Form Ms-1 Instructions For Completing Summary Inventory Of Valuation

ADVERTISEMENT

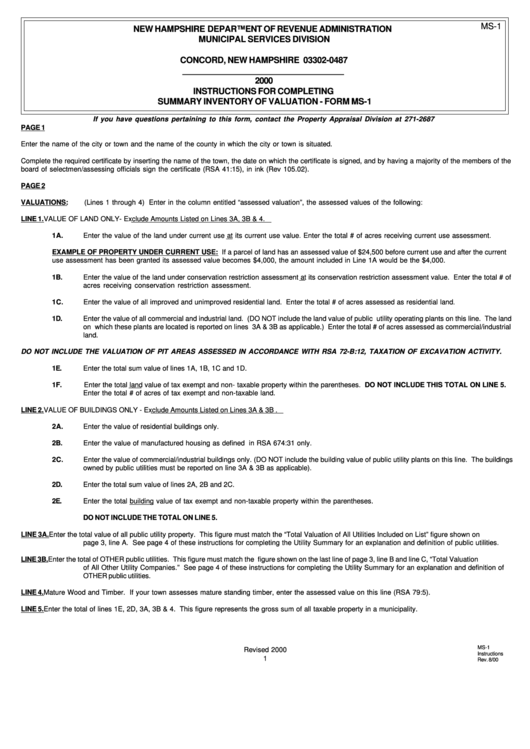

MS-1

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

MUNICIPAL SERVICES DIVISION

P.O. Box 487

CONCORD, NEW HAMPSHIRE 03302-0487

____________________________________

2000

INSTRUCTIONS FOR COMPLETING

SUMMARY INVENTORY OF VALUATION - FORM MS-1

If you have questions pertaining to this form, contact the Property Appraisal Division at 271-2687

PAGE 1

Enter the name of the city or town and the name of the county in which the city or town is situated.

Complete the required certificate by inserting the name of the town, the date on which the certificate is signed, and by having a majority of the members of the

board of selectmen/assessing officials sign the certificate (RSA 41:15), in ink (Rev 105.02).

PAGE 2

VALUATIONS:

(Lines 1 through 4) Enter in the column entitled “assessed valuation”, the assessed values of the following:

LINE 1.

VALUE OF LAND ONLY- Exclude Amounts Listed on Lines 3A, 3B & 4.

1A.

Enter the value of the land under current use at its current use value. Enter the total # of acres receiving current use assessment.

EXAMPLE OF PROPERTY UNDER CURRENT USE: If a parcel of land has an assessed value of $24,500 before current use and after the current

use assessment has been granted its assessed value becomes $4,000, the amount included in Line 1A would be the $4,000.

1B.

Enter the value of the land under conservation restriction assessment at its conservation restriction assessment value. Enter the total # of

acres receiving conservation restriction assessment.

1C.

Enter the value of all improved and unimproved residential land. Enter the total # of acres assessed as residential land.

1D.

Enter the value of all commercial and industrial land. (DO NOT include the land value of public utility operating plants on this line. The land

on which these plants are located is reported on lines 3A & 3B as applicable.) Enter the total # of acres assessed as commercial/industrial

land.

DO NOT INCLUDE THE VALUATION OF PIT AREAS ASSESSED IN ACCORDANCE WITH RSA 72-B:12, TAXATION OF EXCAVATION ACTIVITY.

1E.

Enter the total sum value of lines 1A, 1B, 1C and 1D.

1F.

Enter the total land value of tax exempt and non- taxable property within the parentheses. DO NOT INCLUDE THIS TOTAL ON LINE 5.

Enter the total # of acres of tax exempt and non-taxable land.

LINE 2.

VALUE OF BUILDINGS ONLY - Exclude Amounts Listed on Lines 3A & 3B .

2A.

Enter the value of residential buildings only.

2B.

Enter the value of manufactured housing as defined in RSA 674:31 only.

2C.

Enter the value of commercial/industrial buildings only. (DO NOT include the building value of public utility plants on this line. The buildings

owned by public utilities must be reported on line 3A & 3B as applicable).

2D.

Enter the total sum value of lines 2A, 2B and 2C.

2E.

Enter the total building value of tax exempt and non-taxable property within the parentheses.

DO NOT INCLUDE THE TOTAL ON LINE 5.

LINE 3A.

Enter the total value of all public utility property. This figure must match the “Total Valuation of All Utilities Included on List” figure shown on

page 3, line A. See page 4 of these instructions for completing the Utility Summary for an explanation and definition of public utilities.

LINE 3B.

Enter the total of OTHER public utilities. This figure must match the figure shown on the last line of page 3, line B and line C, “Total Valuation

of All Other Utility Companies.” See page 4 of these instructions for completing the Utility Summary for an explanation and definition of

OTHER public utilities.

LINE 4.

Mature Wood and Timber. If your town assesses mature standing timber, enter the assessed value on this line (RSA 79:5).

LINE 5.

Enter the total of lines 1E, 2D, 3A, 3B & 4. This figure represents the gross sum of all taxable property in a municipality.

MS-1

Revised 2000

Instructions

1

Rev. 8/00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6