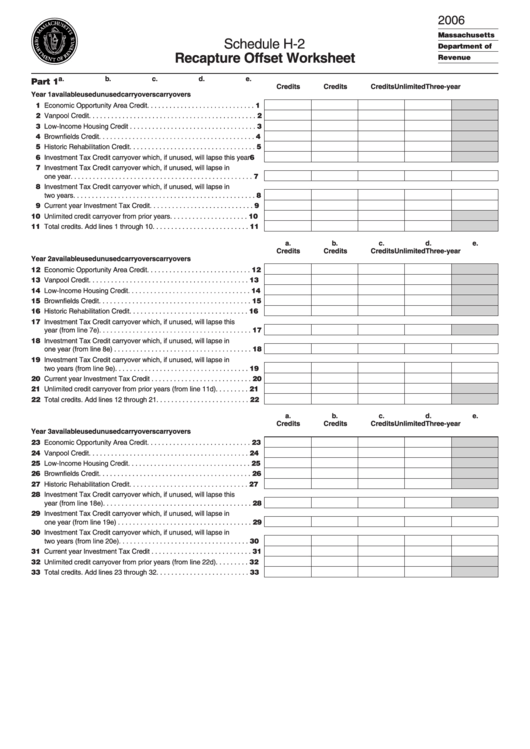

Schedule H-2 - Recapture Offset Worksheet Form - Department Of Revenue - Massachusetts

ADVERTISEMENT

2006

Massachusetts

Schedule H-2

Department of

Recapture Offset Worksheet

Revenue

a.

b.

c.

d.

e.

Part 1

Credits

Credits

Credits

Unlimited

Three-year

Year 1

available

used

unused

carryovers

carryovers

11 Economic Opportunity Area Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

12 Vanpool Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

13 Low-Income Housing Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

14 Brownfields Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

15 Historic Rehabilitation Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

16 Investment Tax Credit carryover which, if unused, will lapse this year 6

17 Investment Tax Credit carryover which, if unused, will lapse in

one year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

18 Investment Tax Credit carryover which, if unused, will lapse in

two years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

19 Current year Investment Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Unlimited credit carryover from prior years . . . . . . . . . . . . . . . . . . . . . 10

11 Total credits. Add lines 1 through 10 . . . . . . . . . . . . . . . . . . . . . . . . . . 11

a.

b.

c.

d.

e.

Credits

Credits

Credits

Unlimited

Three-year

Year 2

available

used

unused

carryovers

carryovers

12 Economic Opportunity Area Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Vanpool Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Low-Income Housing Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Brownfields Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Historic Rehabilitation Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Investment Tax Credit carryover which, if unused, will lapse this

year (from line 7e). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Investment Tax Credit carryover which, if unused, will lapse in

one year (from line 8e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Investment Tax Credit carryover which, if unused, will lapse in

two years (from line 9e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Current year Investment Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21 Unlimited credit carryover from prior years (from line 11d) . . . . . . . . . 21

22 Total credits. Add lines 12 through 21 . . . . . . . . . . . . . . . . . . . . . . . . . 22

a.

b.

c.

d.

e.

Credits

Credits

Credits

Unlimited

Three-year

Year 3

available

used

unused

carryovers

carryovers

23 Economic Opportunity Area Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

24 Vanpool Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

25 Low-Income Housing Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

26 Brownfields Credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

27 Historic Rehabilitation Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

28 Investment Tax Credit carryover which, if unused, will lapse this

year (from line 18e). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

29 Investment Tax Credit carryover which, if unused, will lapse in

one year (from line 19e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

30 Investment Tax Credit carryover which, if unused, will lapse in

two years (from line 20e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

31 Current year Investment Tax Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . 31

32 Unlimited credit carryover from prior years (from line 22d) . . . . . . . . . 32

33 Total credits. Add lines 23 through 32 . . . . . . . . . . . . . . . . . . . . . . . . . 33

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2