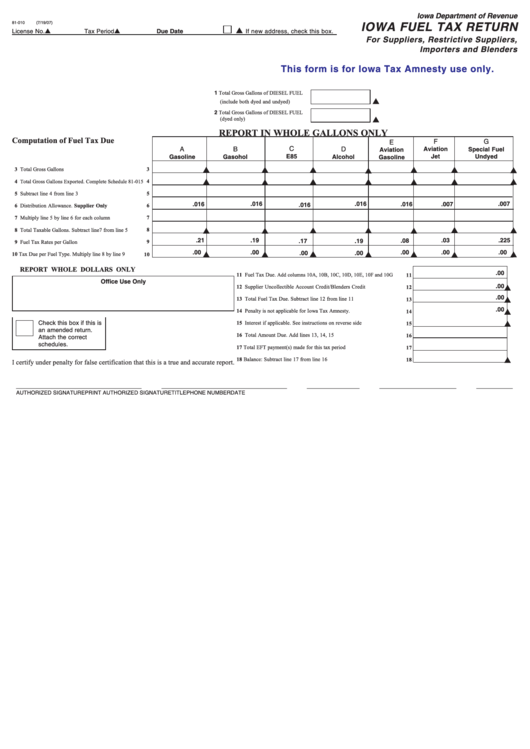

Form 81-010 - Iowa Fuel Tax Return - Iowa Department Of Revenue

ADVERTISEMENT

Iowa Department of Revenue

IOWA FUEL TAX RETURN

81-010

(7/19/07)

If new address, check this box.

License No.

Tax Period

Due Date

For Suppliers, Restrictive Suppliers,

Importers and Blenders

This form is for Iowa Tax Amnesty use only.

1 Total Gross Gallons of DIESEL FUEL

(include both dyed and undyed)

2 Total Gross Gallons of DIESEL FUEL

(dyed only)

REPORT IN WHOLE GALLONS ONLY

Computation of Fuel Tax Due

F

G

E

C

A

B

D

Aviation

Special Fuel

Aviation

E85

Jet

Gasoline

Gasohol

Alcohol

Undyed

Gasoline

3 Total Gross Gallons

3

4 Total Gross Gallons Exported. Complete Schedule 81-015

4

5 Subtract line 4 from line 3

5

.016

.016

.016

.016

.007

.007

.016

6

6 Distribution Allowance. Supplier Only

7 Multiply line 5 by line 6 for each column

7

8 Total Taxable Gallons. Subtract line7 from line 5

8

.21

.19

.03

.225

.08

.17

.19

9 Fuel Tax Rates per Gallon

9

.00

.00

.00

.00

.00

.00

.00

10 Tax Due per Fuel Type. Multiply line 8 by line 9

10

REPORT WHOLE DOLLARS ONLY

.00

11 Fuel Tax Due. Add columns 10A, 10B, 10C, 10D, 10E, 10F and 10G

11

Office Use Only

.00

12 Supplier Uncollectible Account Credit/Blenders Credit

12

.00

13 Total Fuel Tax Due. Subtract line 12 from line 11

13

.00

14 Penalty is not applicable for Iowa Tax Amnesty.

14

Check this box if this is

15 Interest if applicable. See instructions on reverse side

15

an amended return.

16 Total Amount Due. Add lines 13, 14, 15

16

Attach the correct

schedules.

17 Total EFT payment(s) made for this tax period

17

18 Balance: Subtract line 17 from line 16

18

I certify under penalty for false certification that this is a true and accurate report.

_______________________________

_______________________________

_____________

___________________

_________

AUTHORIZED SIGNATURE

PRINT AUTHORIZED SIGNATURE

TITLE

PHONE NUMBER

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2