Reset Form

Print Form

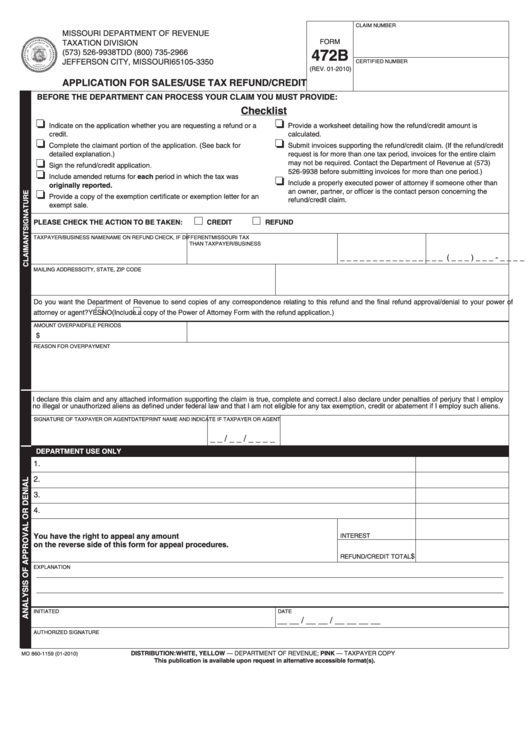

CLAIM NUMBER

MISSOURI DEPARTMENT OF REVENUE

FORM

TAXATION DIVISION

P.O. BOX 3350

(573) 526-9938 TDD (800) 735-2966

472B

JEFFERSON CITY, MISSOURI 65105-3350

CERTIFIED NUMBER

(REV. 01-2010)

salesrefund@dor.mo.gov

APPLICATION FOR SALES/USE TAX REFUND/CREDIT

BEFORE THE DEPARTMENT CAN PROCESS YOUR CLAIM YOU MUST PROVIDE:

Checklist

J

J

Indicate on the application whether you are requesting a refund or a

Provide a worksheet detailing how the refund/credit amount is

credit.

calculated.

J

J

Complete the claimant portion of the application. (See back for

Submit invoices supporting the refund/credit claim. (If the refund/credit

detailed explanation.)

request is for more than one tax period, invoices for the entire claim

J

may not be required. Contact the Department of Revenue at (573)

Sign the refund/credit application.

526-9938 before submitting invoices for more than one period.)

J

Include amended returns for each period in which the tax was

J

Include a properly executed power of attorney if someone other than

originally reported.

an owner, partner, or officer is the contact person concerning the

J

Provide a copy of the exemption certificate or exemption letter for an

refund/credit claim.

exempt sale.

PLEASE CHECK THE ACTION TO BE TAKEN:

CREDIT

REFUND

TAXPAYER/BUSINESS NAME

NAME ON REFUND CHECK, IF DIFFERENT

MISSOURI TAX I.D. NUMBER

PHONE NUMBER

THAN TAXPAYER/BUSINESS

__ __ __ __ __ __ __ __ ( _ _ _ ) _ _ _ - _ _ _ _

MAILING ADDRESS

CITY, STATE, ZIP CODE

Do you want the Department of Revenue to send copies of any correspondence relating to this refund and the final refund approval/denial to your power of

attorney or agent?

YES

NO

(Include a copy of the Power of Attorney Form with the refund application.)

AMOUNT OVERPAID

FILE PERIODS

$

REASON FOR OVERPAYMENT

I declare this claim and any attached information supporting the claim is true, complete and correct. I also declare under penalties of perjury that I employ

no illegal or unauthorized aliens as defined under federal law and that I am not eligible for any tax exemption, credit or abatement if I employ such aliens.

SIGNATURE OF TAXPAYER OR AGENT

DATE

PRINT NAME AND INDICATE IF TAXPAYER OR AGENT

_ _ / _ _ / _ _ _ _

DEPARTMENT USE ONLY

1.

2.

3.

4.

You have the right to appeal any amount denied. See Frequently Asked Questions

INTEREST

on the reverse side of this form for appeal procedures.

$

REFUND/CREDIT TOTAL

EXPLANATION

INITIATED

DATE

__ __ / __ __ / __ __ __ __

AUTHORIZED SIGNATURE

DISTRIBUTION: WHITE, YELLOW — DEPARTMENT OF REVENUE; PINK — TAXPAYER COPY

MO 860-1159 (01-2010)

This publication is available upon request in alternative accessible format(s).

1

1