Form 150-102-128 - Instructions For Research Credit

ADVERTISEMENT

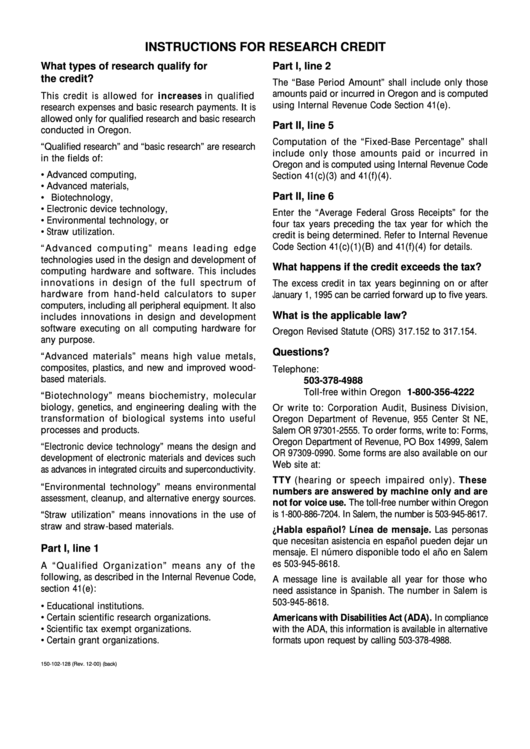

INSTRUCTIONS FOR RESEARCH CREDIT

What types of research qualify for

Part I, line 2

the credit?

The “Base Period Amount” shall include only those

amounts paid or incurred in Oregon and is computed

This credit is allowed for increases in qualified

using Internal Revenue Code Section 41(e).

research expenses and basic research payments. It is

allowed only for qualified research and basic research

Part II, line 5

conducted in Oregon.

Computation of the “Fixed-Base Percentage” shall

“Qualified research” and “basic research” are research

include only those amounts paid or incurred in

in the fields of:

Oregon and is computed using Internal Revenue Code

• Advanced computing,

Section 41(c)(3) and 41(f)(4).

• Advanced materials,

Part II, line 6

• Biotechnology,

• Electronic device technology,

Enter the “Average Federal Gross Receipts” for the

• Environmental technology, or

four tax years preceding the tax year for which the

• Straw utilization.

credit is being determined. Refer to Internal Revenue

Code Section 41(c)(1)(B) and 41(f)(4) for details.

“Advanced computing” means leading edge

technologies used in the design and development of

What happens if the credit exceeds the tax?

computing hardware and software. This includes

innovations in design of the full spectrum of

The excess credit in tax years beginning on or after

hardware from hand-held calculators to super

January 1, 1995 can be carried forward up to five years.

computers, including all peripheral equipment. It also

What is the applicable law?

includes innovations in design and development

software executing on all computing hardware for

Oregon Revised Statute (ORS) 317.152 to 317.154.

any purpose.

Questions?

“Advanced materials” means high value metals,

composites, plastics, and new and improved wood-

Telephone:

based materials.

Salem ....................................... 503-378-4988

Toll-free within Oregon ...... 1-800-356-4222

“Biotechnology” means biochemistry, molecular

biology, genetics, and engineering dealing with the

Or write to: Corporation Audit, Business Division,

transformation of biological systems into useful

Oregon Department of Revenue, 955 Center St NE,

processes and products.

Salem OR 97301-2555. To order forms, write to: Forms,

Oregon Department of Revenue, PO Box 14999, Salem

“Electronic device technology” means the design and

OR 97309-0990. Some forms are also available on our

development of electronic materials and devices such

Web site at:

as advances in integrated circuits and superconductivity.

TTY (hearing or speech impaired only). These

“Environmental technology” means environmental

numbers are answered by machine only and are

assessment, cleanup, and alternative energy sources.

not for voice use. The toll-free number within Oregon

is 1-800-886-7204. In Salem, the number is 503-945-8617.

“Straw utilization” means innovations in the use of

straw and straw-based materials.

¿Habla español? Línea de mensaje. Las personas

que necesitan asistencia en español pueden dejar un

Part I, line 1

mensaje. El número disponible todo el año en Salem

es 503-945-8618.

A “Qualified Organization” means any of the

following, as described in the Internal Revenue Code,

A message line is available all year for those who

section 41(e):

need assistance in Spanish. The number in Salem is

503-945-8618.

• Educational institutions.

• Certain scientific research organizations.

Americans with Disabilities Act (ADA). In compliance

• Scientific tax exempt organizations.

with the ADA, this information is available in alternative

• Certain grant organizations.

formats upon request by calling 503-378-4988.

150-102-128 (Rev. 12-00) (back)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1