interest and penalties.

Under penalties of perjury, I declare that I have compared the information contained on my return, with information I have provided to my Electronic Return

Originator (ERO), and that the amounts described in Part One above, agree with the amounts shown on the corresponding lines of the 2005 Oklahoma

income tax return. To the best of my knowledge and belief, the return is true, correct, and complete. I consent that the return, including this declaration and

accompanying schedules and statements, be sent to the OTC by my ERO.

Sign

Here

Signature of Official or Representative

Date

Title

Declaration of Electronic Return Originator (ERO) or Paid Preparer

3

I declare that I have reviewed the above taxpayer’s return and that the entries on Form EF are complete and correct to the best of my knowledge. (ERO’s

who are collectors are not responsible for reviewing the taxpayer’s return; however, they must ensure that Form EF accurately reflects the data on the return.)

I have obtained the taxpayer’s signature on Form EF and I have provided the taxpayer with a copy of all forms and information to be filed with the OTC, and

have followed all other requirements described the Federal Publication for Moderized E-File (Tax Year 2005). If I am also a Paid Preparer, under penalities of

perjury I declare that I have examined the above taxpayer’s return and accompanying schedules and statements, and to the best of my knowledge and belief,

they are true, correct, and complete. This Paid Preparer declaration is based on all information of which I have any knowledge.

Sign

Here

ERO Signature

Date

FEIN or SSN

Phone Number with Area Code

Paid Preparer Signature

Date

FEIN or SSN

Phone Number with Area Code

Firm Name (or yours if self-employed)

Firm Address, City, and Zip Code

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1