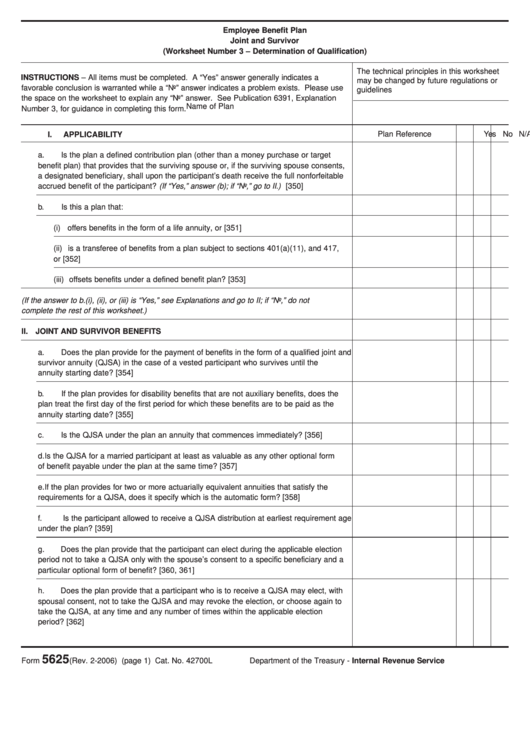

Employee Benefit Plan

Joint and Survivor

(Worksheet Number 3 – Determination of Qualification)

The technical principles in this worksheet

INSTRUCTIONS – All items must be completed. A “Yes” answer generally indicates a

may be changed by future regulations or

favorable conclusion is warranted while a “No” answer indicates a problem exists. Please use

guidelines

the space on the worksheet to explain any “No” answer. See Publication 6391, Explanation

Name of Plan

Number 3, for guidance in completing this form.

Plan Reference

Yes No N/A

I.

APPLICABILITY

a.

Is the plan a defined contribution plan (other than a money purchase or target

benefit plan) that provides that the surviving spouse or, if the surviving spouse consents,

a designated beneficiary, shall upon the participant’s death receive the full nonforfeitable

accrued benefit of the participant? (If “Yes,” answer (b); if “No,” go to II.) [350]

b.

Is this a plan that:

(i)

offers benefits in the form of a life annuity, or [351]

(ii) is a transferee of benefits from a plan subject to sections 401(a)(11), and 417,

or [352]

(iii) offsets benefits under a defined benefit plan? [353]

(If the answer to b.(i), (ii), or (iii) is “Yes,” see Explanations and go to II; if “No,” do not

complete the rest of this worksheet.)

II.

JOINT AND SURVIVOR BENEFITS

a.

Does the plan provide for the payment of benefits in the form of a qualified joint and

survivor annuity (QJSA) in the case of a vested participant who survives until the

annuity starting date? [354]

b.

If the plan provides for disability benefits that are not auxiliary benefits, does the

plan treat the first day of the first period for which these benefits are to be paid as the

annuity starting date? [355]

c.

Is the QJSA under the plan an annuity that commences immediately? [356]

d.

Is the QJSA for a married participant at least as valuable as any other optional form

of benefit payable under the plan at the same time? [357]

e.

If the plan provides for two or more actuarially equivalent annuities that satisfy the

requirements for a QJSA, does it specify which is the automatic form? [358]

f.

Is the participant allowed to receive a QJSA distribution at earliest requirement age

under the plan? [359]

g.

Does the plan provide that the participant can elect during the applicable election

period not to take a QJSA only with the spouse’s consent to a specific beneficiary and a

particular optional form of benefit? [360, 361]

h.

Does the plan provide that a participant who is to receive a QJSA may elect, with

spousal consent, not to take the QJSA and may revoke the election, or choose again to

take the QJSA, at any time and any number of times within the applicable election

period? [362]

5625

Form

(Rev. 2-2006) (page 1) Cat. No. 42700L

Department of the Treasury - Internal Revenue Service

1

1 2

2