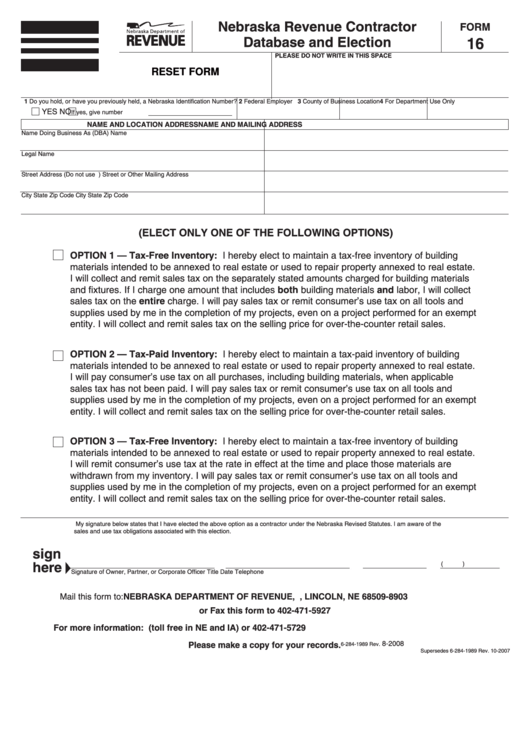

Form 16 - Nebraska Revenue Contractor Database And Election - Nebraska Department Of Revenue

ADVERTISEMENT

Nebraska Revenue Contractor

FORM

Database and Election

16

pLEASE DO NOT WRITE IN THIS SpACE

RESET FORM

1 Do you hold, or have you previously held, a Nebraska Identification Number?

2 Federal Employer I.D. Number

3 County of Business Location 4 For Department Use Only

YES

NO

If yes, give number

NAME AND LOCATION ADDRESS

NAME AND MAILING ADDRESS

Name Doing Business As (DBA)

Name

Legal Name

Street Address (Do not use P.O. Box)

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

(ELECT ONLY ONE OF THE FOLLOWING OpTIONS)

OpTION 1 — Tax-Free Inventory: I hereby elect to maintain a tax-free inventory of building

materials intended to be annexed to real estate or used to repair property annexed to real estate.

I will collect and remit sales tax on the separately stated amounts charged for building materials

and fixtures. If I charge one amount that includes both building materials and labor, I will collect

sales tax on the entire charge. I will pay sales tax or remit consumer’s use tax on all tools and

supplies used by me in the completion of my projects, even on a project performed for an exempt

entity. I will collect and remit sales tax on the selling price for over-the-counter retail sales.

OpTION 2 — Tax-paid Inventory: I hereby elect to maintain a tax-paid inventory of building

materials intended to be annexed to real estate or used to repair property annexed to real estate.

I will pay consumer’s use tax on all purchases, including building materials, when applicable

sales tax has not been paid. I will pay sales tax or remit consumer’s use tax on all tools and

supplies used by me in the completion of my projects, even on a project performed for an exempt

entity. I will collect and remit sales tax on the selling price for over-the-counter retail sales.

OpTION 3 — Tax-Free Inventory: I hereby elect to maintain a tax-free inventory of building

materials intended to be annexed to real estate or used to repair property annexed to real estate.

I will remit consumer’s use tax at the rate in effect at the time and place those materials are

withdrawn from my inventory. I will pay sales tax or remit consumer’s use tax on all tools and

supplies used by me in the completion of my projects, even on a project performed for an exempt

entity. I will collect and remit sales tax on the selling price for over-the-counter retail sales.

My signature below states that I have elected the above option as a contractor under the Nebraska Revised Statutes. I am aware of the

sales and use tax obligations associated with this election.

sign

here

(

)

Signature of Owner, Partner, or Corporate Officer

Title

Date

Telephone

Mail this form to: NEBRASKA DEpARTMENT OF REVENUE, p.O. BOX 98903, LINCOLN, NE 68509-8903

or Fax this form to 402-471-5927

For more information: or call 800-742-7474 (toll free in NE and IA) or 402-471-5729

8-2008

please make a copy for your records.

6-284-1989 Rev.

Supersedes 6-284-1989 Rev. 10-2007

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1