Local Earned Income Tax Retur Form - 2007 - Penncrest School Distric

ADVERTISEMENT

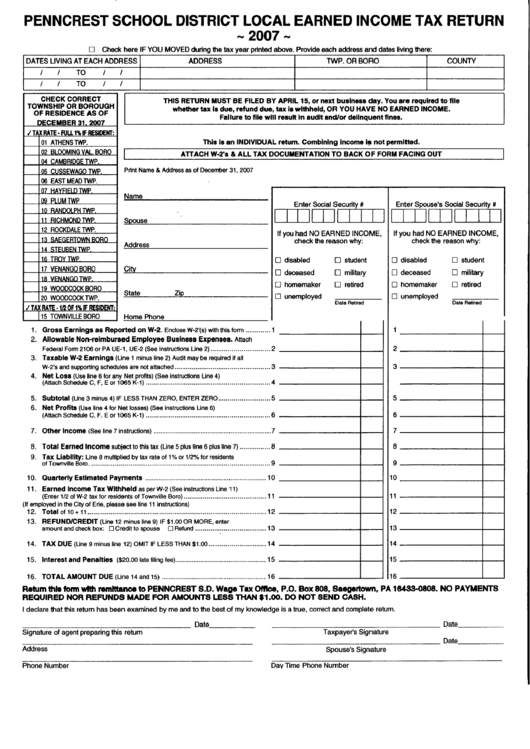

PENNCREST SCHOOL DISTRICT LOCAL EARNED INCOME TAX RETURN

- 2OO7 -

D Check hsre lF YOU MOVED during lhe tax year printed above. Provide each address and datos living lhere:

DATES LIVING AT EACH ADDRESS

ADDRESS

TWP. OR BORO

COUNTY

I

I

TO

I

I

I

I

TO

I

THIS RETURN ilUST BE FILED BY APRIL 15, or ncxt buslness day. You are requlred to file

whedrer tax ls due, refund due, tax ls wlthheld, OR YOU HAVE NO EARNED lt{COME.

Fallure to file wlll result ln audlt and/or dellnquent fines.

CHECK CORRECT

TOWNSHIP OR BOROUGH

OF RESIDENCE AS OF

nF^EltEEA

e1 qrao,

./ TAI nllE. H|lI r% F ffiSmElft

01 ATHENSTWP.

02 H r}oM|NG Vil nono

M CAMBRIDGE IWP,

05 c| ISqFWAGN TWP

06 EASTMEAOTWP.

07 HAYFIFI N TWP

0 9 P I T J M T W P

tn RANnd pHTwp

I RICI{MONDTWP

12 ROCKNAIFTWP

l/t STFI IRFN TWP

16 TROYTWP

17 VFNANGOROPO

tN VFNANGNTWP

19 WOODCOCKBORO

20 wooDcocKTwP.

./ TAI NATF . I,, NF IO( F NFC|nFlIt

5 TOWNVILLE BORO

This le an INDIVIOUAL retum. Comblnlng Income 19 not permlfted.

ATTACH W-2's & ALLTAX DOCUIIENTATION TO BACK OF FORU FACr.lG OUT

Pdnt Nam€ & Address as of D€cenb€r 31, 2007

Name

Enter Social Securig #

Enter Spouse's Social Security #

Soouse

nrrmrT-rn

Artdress

lf you had NO EARNED INCOME,

check the reason why:

lf you had NO EARNED INCOME,

check the reason whv:

Citv

!

disabled

!

deceased

!

tpmemaker

E unemployed

I stud€nt

! military

n retired

! disabled

D deceased

!

homemaker

tr unemployed

1

! studenl

! military

E retired

State

Zio

Dato R€tir€d

'1. Gross Earnlngs as Reported on W-2. Enctos€ w-2'(s) rvith this torm ............. 1

2. Allowable Non+elmbursed Employee Business Exp€nses. Attach

Federal

Form 2106 or PA UE-1, UE-2 (S€e instruclions

Line 2) ....................

...........2

3. Taxable W-2 Earnings (Line 1 minus line 2) Audit may be required il all

W-2's and supporting

sch€dul€s

are not attached.

.........................3

Net Losg (Us€ lin€ 6 for any Net profits) (See instructions Line 4)

(Anach Sch€dule C, F, E or 1065 K-1)

.................4

Subtotal (Une 3 minus 4) lF LESS THAN ZERO, ENTER ZERO...........................5

Net Prolits (Use line 4 for Net losses) (Soe instructions Line 6)

(Attach Schedule C, F. E or 1065 K-1) .................

........................6

7. Other Income (See line 7 instruclions)

................7

Total Earned Income subiect to this tax (Line 5 plus lino 6 plus line 7) ................8

Tax Liabllity: Lin€ I multlpliod by tax rate of 1% or 1/2olo for residsnts

of Townville Boro

10. Ouarterly Estlmated Payments

..................

10

1 1 . Earned lncome Tax Wlthheld as per w-2 (See instructions Line 1 1)

(Enter 1/2 of W-2 tax for residents of Townville Boro)...........................................

1 1

(lf employed in th€ City of Erie, please s€€ line I I instructions)

1 2 . T o t a l o l 1 0 + 1 1 . . . . . . . . . .

. . . . . . . . . . . 1 2

13. REFUND/CREDIT 1t-ine 12 minus line 9) lF $1.00 OR MORE, enter

amountandcheckbox:

DCredittospouse 8Refund.............:.......................13

14. TAX DUE (Line 9 minus line 12) OMIT lF LESS THAN $1.0O..............................14

15. Interest and Penalties ($20.00 late liling fee)......................................................

15

16. TOTAL AMOUNT DUE (Line 14 and 15)

........ 16

Retrm thle lorm nlt| rcmlttancc to PENNCREST S.D. Wago Tax Ofllce, P.O. Box 808, Saegertiln,

PA 16439-0808. NO PAYMENTS

REQUIRED NOR REFUNDS MADE FOR AMOI'NT8 LESS THAN $1.OO. DO NOT SEND CASH.

I declare that this retum has been examined by me and to the best of my knowledge is a true, correct and complete return.

Signature of agent preparing this retum

Taxpayeds Signature

Date

Date

Address

Spouse's Signature

Datc R€lked

Home Phone

4 .

5 .

6.

8 .

9.

Phone Number

Date-

Dav Time Phone Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2