Transfer Lihc Form - Low-Income Housing Credit Statement

ADVERTISEMENT

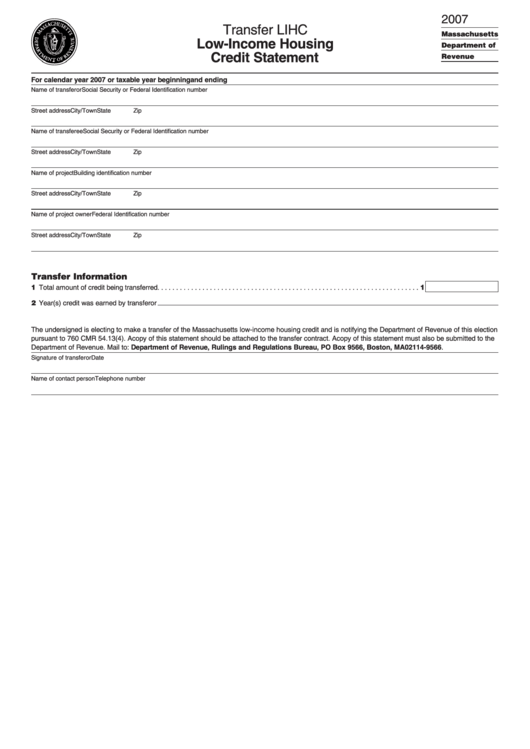

2007

Transfer LIHC

Massachusetts

Low-Income Housing

Department of

Credit Statement

Revenue

For calendar year 2007 or taxable year beginning

and ending

Name of transferor

Social Security or Federal Identification number

Street address

City/Town

State

Zip

Name of transferee

Social Security or Federal Identification number

Street address

City/Town

State

Zip

Name of project

Building identification number

Street address

City/Town

State

Zip

Name of project owner

Federal Identification number

Street address

City/Town

State

Zip

Transfer Information

1 Total amount of credit being transferred . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Year(s) credit was earned by transferor

The undersigned is electing to make a transfer of the Massachusetts low-income housing credit and is notifying the Department of Revenue of this election

pursuant to 760 CMR 54.13(4). A copy of this statement should be attached to the transfer contract. A copy of this statement must also be submitted to the

Department of Revenue. Mail to: Department of Revenue, Rulings and Regulations Bureau, PO Box 9566, Boston, MA 02114-9566.

Signature of transferor

Date

Name of contact person

Telephone number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1