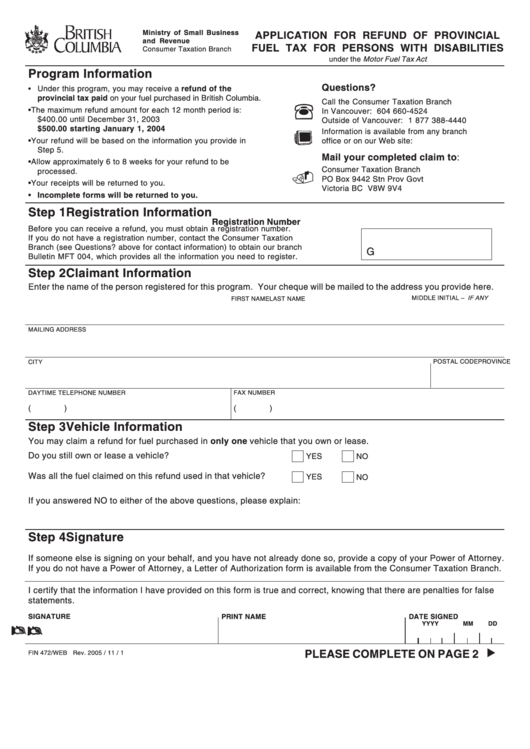

Form Fin 472 - Application For Refund Of Provincial Fuel Tax For Persons With Disabilities

ADVERTISEMENT

Ministry of Small Business

APPLICATION FOR REFUND OF PROVINCIAL

and Revenue

FUEL TAX FOR PERSONS WITH DISABILITIES

Consumer Taxation Branch

under the Motor Fuel Tax Act

Program Information

Questions?

Under this program, you may receive a refund of the

•

provincial tax paid on your fuel purchased in British Columbia.

Call the Consumer Taxation Branch

• The maximum refund amount for each 12 month period is:

In Vancouver: 604 660-4524

$400.00 until December 31, 2003

Outside of Vancouver: 1 877 388-4440

$500.00 starting January 1, 2004

Information is available from any branch

• Your refund will be based on the information you provide in

office or on our Web site:

Step 5.

Mail your completed claim to:

• Allow approximately 6 to 8 weeks for your refund to be

Consumer Taxation Branch

processed.

PO Box 9442 Stn Prov Govt

• Your receipts will be returned to you.

Victoria BC V8W 9V4

• Incomplete forms will be returned to you.

Step 1 Registration Information

Registration Number

Before you can receive a refund, you must obtain a registration number.

If you do not have a registration number, contact the Consumer Taxation

Branch (see Questions? above for contact information) to obtain our branch

G

Bulletin MFT 004, which provides all the information you need to register.

Step 2 Claimant Information

Enter the name of the person registered for this program. Your cheque will be mailed to the address you provide here.

MIDDLE INITIAL – IF ANY

LAST NAME

FIRST NAME

MAILING ADDRESS

CITY

PROVINCE

POSTAL CODE

DAYTIME TELEPHONE NUMBER

FAX NUMBER

(

)

(

)

Step 3 Vehicle Information

You may claim a refund for fuel purchased in only one vehicle that you own or lease.

Do you still own or lease a vehicle?

YES

NO

Was all the fuel claimed on this refund used in that vehicle?

YES

NO

If you answered NO to either of the above questions, please explain:

Step 4 Signature

If someone else is signing on your behalf, and you have not already done so, provide a copy of your Power of Attorney.

If you do not have a Power of Attorney, a Letter of Authorization form is available from the Consumer Taxation Branch.

I certify that the information I have provided on this form is true and correct, knowing that there are penalties for false

statements.

SIGNATURE

PRINT NAME

DATE SIGNED

YYYY

MM

DD

PLEASE COMPLETE ON PAGE 2

FIN 472/WEB Rev. 2005 / 11 / 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4