Instructions For Form 943 - 2011

ADVERTISEMENT

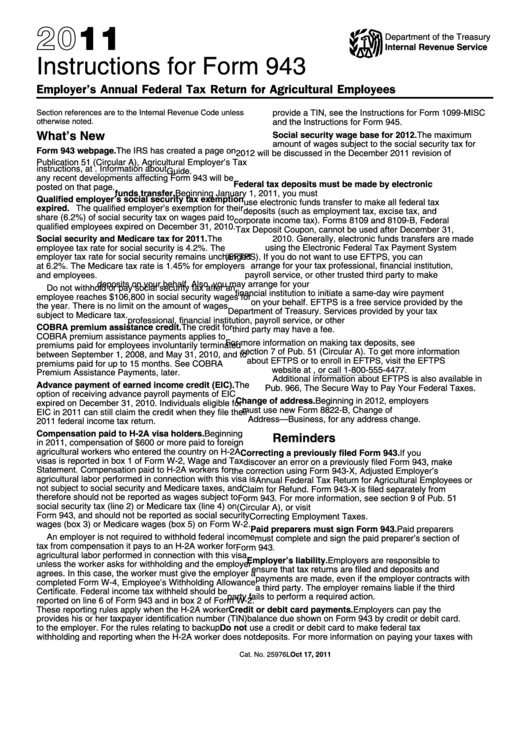

2011

Department of the Treasury

Internal Revenue Service

Instructions for Form 943

Employer’s Annual Federal Tax Return for Agricultural Employees

provide a TIN, see the Instructions for Form 1099-MISC

Section references are to the Internal Revenue Code unless

otherwise noted.

and the Instructions for Form 945.

What’s New

Social security wage base for 2012. The maximum

amount of wages subject to the social security tax for

Form 943 webpage. The IRS has created a page on

2012 will be discussed in the December 2011 revision of

IRS.gov for information about Form 943 and its

Publication 51 (Circular A), Agricultural Employer’s Tax

instructions, at Information about

Guide.

any recent developments affecting Form 943 will be

Federal tax deposits must be made by electronic

posted on that page.

funds transfer. Beginning January 1, 2011, you must

Qualified employer’s social security tax exemption

use electronic funds transfer to make all federal tax

expired. The qualified employer’s exemption for their

deposits (such as employment tax, excise tax, and

share (6.2%) of social security tax on wages paid to

corporate income tax). Forms 8109 and 8109-B, Federal

qualified employees expired on December 31, 2010.

Tax Deposit Coupon, cannot be used after December 31,

Social security and Medicare tax for 2011. The

2010. Generally, electronic funds transfers are made

employee tax rate for social security is 4.2%. The

using the Electronic Federal Tax Payment System

employer tax rate for social security remains unchanged

(EFTPS). If you do not want to use EFTPS, you can

arrange for your tax professional, financial institution,

at 6.2%. The Medicare tax rate is 1.45% for employers

and employees.

payroll service, or other trusted third party to make

deposits on your behalf. Also, you may arrange for your

Do not withhold or pay social security tax after an

financial institution to initiate a same-day wire payment

employee reaches $106,800 in social security wages for

on your behalf. EFTPS is a free service provided by the

the year. There is no limit on the amount of wages

Department of Treasury. Services provided by your tax

subject to Medicare tax.

professional, financial institution, payroll service, or other

COBRA premium assistance credit. The credit for

third party may have a fee.

COBRA premium assistance payments applies to

For more information on making tax deposits, see

premiums paid for employees involuntarily terminated

section 7 of Pub. 51 (Circular A). To get more information

between September 1, 2008, and May 31, 2010, and to

about EFTPS or to enroll in EFTPS, visit the EFTPS

premiums paid for up to 15 months. See COBRA

website at , or call 1-800-555-4477.

Premium Assistance Payments, later.

Additional information about EFTPS is also available in

Advance payment of earned income credit (EIC). The

Pub. 966, The Secure Way to Pay Your Federal Taxes.

option of receiving advance payroll payments of EIC

Change of address. Beginning in 2012, employers

expired on December 31, 2010. Individuals eligible for

must use new Form 8822-B, Change of

EIC in 2011 can still claim the credit when they file their

Address—Business, for any address change.

2011 federal income tax return.

Compensation paid to H-2A visa holders. Beginning

Reminders

in 2011, compensation of $600 or more paid to foreign

agricultural workers who entered the country on H-2A

Correcting a previously filed Form 943. If you

visas is reported in box 1 of Form W-2, Wage and Tax

discover an error on a previously filed Form 943, make

Statement. Compensation paid to H-2A workers for

the correction using Form 943-X, Adjusted Employer’s

agricultural labor performed in connection with this visa is

Annual Federal Tax Return for Agricultural Employees or

not subject to social security and Medicare taxes, and

Claim for Refund. Form 943-X is filed separately from

therefore should not be reported as wages subject to

Form 943. For more information, see section 9 of Pub. 51

social security tax (line 2) or Medicare tax (line 4) on

(Circular A), or visit IRS.gov and enter the keywords

Form 943, and should not be reported as social security

Correcting Employment Taxes.

wages (box 3) or Medicare wages (box 5) on Form W-2.

Paid preparers must sign Form 943. Paid preparers

An employer is not required to withhold federal income

must complete and sign the paid preparer’s section of

tax from compensation it pays to an H-2A worker for

Form 943.

agricultural labor performed in connection with this visa

Employer’s liability. Employers are responsible to

unless the worker asks for withholding and the employer

ensure that tax returns are filed and deposits and

agrees. In this case, the worker must give the employer a

payments are made, even if the employer contracts with

completed Form W-4, Employee’s Withholding Allowance

a third party. The employer remains liable if the third

Certificate. Federal income tax withheld should be

party fails to perform a required action.

reported on line 6 of Form 943 and in box 2 of Form W-2.

These reporting rules apply when the H-2A worker

Credit or debit card payments. Employers can pay the

provides his or her taxpayer identification number (TIN)

balance due shown on Form 943 by credit or debit card.

Do not use a credit or debit card to make federal tax

to the employer. For the rules relating to backup

withholding and reporting when the H-2A worker does not

deposits. For more information on paying your taxes with

Oct 17, 2011

Cat. No. 25976L

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8