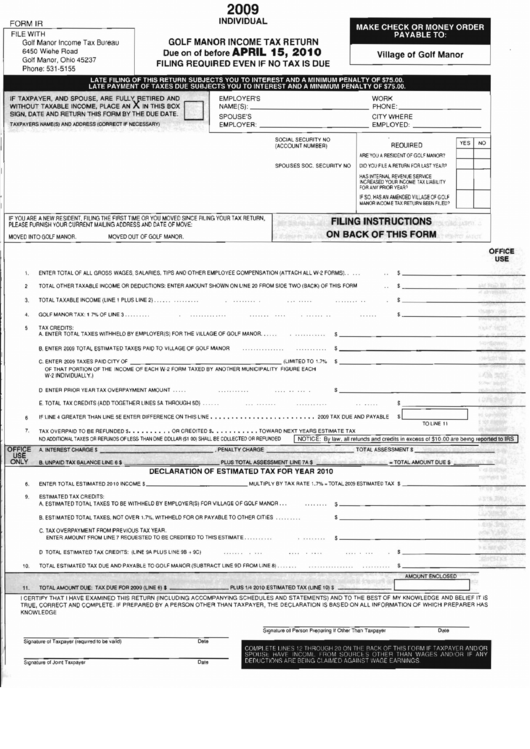

Form Ir - Golf Manor Income Tax Return - 2009

ADVERTISEMENT

Village of Golf Manor

20Q9

INDIVIDUAL

FORM IR

FILE WITH

Golf Manor Income Tax Bureau

GOLF MANOR INCOME TAX RETURN

6450 Wiehe Road

Due on of before

APRIL 15, 2010

Golf Manor, Ohio 45237

FILING REQUIRED EVEN IF NO TAX IS DUE

Phone: 531-5155

LATE FILING OF THIS RETURN SUBJECTS YOU TO INTEREST AND A MINIMUM PENALTY OF

$75.00.

LATE PAYMENT OF TAXES DUE SUBJECTS YOU TO INTEREST AND A MINIMUM PENALTY OF

$75.00.

IF TAXPAYER, AND SPOUSEO. ARE FuLL'( ~ETIRED AND

WITHOUT TAXABLE INCOME. PLACE AN

X

IN THtS BOX

D

SIGN, DATE AND RETURN THIS FORM BY THE DUE DATE.

TAXPAYERS NAME(S) AND ADDRESS (CORRECT IF NECESSARY)

EMPLOYER'S

NAME(S):

SPOUSE'S

EMPLOYER:

WORK

PHONE:

CITY WHERE

EMPLOYED:

_

SOCIAL SECURITY NO

(ACCOUNT NUMBER)

REOUIRED

ARE YOU ARESIDENT OF GOLF MANOR?

SPOUSES SOC. SECURITY NO

DID YOU FILE ARETURN FOR LAST YEAR?

HAS INTERNAL REVENUE SERVICE

INCREASED YOUR INCOME TAX LIABILITY

FOR ANY PRIOR YEAR?

IF SO. HAS AN AMENDED VILLAGE OF GOLF

MANOR INCOME TAX RETURN BEEN FILED?

YES

NO

IF YOU ARE A NEW RESIDENT. FILING THE FIRST TIME OR YOU MOVED SINCE FILING YOUR TAX RETURN,

PLEASE FURNISH YOUR CURRENT MAILING ADDRESS AND DATE OF MOVE:

MOVED INTO GOLF MANOR.

MOVED OUT OF GOLF MANOR.

FILING INSTRUCTIONS

ON BACK OF THIS FORM

OFFICE

USE

1.

ENTER TOTAL OF ALL GROSS WAGES, SALARIES, TIPS AND OTHER EMPLOYEE COMPENSATION (ATIACH ALL W·2 FORMS) ..

$ - - - - - - - - - - - -

2

TOTAL OTHER TAXABLE INCOME OR DEDUCTIONS: ENTER AMOUNT SHOWN ON LINE 20 FROM SIDE TWO (BACK) OF THIS FORM

$ - - - - - - - - - - - - -

3.

TOT AL TAXABLE INCOME (LINE 1 PLUS LINE 2) . . . . .. . •...

$

--------~---

4.

GOLF MANOR TAX: 1 7% OF LINE 3.

