Reset

Print

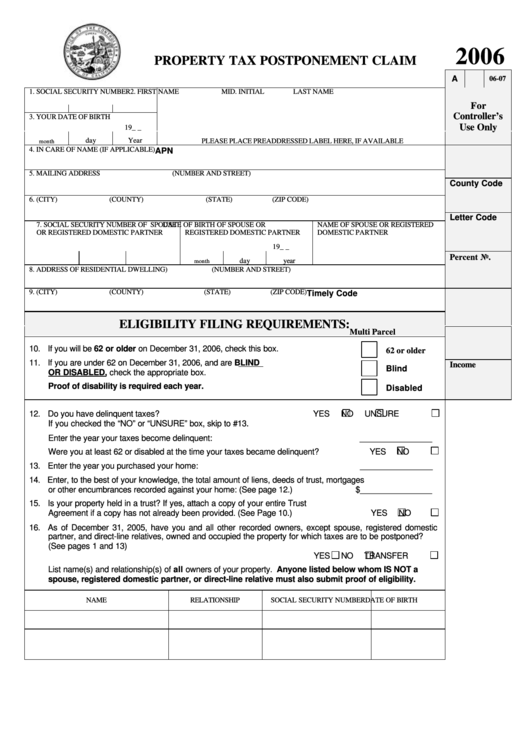

2006

PROPERTY TAX POSTPONEMENT CLAIM

A

06-07

1. SOCIAL SECURITY NUMBER

2. FIRST NAME

MID. INITIAL

LAST NAME

For

Controller’s

3. YOUR DATE OF BIRTH

Use Only

19_ _

day

Year

PLEASE PLACE PREADDRESSED LABEL HERE, IF AVAILABLE

month

4. IN CARE OF NAME (IF APPLICABLE)

APN

5. MAILING ADDRESS

(NUMBER AND STREET)

County Code

6. (CITY)

(COUNTY)

(STATE)

(ZIP CODE)

Letter Code

7. SOCIAL SECURITY NUMBER OF SPOUSE

DATE OF BIRTH OF SPOUSE OR

NAME OF SPOUSE OR REGISTERED

OR REGISTERED DOMESTIC PARTNER

REGISTERED DOMESTIC PARTNER

DOMESTIC PARTNER

19_ _

Percent No.

day

year

month

8. ADDRESS OF RESIDENTIAL DWELLING)

(NUMBER AND STREET)

9. (CITY)

(COUNTY)

(STATE)

(ZIP CODE)

Timely Code

ELIGIBILITY FILING REQUIREMENTS:

Multi Parcel

10. If you will be 62 or older on December 31, 2006, check this box.

62 or older

11. If you are under 62 on December 31, 2006, and are BLIND

Income

Blind

OR DISABLED, check the appropriate box.

Proof of disability is required each year.

Disabled

12. Do you have delinquent taxes?

YES

NO

UNSURE

If you checked the “NO” or “UNSURE” box, skip to #13.

Enter the year your taxes become delinquent:

________________

Were you at least 62 or disabled at the time your taxes became delinquent?

YES

NO

13. Enter the year you purchased your home:

________________

14. Enter, to the best of your knowledge, the total amount of liens, deeds of trust, mortgages

or other encumbrances recorded against your home: (See page 12.)

$________________

15. Is your property held in a trust? If yes, attach a copy of your entire Trust

Agreement if a copy has not already been provided. (See Page 10.)

YES

NO

16. As of December 31, 2005, have you and all other recorded owners, except spouse, registered domestic

partner, and direct-line relatives, owned and occupied the property for which taxes are to be postponed?

(See pages 1 and 13)

YES

NO

TRANSFER

List name(s) and relationship(s) of all owners of your property. Anyone listed below whom IS NOT a

spouse, registered domestic partner, or direct-line relative must also submit proof of eligibility.

NAME

RELATIONSHIP

SOCIAL SECURITY NUMBER

DATE OF BIRTH

1

1 2

2