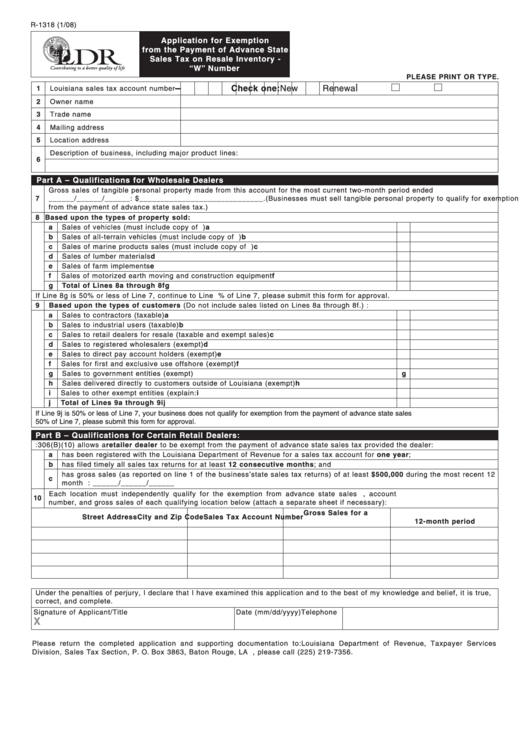

R-1318 (1/08)

Application for Exemption

from the Payment of Advance State

Sales Tax on Resale Inventory -

“W” Number

PLEASE PRINT OR TYPE.

l

–

Check one:

New

Renewa

1

Louisiana sales tax account number

2

Owner name

3

Trade name

4

Mailing address

5

Location address

Description of business, including major product lines:

6

Part A – Qualifications for Wholesale Dealers

Gross sales of tangible personal property made from this account for the most current two-month period ended

7

______/______/______: $_____________________________. (Businesses must sell tangible personal property to qualify for exemption

from the payment of advance state sales tax.)

8 Based upon the types of property sold:

a

a

Sales of vehicles (must include copy of La. Permit)

b

b

Sales of all-terrain vehicles (must include copy of La. Permit)

c

c

Sales of marine products sales (must include copy of La. Permit)

d

d

Sales of lumber materials

e

e

Sales of farm implements

f

Sales of motorized earth moving and construction equipment

f

g

Total of Lines 8a through 8f

g

If Line 8g is 50% or less of Line 7, continue to Line 9. If Line 8g is greater than 50% of Line 7, please submit this form for approval.

9

Based upon the types of customers (Do not include sales listed on Lines 8a through 8f.) :

a

Sales to contractors (taxable)

a

b

Sales to industrial users (taxable)

b

c

Sales to retail dealers for resale (taxable and exempt sales)

c

d

Sales to registered wholesalers (exempt)

d

e

e

Sales to direct pay account holders (exempt)

f

f

Sales for first and exclusive use offshore (exempt)

g

g

Sales to government entities (exempt)

h

h

Sales delivered directly to customers outside of Louisiana (exempt)

i

i

Sales to other exempt entities (explain:

j

Total of Lines 9a through 9i

j

If Line 9j is 50% or less of Line 7, your business does not qualify for exemption from the payment of advance state sales tax. If Line 9j is greater than

50% of Line 7, please submit this form for approval.

Part B – Qualifications for Certain Retail Dealers:

La. R.S. 47:306(B)(10) allows a retailer dealer to be exempt from the payment of advance state sales tax provided the dealer:

a

has been registered with the Louisiana Department of Revenue for a sales tax account for one year;

b

has filed timely all sales tax returns for at least 12 consecutive months; and

has gross sales (as reported on line 1 of the business’ state sales tax returns) of at least $500,000 during the most recent 12

c

month period. Indicate 12-month period: ______/______/______

Each location must independently qualify for the exemption from advance state sales taxes. Please list the address, account

10

number, and gross sales of each qualifying location below (attach a separate sheet if necessary):

Gross Sales for a

Street Address

City and Zip Code

Sales Tax Account Number

12-month period

Under the penalties of perjury, I declare that I have examined this application and to the best of my knowledge and belief, it is true,

correct, and complete.

Signature of Applicant/Title

Date (mm/dd/yyyy)

Telephone

X

Please return the completed application and supporting documentation to: Louisiana Department of Revenue, Taxpayer Services

Division, Sales Tax Section, P. O. Box 3863, Baton Rouge, LA 70821. For assistance, please call (225) 219-7356.

1

1