$ - - - - - - - - - - - -

TAX CREDITS:

A. ENTER TOTAL TAXES WITHHELD BY EMPLOYER(S) FOR THE VILLAGE OF GOLF MANOR. ..

$---------------------

B. ENTER 2009 TOTAL ESTIMATED TAXES PAID TO VILLAGE OF GOLF MANOR

C. ENTER 2009 TAXES PAID CITY OF

(LIMITED TO 1.7%

OF THAT PORTION OF THE INCOME OF EACH W·2 FORM TAXED BY ANOTHER MUNICIPALITY FIGURE EACH

W·2 INDIVIDUALLY.)

$-----------------,..-,-.,-,.......,-

$

--.,..._--'

o

ENTER PRIOR YEAR TAX OVERPAYMENT AMOUNT .....

$--------------------'-

6

7.

E. TOTAL TAX CREDITS (ADD TOGETHER LINES SA THROUGH 5D)

IF LINE 4 GREATER THAN LINE 5E ENTER DIFFERENCE ON THIS LINE •••••••••••••••••.••••••• 2009 TAX DUE AND PAYABLE

$r=======;----~

$I_~-=-_

TO LINE 11

TAX OVERPAID TO BE REFUNDED

$••••••••••

OR CREDITED

$• • • • • • • • • • •

TOWARD NEXTr..,-:Y"::' E ' : "' A R:-::S-,:E,..-S-,:T_IM.,...A_T_E.,...T.,...A_X

..,,---,

~,.__-__.,...---_..,.........,=.,

NO ADDITIONAL TAXES OR REFUNDS OF LESS THAN ONE DDLLAR ($100) SHALL BE COLLECTED OR REFUNDED

I

NOTICE: By law. all refunds and credits in excess of $10.00 are being reponed to IRS

I

OFFICE

A. INTEREST CHARGE

$

,

PENALTV CHARGE

TOTAL ASSESSMENT

$

_

USE

ONLY

B.

UNPAID TAX BALANCE lIN.E

6

$

PLUS TOTAL ASSESSMENT LINE 7A $

• TOTAL AMOUNT DU_E

~

DECLARATION OF ESTIMATED TAX FOR YEAR 2010

6.

ENTER TOTAL ESTIMATED 2010 INCOME $

MULT1PL Y BY TAX RATE

\.7% •

TOTAL 2009 ESTIMATED TAX $

--:-__.,...---

9.

ESTIMATED TAX CREDITS:

A. ESTIMATED TOTAL TAXES TO BE WITHHELD BY EMPLOYER(Sj FOR VILLAGE OF GOLF MANOR.

$-------------------

B. ESTIMATED TOTAL TAXES, NOT OVER

\.7%,

WITHHELD FOR OR PAYABLE TO OTHER CITIES

$--------------------

C. TAX OVERPAYMENT FROM PREVIOUS TAX YEAR.

ENTER AMOUNT FROM LINE 7 REOUESTED TO BE CREDITED TO THIS ESTIMATE.

$--------------------~

D TOTAL ESTIMATED TAX CREDITS: (LINE 9A PLUS LINE 9B

+

9Cl

$--------------~

10.

TOTAL ESTIMATED TAX DUE AND PAYABLE TO GOLF MANOR (SUBTRACT LINE 9D FROM LINE

8) .

$

AMOUNT ENC.LOSED

11.

TOTAL AMOUNT DUE: TAX DUE FOR 2009 (LINE 6) $

PLUS 1142010 ESTIMATED TAX (LINE 10) $

I CERTIFY THAT I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS

TRUE, CORRECT AND COMPLETE. IF PREPARED BY A PERSON OTHER THAN TAXPAYER, THE DECLARATION IS BASED ON ALL INFORMATION OF WHICH PREPARER HAS

KNOWLEDGE

S,gn.lure

01

Person Preparing

II

O1her Than Taxpayer

Dale

Signalure of Taxpayar (reQurred to be valid)

Dete

COMPI ETE

II~I~S

I. THROIIGH 211

on

Till RACK OF THIS ,onM IF TAXPAYCR AND

OR

SPOlJSl HAVI

I~JC'-.JrAL

I ",-'M SOUHCL", UTHER

THA~I

WAGES MJll UH IF ANY

Signature of JOint Taxpayer

Dale

OErlUCTIONS AHC [3CII'JG Cl AIMlO AGAIIJST WAGC LAHNINGS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2