Instructions For Form 540x - Amended Individual Income Tax Return - Franchise Tax Board - 2002

ADVERTISEMENT

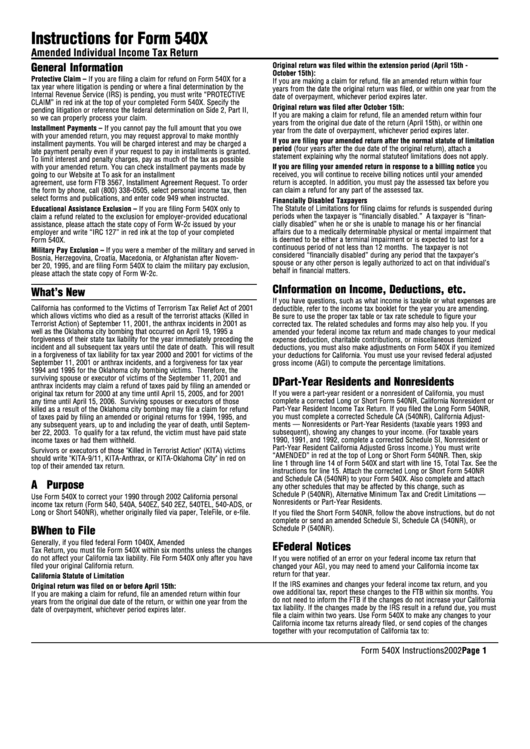

Instructions for Form 540X

Amended Individual Income Tax Return

General Information

Original return was filed within the extension period (April 15th -

October 15th):

Protective Claim – If you are filing a claim for refund on Form 540X for a

If you are making a claim for refund, file an amended return within four

tax year where litigation is pending or where a final determination by the

years from the date the original return was filed, or within one year from the

Internal Revenue Service (IRS) is pending, you must write “PROTECTIVE

date of overpayment, whichever period expires later.

CLAIM” in red ink at the top of your completed Form 540X. Specify the

Original return was filed after October 15th:

pending litigation or reference the federal determination on Side 2, Part II,

If you are making a claim for refund, file an amended return within four

so we can properly process your claim.

years from the original due date of the return (April 15th), or within one

Installment Payments – If you cannot pay the full amount that you owe

year from the date of overpayment, whichever period expires later.

with your amended return, you may request approval to make monthly

If you are filing your amended return after the normal statute of limitation

installment payments. You will be charged interest and may be charged a

period (four years after the due date of the original return), attach a

late payment penalty even if your request to pay in installments is granted.

statement explaining why the normal statute of limitations does not apply.

To limit interest and penalty charges, pay as much of the tax as possible

If you are filing your amended return in response to a billing notice you

with your amended return. You can check installment payments made by

received, you will continue to receive billing notices until your amended

going to our Website at To ask for an installment

agreement, use form FTB 3567, Installment Agreement Request. To order

return is accepted. In addition, you must pay the assessed tax before you

can claim a refund for any part of the assessed tax.

the form by phone, call (800) 338-0505, select personal income tax, then

select forms and publications, and enter code 949 when instructed.

Financially Disabled Taxpayers

The Statute of Limitations for filing claims for refunds is suspended during

Educational Assistance Exclusion – If you are filing Form 540X only to

periods when the taxpayer is “financially disabled.” A taxpayer is “finan-

claim a refund related to the exclusion for employer-provided educational

cially disabled” when he or she is unable to manage his or her financial

assistance, please attach the state copy of Form W-2c issued by your

affairs due to a medically determinable physical or mental impairment that

employer and write “IRC 127” in red ink at the top of your completed

is deemed to be either a terminal impairment or is expected to last for a

Form 540X.

continuous period of not less than 12 months. The taxpayer is not

Military Pay Exclusion – If you were a member of the military and served in

considered “financially disabled” during any period that the taxpayer’s

Bosnia, Herzegovina, Croatia, Macedonia, or Afghanistan after Novem-

spouse or any other person is legally authorized to act on that individual’s

ber 20, 1995, and are filing Form 540X to claim the military pay exclusion,

behalf in financial matters.

please attach the state copy of Form W-2c.

C Information on Income, Deductions, etc.

