Aurora Occupational Privilege Tax Return Form

ADVERTISEMENT

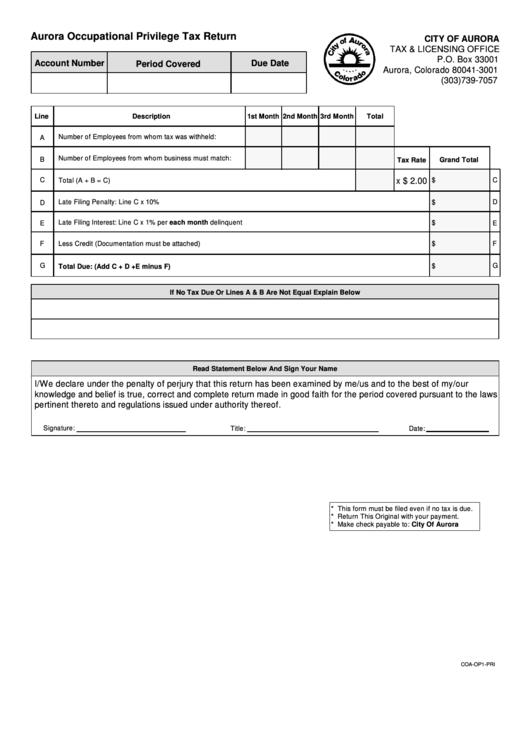

Aurora Occupational Privilege Tax Return

CITY OF AURORA

TAX & LICENSING OFFICE

P.O. Box 33001

Account Number

Due Date

Period Covered

Aurora, Colorado 80041-3001

(303)739-7057

Line

Description

1st Month

2nd Month 3rd Month

Total

Number of Employees from whom tax was withheld:

A

Number of Employees from whom business must match:

B

Tax Rate

Grand Total

C

x $ 2.00

Total (A + B = C)

$

C

Late Filing Penalty: Line C x 10%

D

$

D

Late Filing Interest: Line C x 1% per each month delinquent

$

E

E

F

Less Credit (Documentation must be attached)

$

F

G

G

Total Due: (Add C + D +E minus F)

$

If No Tax Due Or Lines A & B Are Not Equal Explain Below

Read Statement Below And Sign Your Name

I/We declare under the penalty of perjury that this return has been examined by me/us and to the best of my/our

knowledge and belief is true, correct and complete return made in good faith for the period covered pursuant to the laws

pertinent thereto and regulations issued under authority thereof.

Signature:

Title:

Date:

* This form must be filed even if no tax is due.

* Return This Original with your payment.

* Make check payable to: City Of Aurora

COA-OP1-PRI

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1