Form 51a128 - Solid Waste Recycling Machinery Exemption Certificate

ADVERTISEMENT

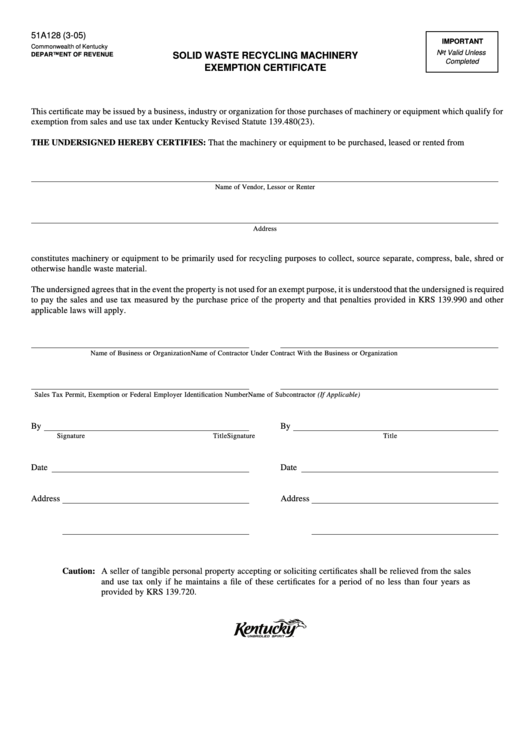

51A128 (3-05)

IMPORTANT

Commonwealth of Kentucky

Not Valid Unless

SOLID WASTE RECYCLING MACHINERY

DEPARTMENT OF REVENUE

Completed

EXEMPTION CERTIFICATE

This certificate may be issued by a business, industry or organization for those purchases of machinery or equipment which qualify for

exemption from sales and use tax under Kentucky Revised Statute 139.480(23).

THE UNDERSIGNED HEREBY CERTIFIES: That the machinery or equipment to be purchased, leased or rented from

Name of Vendor, Lessor or Renter

Address

constitutes machinery or equipment to be primarily used for recycling purposes to collect, source separate, compress, bale, shred or

otherwise handle waste material.

The undersigned agrees that in the event the property is not used for an exempt purpose, it is understood that the undersigned is required

to pay the sales and use tax measured by the purchase price of the property and that penalties provided in KRS 139.990 and other

applicable laws will apply.

Name of Business or Organization

Name of Contractor Under Contract With the Business or Organization

Sales Tax Permit, Exemption or Federal Employer Identification Number

Name of Subcontractor (If Applicable)

By

By

Signature

Title

Signature

Title

Date

Date

Address

Address

Caution: A seller of tangible personal property accepting or soliciting certificates shall be relieved from the sales

and use tax only if he maintains a file of these certificates for a period of no less than four years as

provided by KRS 139.720.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1