Form Mt-40 - Instructions

ADVERTISEMENT

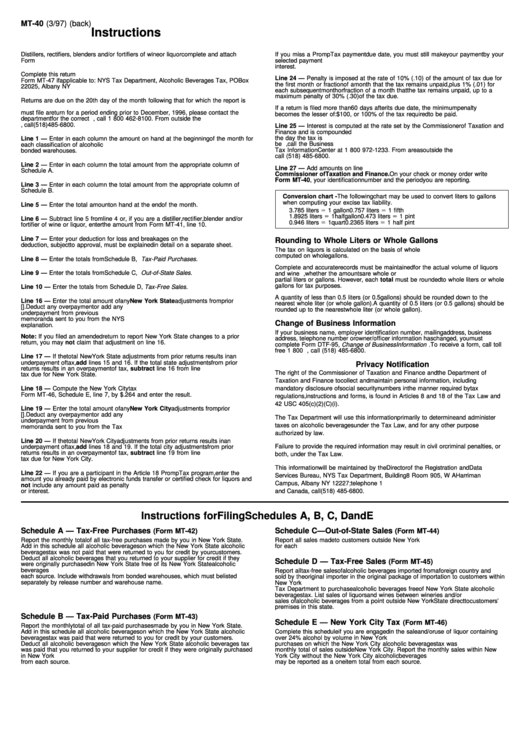

MT-40 (3/97) (back)

Instructions

Distillers, rectifiers, blenders and/or fortifiers of wine or liquor complete and attach

If you miss a PrompTax payment due date, you must still make your payment by your

Form MT-41. Do not use lines 1 through 5 on Form MT-40.

selected payment option. Late payment may result in the imposition of penalties and

interest.

Complete this return in duplicate. Send the original copy with your payment and

Line 24 — Penalty is imposed at the rate of 10% (.10) of the amount of tax due for

Form MT-47 if applicable to: NYS Tax Department, Alcoholic Beverages Tax, PO Box

the first month or fraction of a month that the tax remains unpaid, plus 1% (.01) for

22025, Albany NY 12201-2025. Keep the duplicate copy for your files.

each subsequent month or fraction of a month that the tax remains unpaid, up to a

maximum penalty of 30% (.30) of the tax due.

Returns are due on the 20th day of the month following that for which the report is

made. Any report filed after the due date is subject to penalty and interest. If you

If a return is filed more than 60 days after its due date, the minimum penalty

must file a return for a period ending prior to December, 1996, please contact the

becomes the lesser of: $100, or 100% of the tax required to be paid.

department for the correct form. For forms, call 1 800 462-8100. From outside the

U.S. and Canada, call (518) 485-6800.

Line 25 — Interest is computed at the rate set by the Commissioner of Taxation and

Finance and is compounded daily. It is computed from the day the tax was due until

the day the tax is paid. Interest is a charge for the use of state money and may not

Line 1 — Enter in each column the amount on hand at the beginning of the month for

be waived. If you require assistance in the computation of interest, call the Business

each classification of alcoholic beverage. Do not include alcoholic beverages held in

Tax Information Center at 1 800 972-1233. From areas outside the U.S. and Canada

bonded warehouses.

call (518) 485-6800.

Line 2 — Enter in each column the total amount from the appropriate column of

Line 27 — Add amounts on line 26. Make check or money order payable to

Schedule A.

Commissioner of Taxation and Finance. On your check or money order write

Form MT-40, your identification number and the period you are reporting.

Line 3 — Enter in each column the total amount from the appropriate column of

Schedule B.

Conversion chart - The following chart may be used to convert liters to gallons

when computing your excise tax liability.

Line 5 — Enter the total amount on hand at the end of the month.

3.785 liters

1 gallon

0.757 liters

1 fifth

1.8925 liters

1 half gallon

0.473 liters

1 pint

Line 6 — Subtract line 5 from line 4 or, if you are a distiller, rectifier, blender and/or

0.946 liters

1 quart

0.2365 liters

1 half pint

fortifier of wine or liquor, enter the amount from Form MT-41, line 10.

Line 7 — Enter your deduction for loss and breakages on the premises. This

Rounding to Whole Liters or Whole Gallons

deduction, subject to approval, must be explained in detail on a separate sheet.

The tax on liquors is calculated on the basis of whole liters. The tax on wines is

computed on whole gallons.

Line 8 — Enter the totals from Schedule B, Tax-Paid Purchases.

Complete and accurate records must be maintained for the actual volume of liquors

Line 9 — Enter the totals from Schedule C, Out-of-State Sales.

and wine sold. purchased and manufactured, whether the amounts are whole or

partial liters or gallons. However, each total must be rounded to whole liters or whole

gallons for tax purposes.

Line 10 — Enter the totals from Schedule D, Tax-Free Sales.

