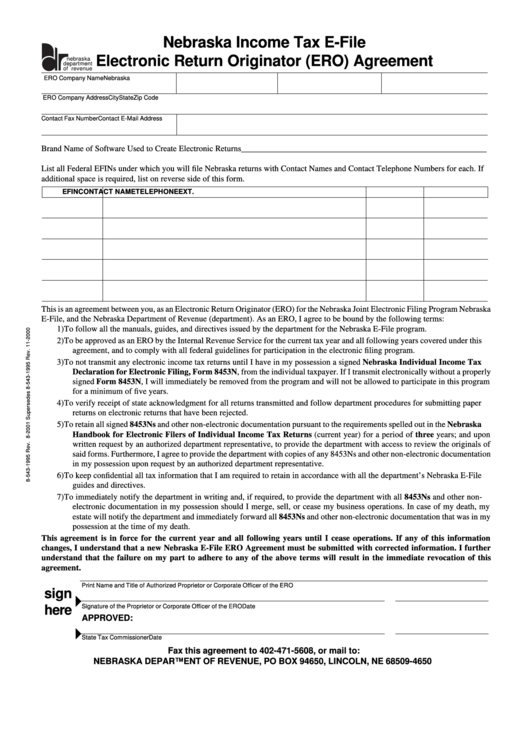

Form 8-543-1999 - Nebraska Income Tax E-File - Electronic Return Originator (Ero) Agreement

ADVERTISEMENT

Nebraska Income Tax E-File

Electronic Return Originator (ERO) Agreement

nebraska

department

of revenue

ERO Company Name

Nebraska I.D. No.

Primary ERO Contact Name

ERO Contact Telephone /Ext.

ERO Company Address

City

State

Zip Code

Contact Fax Number

Contact E-Mail Address

Brand Name of Software Used to Create Electronic Returns ___________________________________________________________

List all Federal EFINs under which you will file Nebraska returns with Contact Names and Contact Telephone Numbers for each. If

additional space is required, list on reverse side of this form.

EFIN

CONTACT NAME

TELEPHONE

EXT.

This is an agreement between you, as an Electronic Return Originator (ERO) for the Nebraska Joint Electronic Filing Program Nebraska

E-File, and the Nebraska Department of Revenue (department). As an ERO, I agree to be bound by the following terms:

1)

To follow all the manuals, guides, and directives issued by the department for the Nebraska E-File program.

2)

To be approved as an ERO by the Internal Revenue Service for the current tax year and all following years covered under this

agreement, and to comply with all federal guidelines for participation in the electronic filing program.

3)

To not transmit any electronic income tax returns until I have in my possession a signed Nebraska Individual Income Tax

Declaration for Electronic Filing, Form 8453N, from the individual taxpayer. If I transmit electronically without a properly

signed Form 8453N, I will immediately be removed from the program and will not be allowed to participate in this program

for a minimum of five years.

4)

To verify receipt of state acknowledgment for all returns transmitted and follow department procedures for submitting paper

returns on electronic returns that have been rejected.

5)

To retain all signed 8453Ns and other non-electronic documentation pursuant to the requirements spelled out in the Nebraska

Handbook for Electronic Filers of Individual Income Tax Returns (current year) for a period of three years; and upon

written request by an authorized department representative, to provide the department with access to review the originals of

said forms. Furthermore, I agree to provide the department with copies of any 8453Ns and other non-electronic documentation

in my possession upon request by an authorized department representative.

6)

To keep confidential all tax information that I am required to retain in accordance with all the department’s Nebraska E-File

guides and directives.

7)

To immediately notify the department in writing and, if required, to provide the department with all 8453Ns and other non-

electronic documentation in my possession should I merge, sell, or cease my business operations. In case of my death, my

estate will notify the department and immediately forward all 8453Ns and other non-electronic documentation that was in my

possession at the time of my death.

This agreement is in force for the current year and all following years until I cease operations. If any of this information

changes, I understand that a new Nebraska E-File ERO Agreement must be submitted with corrected information. I further

understand that the failure on my part to adhere to any of the above terms will result in the immediate revocation of this

agreement.

Print Name and Title of Authorized Proprietor or Corporate Officer of the ERO

sign

Signature of the Proprietor or Corporate Officer of the ERO

Date

here

APPROVED:

State Tax Commissioner

Date

Fax this agreement to 402-471-5608, or mail to:

NEBRASKA DEPARTMENT OF REVENUE, PO BOX 94650, LINCOLN, NE 68509-4650

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1