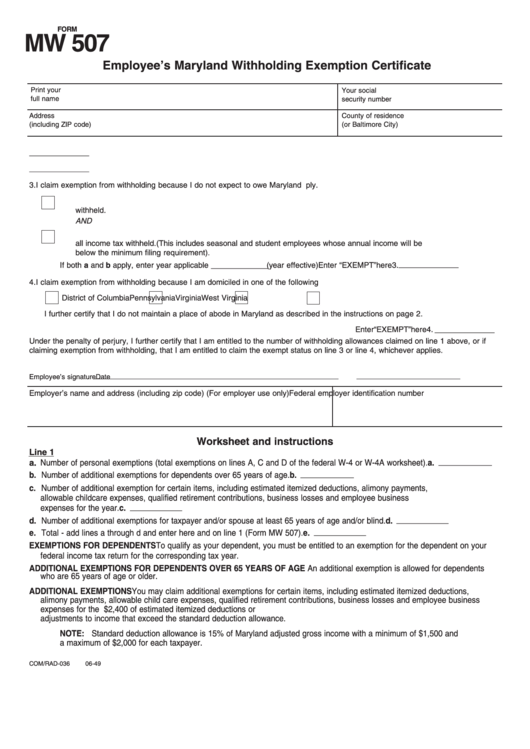

FORM

MW 507

Employee’s Maryland Withholding Exemption Certificate

Print your

Your social

full name

security number

Address

County of residence

(including ZIP code)

(or Baltimore City)

1. _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

1.

Total number of exemptions you are claiming from worksheet below

2. _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

2.

Additional withholding per pay period under agreement with employer

3.

I claim exemption from withholding because I do not expect to owe Maryland tax. See instructions below and check boxes that apply.

a.

Last year I did not owe any Maryland income tax and had a right to a full refund of all income tax

withheld.

AND

b.

This year I do not expect to owe any Maryland income tax and expect to have the right to a full refund of

all income tax withheld. (This includes seasonal and student employees whose annual income will be

below the minimum filing requirement).

Enter “EXEMPT” here 3. _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

If both a and b apply, enter year applicable _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _(year effective)

4.

I claim exemption from withholding because I am domiciled in one of the following states. Check state that applies.

District of Columbia

Pennsylvania

Virginia

West Virginia

I further certify that I do not maintain a place of abode in Maryland as described in the instructions on page 2.

Enter “EXEMPT” here 4. _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Under the penalty of perjury, I further certify that I am entitled to the number of withholding allowances claimed on line 1 above, or if

claiming exemption from withholding, that I am entitled to claim the exempt status on line 3 or line 4, whichever applies.

Employee’s signature

Date

Employer’s name and address (including zip code) (For employer use only)

Federal employer identification number

Worksheet and instructions

Line 1

a. Number of personal exemptions (total exemptions on lines A, C and D of the federal W-4 or W-4A worksheet). a. _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

b. _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

b. Number of additional exemptions for dependents over 65 years of age.

c. Number of additional exemption for certain items, including estimated itemized deductions, alimony payments,

allowable childcare expenses, qualified retirement contributions, business losses and employee business

c. ____________

expenses for the year.

d. ____________

d. Number of additional exemptions for taxpayer and/or spouse at least 65 years of age and/or blind.

e. ____________

e. Total - add lines a through d and enter here and on line 1 (Form MW 507).

EXEMPTIONS FOR DEPENDENTS To qualify as your dependent, you must be entitled to an exemption for the dependent on your

federal income tax return for the corresponding tax year.

ADDITIONAL EXEMPTIONS FOR DEPENDENTS OVER 65 YEARS OF AGE An additional exemption is allowed for dependents

who are 65 years of age or older.

ADDITIONAL EXEMPTIONS You may claim additional exemptions for certain items, including estimated itemized deductions,

alimony payments, allowable child care expenses, qualified retirement contributions, business losses and employee business

expenses for the year. One additional withholding exemption is permitted for each $2,400 of estimated itemized deductions or

adjustments to income that exceed the standard deduction allowance.

NOTE: Standard deduction allowance is 15% of Maryland adjusted gross income with a minimum of $1,500 and

a maximum of $2,000 for each taxpayer.

COM/RAD-036

06-49

1

1