A quantity of less than 0.5 liters (or 0.5 gallons) should be rounded down to the

Line 16 — Enter the total amount of any New York State adjustments from prior

nearest whole liter (or whole gallon). A quantity of 0.5 liters (or 0.5 gallons) should be

returns. Enter any subtraction in brackets [ ]. Deduct any overpayment or add any

rounded up to the nearest whole liter (or whole gallon).

underpayment from previous returns. Include amounts from any debit or credit

memoranda sent to you from the NYS Tax Department. Attach a complete

Change of Business Information

explanation.

If your business name, employer identification number, mailing address, business

Note: If you filed an amended return to report New York State changes to a prior

address, telephone number or owner/officer information has changed, you must

return, you may not claim that adjustment on line 16.

complete Form DTF-95, Change of Business Information . To receive a form, call toll

free 1 800 462-8100. From areas outside the U.S. and Canada, call (518) 485-6800.

Line 17 — If the total New York State adjustments from prior returns results in an

underpayment of tax, add lines 15 and 16. If the total state adjustments from prior

Privacy Notification

returns results in an overpayment of tax, subtract line 16 from line 15. This is the net

The right of the Commissioner of Taxation and Finance and the Department of

tax due for New York State.

Taxation and Finance to collect and maintain personal information, including

Line 18 — Compute the New York City tax due. Multiply the number of liters from

mandatory disclosure of social security numbers in the manner required by tax

Form MT-46, Schedule E, line 7, by $.264 and enter the result.

regulations, instructions and forms, is found in Articles 8 and 18 of the Tax Law and

42 USC 405(c)(2)(C)(i).

Line 19 — Enter the total amount of any New York City adjustments from prior

returns. Enter any subtraction in brackets [ ]. Deduct any overpayment or add any

The Tax Department will use this information primarily to determine and administer

underpayment from previous returns. Include amounts from any debit or credit

taxes on alcoholic beverages under the Tax Law, and for any other purpose

memoranda sent to you from the Tax Department. Attach a complete explanation.

authorized by law.

Line 20 — If the total New York City adjustments from prior returns results in an

Failure to provide the required information may result in civil or criminal penalties, or

underpayment of tax, add lines 18 and 19. If the total city adjustments from prior

returns results in an overpayment of tax, subtract line 19 from line 18. This is the net

both, under the Tax Law.

tax due for New York City.

This information will be maintained by the Director of the Registration and Data

Line 22 — If you are a participant in the Article 18 PrompTax program, enter the

Services Bureau, NYS Tax Department, Building 8 Room 905, W A Harriman

amount you already paid by electronic funds transfer or certified check for liquors and

Campus, Albany NY 12227; telephone 1 800-225-5829. From areas outside the U.S.

wines. Attach Form MT-47 to your return. Do not include any amount paid as penalty

or interest.

and Canada, call (518) 485-6800.

Instructions for Filing Schedules A, B, C, D and E

Schedule A — Tax-Free Purchases

Schedule C — Out-of-State Sales

(Form MT-42)

(Form MT-44)

Report the monthly total of all tax-free purchases made by you in New York State.

Report all sales made to customers outside New York State. Use a separate schedule

Add in this schedule all alcoholic beverages on which the New York State alcoholic

for each state. File in duplicate.

beverages tax was not paid that were returned to you for credit by your customers.

Deduct all alcoholic beverages that you returned to your supplier for credit if they

Schedule D — Tax-Free Sales

(Form MT-45)

were originally purchased in New York State free of its New York State alcoholic

beverages tax. All purchases and returns may be reported as a one item total from

Report all tax-free sales of alcoholic beverages imported from a foreign country and

each source. Include withdrawals from bonded warehouses, which must be listed

sold by the original importer in the original package of importation to customers within

separately by release number and warehouse name.

New York State. List sales to customers who have obtained permission from the NYS

Tax Department to purchase alcoholic beverages free of New York State alcoholic

beverages tax. List sales of liquors and wines between wineries and/or distillers. List

sales of alcoholic beverages from a point outside New York State direct to customers’

premises in this state.

Schedule B — Tax-Paid Purchases

(Form MT-43)

Schedule E — New York City Tax

(Form MT-46)

Report the monthly total of all tax-paid purchases made by you in New York State.

Add in this schedule all alcoholic beverages on which the New York State alcoholic

Complete this schedule if you are engaged in the sale and/or use of liquor containing

beverages tax was paid that were returned to you for credit by your customers.

over 24% alcohol by volume in New York City. Report the monthly total of all tax-paid

Deduct all alcoholic beverages on which the New York State alcoholic beverages tax

purchases on which the New York City alcoholic beverages tax was paid. Report the

was paid that you returned to your supplier for credit if they were originally purchased

monthly total of sales outside New York City. Report the monthly sales within New

in New York State. All purchases and returns may be reported as a one item total

York City without the New York City alcoholic beverages tax. All purchases and sales

from each source.

may be reported as a one item total from each source.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1