Instructions For Form 8863 - Education Credits (American Opportunity And Lifetime Learning Credits) - 2010

ADVERTISEMENT

2010

Department of the Treasury

Internal Revenue Service

Instructions for Form 8863

Education Credits (American Opportunity and Lifetime Learning Credits)

You may be able to take the tuition and fees deduction

Section references are to the Internal Revenue Code unless

for you, your spouse, or a dependent, instead of an

otherwise noted.

TIP

education credit. Figure your tax both ways and choose

General Instructions

the one that gives you the lower tax. See Form 8917, Tuition

and Fees Deduction, and chapter 6 of Pub. 970, Tax Benefits

for Education, for more information about the tuition and fees

What’s New

deduction.

Midwestern disaster area. For 2010, the special benefits

Who Can Claim an Education Credit

available to students in a Midwestern disaster area have

expired.

You may be able to claim an education credit if you, your

spouse, or a dependent you claim on your tax return was a

Hope credit. The Hope credit is not available for 2010.

student enrolled at or attending an eligible educational

institution. The credits are based on the amount of qualified

Purpose of Form

education expenses paid for the student in 2010 for academic

periods beginning in 2010 and in the first 3 months of 2011.

Use Form 8863 to figure and claim your education credits,

which are based on qualified education expenses paid to an

Qualified education expenses must be reduced by any

eligible postsecondary educational institution. For 2010, there

!

expenses paid directly or indirectly using tax-free

are two education credits.

educational assistance. See Tax-Free Educational

CAUTION

•

The American opportunity credit, part of which may be

Assistance and Refunds of Qualified Education Expenses on

refundable. Complete Parts I, III, and IV.

page 2.

•

The lifetime learning credit, which is nonrefundable.

Who can claim a dependent’s expenses. If a student is

Complete Parts II and IV.

claimed as a dependent on another person’s tax return, only the

person who claims the student as a dependent can claim a

A refundable credit can give you a refund for any part of the

credit for the student’s qualified education expenses. If a

credit that is more than your total tax. A nonrefundable credit

student is not claimed as a dependent on another person’s tax

can reduce your tax, but any excess is not refunded to you.

return, only the student can claim a credit.

Generally, qualified education expenses paid on behalf of

Both of these credits have different rules that can affect your

the student by someone other than the student (such as a

eligibility to claim a specific credit. These differences are shown

relative) are treated as paid by the student. However, qualified

in Table 1 below.

education expenses paid (or treated as paid) by a student who

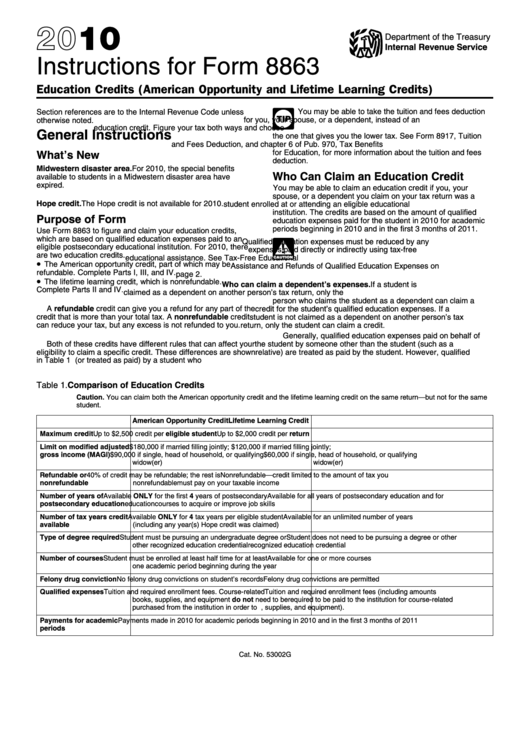

Table 1. Comparison of Education Credits

Caution. You can claim both the American opportunity credit and the lifetime learning credit on the same return — but not for the same

student.

American Opportunity Credit

Lifetime Learning Credit

Maximum credit

Up to $2,500 credit per eligible student

Up to $2,000 credit per return

Limit on modified adjusted $180,000 if married filling jointly;

$120,000 if married filling jointly;

gross income (MAGI)

$90,000 if single, head of household, or qualifying

$60,000 if single, head of household, or qualifying

widow(er)

widow(er)

Refundable or

40% of credit may be refundable; the rest is

Nonrefundable — credit limited to the amount of tax you

nonrefundable

nonrefundable

must pay on your taxable income

Number of years of

Available ONLY for the first 4 years of postsecondary

Available for all years of postsecondary education and for

postsecondary education

education

courses to acquire or improve job skills

Number of tax years credit Available ONLY for 4 tax years per eligible student

Available for an unlimited number of years

available

(including any year(s) Hope credit was claimed)

Type of degree required

Student must be pursuing an undergraduate degree or

Student does not need to be pursuing a degree or other

other recognized education credential

recognized education credential

Number of courses

Student must be enrolled at least half time for at least

Available for one or more courses

one academic period beginning during the year

Felony drug conviction

No felony drug convictions on student’s records

Felony drug convictions are permitted

Qualified expenses

Tuition and required enrollment fees. Course-related

Tuition and required enrollment fees (including amounts

books, supplies, and equipment do not need to be

required to be paid to the institution for course-related

purchased from the institution in order to qualify.

books, supplies, and equipment).

Payments for academic

Payments made in 2010 for academic periods beginning in 2010 and in the first 3 months of 2011

periods

Cat. No. 53002G

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4