Form Bot-301e - Instructions Form For Annual Business And Occupation Tax Return For Electric Power - 2015

ADVERTISEMENT

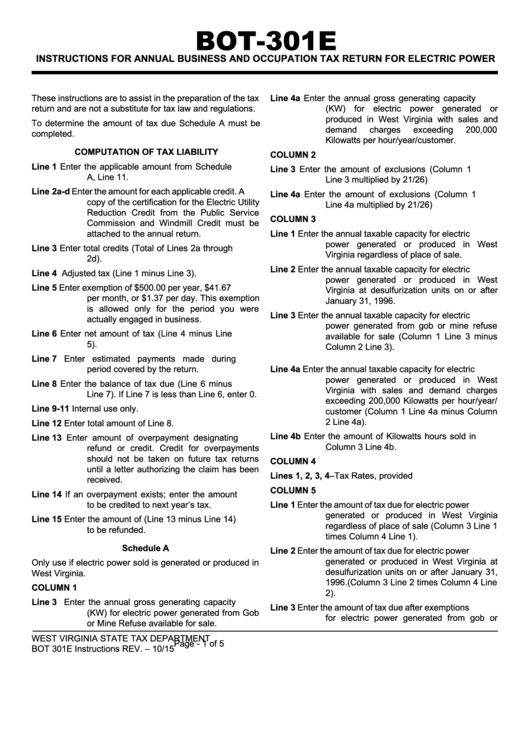

BOT-301E

InstructIons For AnnuAl BusIness And occupAtIon tAx return For electrIc power

These instructions are to assist in the preparation of the tax

line 4a

Enter the annual gross generating capacity

return and are not a substitute for tax law and regulations.

(KW) for electric power generated or

produced in West Virginia with sales and

To determine the amount of tax due Schedule A must be

demand

charges

exceeding

200,000

completed.

Kilowatts per hour/year/customer.

coMputAtIon oF tAx lIABIlItY

coluMn 2

line 1

Enter the applicable amount from Schedule

line 3

Enter the amount of exclusions (Column 1

A, Line 11.

Line 3 multiplied by 21/26)

line 2a-d

Enter the amount for each applicable credit. A

line 4a

Enter the amount of exclusions (Column 1

copy of the certification for the Electric Utility

Line 4a multiplied by 21/26)

Reduction Credit from the Public Service

coluMn 3

Commission and Windmill Credit must be

attached to the annual return.

line 1

Enter the annual taxable capacity for electric

power generated or produced in West

line 3

Enter total credits (Total of Lines 2a through

Virginia regardless of place of sale.

2d).

line 2

Enter the annual taxable capacity for electric

line 4

Adjusted tax (Line 1 minus Line 3).

power generated or produced in West

line 5

Enter exemption of $500.00 per year, $41.67

Virginia at desulfurization units on or after

per month, or $1.37 per day. This exemption

January 31, 1996.

is allowed only for the period you were

line 3

Enter the annual taxable capacity for electric

actually engaged in business.

power generated from gob or mine refuse

line 6

Enter net amount of tax (Line 4 minus Line

available for sale (Column 1 Line 3 minus

5).

Column 2 Line 3).

line 7

Enter estimated payments made during

period covered by the return.

line 4a

Enter the annual taxable capacity for electric

power generated or produced in West

line 8

Enter the balance of tax due (Line 6 minus

Virginia with sales and demand charges

Line 7). If Line 7 is less than Line 6, enter 0.

exceeding 200,000 Kilowatts per hour/year/

line 9-11

Internal use only.

customer (Column 1 Line 4a minus Column

2 Line 4a).

line 12

Enter total amount of Line 8.

line 4b

Enter the amount of Kilowatts hours sold in

line 13

Enter amount of overpayment designating

Column 3 Line 4b.

refund or credit. Credit for overpayments

should not be taken on future tax returns

coluMn 4

until a letter authorizing the claim has been

lines 1, 2, 3, 4–Tax Rates, provided

received.

coluMn 5

line 14

If an overpayment exists; enter the amount

to be credited to next year’s tax.

line 1

Enter the amount of tax due for electric power

generated or produced in West Virginia

line 15

Enter the amount of (Line 13 minus Line 14)

regardless of place of sale (Column 3 Line 1

to be refunded.

times Column 4 Line 1).

schedule A

line 2

Enter the amount of tax due for electric power

generated or produced in West Virginia at

Only use if electric power sold is generated or produced in

desulfurization units on or after January 31,

West Virginia.

1996.(Column 3 Line 2 times Column 4 Line

coluMn 1

2).

line 3

Enter the annual gross generating capacity

line 3

Enter the amount of tax due after exemptions

(KW) for electric power generated from Gob

for electric power generated from gob or

or Mine Refuse available for sale.

WEST VIRGINIA STATE TAX DEPARTMENT

Page - 1 of 5

BOT 301E Instructions REV. – 10/15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5