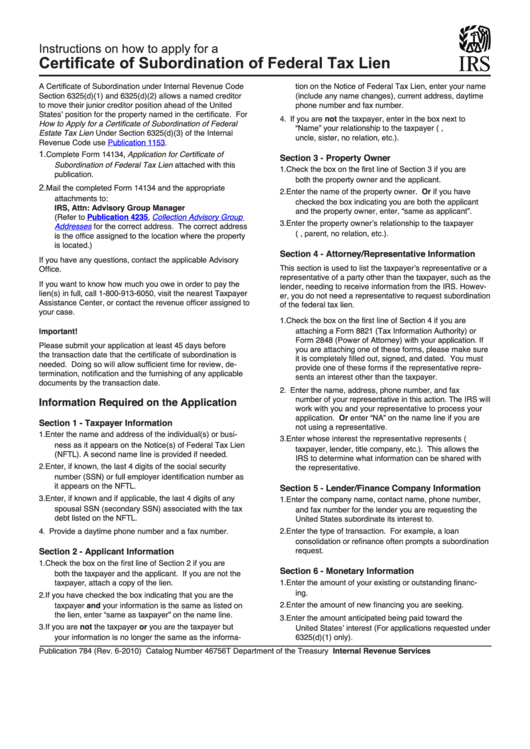

Instructions on how to apply for a

Certificate of Subordination of Federal Tax Lien

A Certificate of Subordination under Internal Revenue Code

tion on the Notice of Federal Tax Lien, enter your name

Section 6325(d)(1) and 6325(d)(2) allows a named creditor

(include any name changes), current address, daytime

to move their junior creditor position ahead of the United

phone number and fax number.

States’ position for the property named in the certificate. For

4. If you are not the taxpayer, enter in the box next to

How to Apply for a Certificate of Subordination of Federal

“Name” your relationship to the taxpayer (e.g. parent,

Estate Tax Lien Under Section 6325(d)(3) of the Internal

uncle, sister, no relation, etc.).

Revenue Code use

Publication

1153.

1.

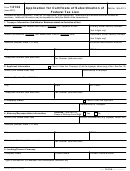

Complete Form 14134, Application for Certificate of

Section 3 - Property Owner

Subordination of Federal Tax Lien attached with this

1. Check the box on the first line of Section 3 if you are

publication.

both the property owner and the applicant.

2.

Mail the completed Form 14134 and the appropriate

2. Enter the name of the property owner. Or if you have

attachments to:

checked the box indicating you are both the applicant

IRS, Attn: Advisory Group Manager

and the property owner, enter, “same as applicant”.

Publication

4235,

Collection Advisory Group

(Refer to

3. Enter the property owner’s relationship to the taxpayer

Addresses

for the correct address. The correct address

(e.g. taxpayer, parent, no relation, etc.).

is the office assigned to the location where the property

is located.)

Section 4 - Attorney/Representative Information

If you have any questions, contact the applicable Advisory

This section is used to list the taxpayer’s representative or a

Office.

representative of a party other than the taxpayer, such as the

If you want to know how much you owe in order to pay the

lender, needing to receive information from the IRS. Howev-

lien(s) in full, call 1-800-913-6050, visit the nearest Taxpayer

er, you do not need a representative to request subordination

Assistance Center, or contact the revenue officer assigned to

of the federal tax lien.

your case.

1. Check the box on the first line of Section 4 if you are

Important!

attaching a Form 8821 (Tax Information Authority) or

Form 2848 (Power of Attorney) with your application. If

Please submit your application at least 45 days before

you are attaching one of these forms, please make sure

the transaction date that the certificate of subordination is

it is completely filled out, signed, and dated. You must

needed. Doing so will allow sufficient time for review, de-

provide one of these forms if the representative repre-

termination, notification and the furnishing of any applicable

sents an interest other than the taxpayer.

documents by the transaction date.

2. Enter the name, address, phone number, and fax

number of your representative in this action. The IRS will

Information Required on the Application

work with you and your representative to process your

application. Or enter “NA” on the name line if you are

Section 1 - Taxpayer Information

not using a representative.

1. Enter the name and address of the individual(s) or busi-

3. Enter whose interest the representative represents (e.g.

ness as it appears on the Notice(s) of Federal Tax Lien

taxpayer, lender, title company, etc.). This allows the

(NFTL). A second name line is provided if needed.

IRS to determine what information can be shared with

2. Enter, if known, the last 4 digits of the social security

the representative.

number (SSN) or full employer identification number as

it appears on the NFTL.

Section 5 - Lender/Finance Company Information

3. Enter, if known and if applicable, the last 4 digits of any

1. Enter the company name, contact name, phone number,

spousal SSN (secondary SSN) associated with the tax

and fax number for the lender you are requesting the

debt listed on the NFTL.

United States subordinate its interest to.

4. Provide a daytime phone number and a fax number.

2. Enter the type of transaction. For example, a loan

consolidation or refinance often prompts a subordination

Section 2 - Applicant Information

request.

1. Check the box on the first line of Section 2 if you are

Section 6 - Monetary Information

both the taxpayer and the applicant. If you are not the

taxpayer, attach a copy of the lien.

1. Enter the amount of your existing or outstanding financ-

ing.

2. If you have checked the box indicating that you are the

taxpayer and your information is the same as listed on

2. Enter the amount of new financing you are seeking.

the lien, enter “same as taxpayer” on the name line.

3. Enter the amount anticipated being paid toward the

3. If you are not the taxpayer or you are the taxpayer but

United States’ interest (For applications requested under

your information is no longer the same as the informa-

6325(d)(1) only).

Publication 784 (Rev. 6-2010)

Catalog Number 46756T

Department of the Treasury Internal Revenue Services

1

1 2

2 3

3 4

4 5

5 6

6 7

7