What’s New

If you have questions, such as what income is taxable or what expenses are

California has conformed to the Victims of Terrorism Tax Relief Act of 2001

deductible, refer to the income tax booklet for the year you are amending.

which allows victims who died as a result of the terrorist attacks (Killed in

Be sure to use the proper tax table or tax rate schedule to figure your

Terrorist Action) of September 11, 2001, the anthrax incidents in 2001 as

corrected tax. The related schedules and forms may also help you. If you

well as the Oklahoma city bombing that occurred on April 19, 1995 a

amended your federal income tax return and made changes to your medical

forgiveness of their state tax liability for the year immediately preceding the

expense deduction, charitable contributions, or miscellaneous itemized

incident and all subsequent tax years until the date of death. This will result

deductions, you must also make adjustments on Form 540X if you itemized

in a forgiveness of tax liability for tax year 2000 and 2001 for victims of the

your deductions for California. You must use your revised federal adjusted

September 11, 2001 or anthrax incidents, and a forgiveness for tax year

gross income (AGI) to compute the percentage limitations.

1994 and 1995 for the Oklahoma city bombing victims. Therefore, the

surviving spouse or executor of victims of the September 11, 2001 and

D Part-Year Residents and Nonresidents

anthrax incidents may claim a refund of taxes paid by filing an amended or

original tax return for 2000 at any time until April 15, 2005, and for 2001

If you were a part-year resident or a nonresident of California, you must

complete a corrected Long or Short Form 540NR, California Nonresident or

any time until April 15, 2006. Surviving spouses or executors of those

killed as a result of the Oklahoma city bombing may file a claim for refund

Part-Year Resident Income Tax Return. If you filed the Long Form 540NR,

you must complete a corrected Schedule CA (540NR), California Adjust-

of taxes paid by filing an amended or original returns for 1994, 1995, and

any subsequent years, up to and including the year of death, until Septem-

ments — Nonresidents or Part-Year Residents (taxable years 1993 and

subsequent), showing any changes to your income. (For taxable years

ber 22, 2003. To qualify for a tax refund, the victim must have paid state

income taxes or had them withheld.

1990, 1991, and 1992, complete a corrected Schedule SI, Nonresident or

Part-Year Resident California Adjusted Gross Income.) You must write

Survivors or executors of those "Killed in Terrorist Action" (KITA) victims

“AMENDED” in red at the top of Long or Short Form 540NR. Then, skip

should write "KITA-9/11, KITA-Anthrax, or KITA-Oklahoma City" in red on

line 1 through line 14 of Form 540X and start with line 15, Total Tax. See the

top of their amended tax return.

instructions for line 15. Attach the corrected Long or Short Form 540NR

and Schedule CA (540NR) to your Form 540X. Also complete and attach

A Purpose

any other schedules that may be affected by this change, such as

Schedule P (540NR), Alternative Minimum Tax and Credit Limitations —

Use Form 540X to correct your 1990 through 2002 California personal

Nonresidents or Part-Year Residents.

income tax return (Form 540, 540A, 540EZ, 540 2EZ, 540TEL, 540-ADS, or

Long or Short 540NR), whether originally filed via paper, TeleFile, or e-file.

If you filed the Short Form 540NR, follow the above instructions, but do not

complete or send an amended Schedule SI, Schedule CA (540NR), or

Schedule P (540NR).

B When to File

Generally, if you filed federal Form 1040X, Amended U.S. Individual Income

E Federal Notices

Tax Return, you must file Form 540X within six months unless the changes

do not affect your California tax liability. File Form 540X only after you have

If you were notified of an error on your federal income tax return that

filed your original California return.

changed your AGI, you may need to amend your California income tax

return for that year.

California Statute of Limitation

If the IRS examines and changes your federal income tax return, and you

Original return was filed on or before April 15th:

owe additional tax, report these changes to the FTB within six months. You

If you are making a claim for refund, file an amended return within four

do not need to inform the FTB if the changes do not increase your California

years from the original due date of the return, or within one year from the

tax liability. If the changes made by the IRS result in a refund due, you must

date of overpayment, whichever period expires later.

file a claim within two years. Use Form 540X to make any changes to your

California income tax returns already filed, or send copies of the changes

together with your recomputation of California tax to:

Form 540X Instructions 2002 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4