Form Wh-13 - Withholding Instructions For Indiana State And County Income Taxes - Indiana Department Of Revenue

ADVERTISEMENT

Special Withholding Groups

Please see Information Bulletin #52 for more detailed

Electronic Funds Transfer (EFT)

Withholding Agents' Records

Withholding agents frequently contact the Department

information about Special Withholding Groups.

Any taxpayer may participate in the EFT program.

Every withholding agent is required to have a correct

of Revenue with questions about special requirements

This includes many taxpayers whose payments fall

listing of all employees (both residents and

Filing Status

for particular groups of employees. We have listed the

below the required threshold. However, Indiana

nonresidents). This list must contain the following

The Department will assign each new withholding agent

most common circumstances below:

taxpayers whose average withholding tax payments

information individually for each employee: whether

a filing status. This is based on the anticipated monthly

Part-time or Summer Employees: Withholding agents

during a twelve (12) month period exceed $10,000

they are employed by the month, week, day; and the

wages paid to Indiana employees. For existing

are required to withhold state and county income tax

monthly are required to make withholding payments

length of time covered by a normal pay period. Your

withholding agents, the Department annually reviews

from part-time or summer employees as though they

using EFT. For more information, contact the

records must also show all salaries, wages, tips, fees,

each withholding account and assigns the filing status

were full-time or permanent employees. This is true

Department's EFT Section at (317) 615-2695.

bonuses, and commissions paid to nonresidents for

based on the employer's preceding year's average

even if the IRS waives federal withholding requirements

services performed in Indiana.

monthly withholding.

Withholding Returns

or if the employee does not earn more than the $1,000

WH-1 Withholding agents assigned to a quarterly,

Withholding Agents' Statement to Taxpayers

Indiana exemption allowance.

If the withholding account's average monthly payments

monthly, or early filer filing status will be mailed a

Every withholding agent withholding tax from income

Casual Laborers, Domestic Employees, and

significantly increase or decrease over the course of

voucher packet containing the Indiana Employer's

must give each employee or nominee a statement of

Ministers: Withholding agents are not required to

the year, the filing status of the account will be changed.

Withholding Tax Returns, Form WH-1. This return

the amount of taxable income paid or credited and the

withhold state and county income tax from casual

The Department will notify you in writing (at the end

needs to be completed and mailed (postmarked) by

amount of state and county tax withheld. This is usually

laborers, some domestic employees, and ministers.

of the year) of the newly assigned filing status.

the appropriate due date and should include the total

shown on a Federal Form W-2 Wage and Tax Statement

However, because the income earned by these

amount withheld for that period.

or a Form WH-18. The employer should complete this

employees is subject to taxation, the employees may

form by providing the amount of state and county

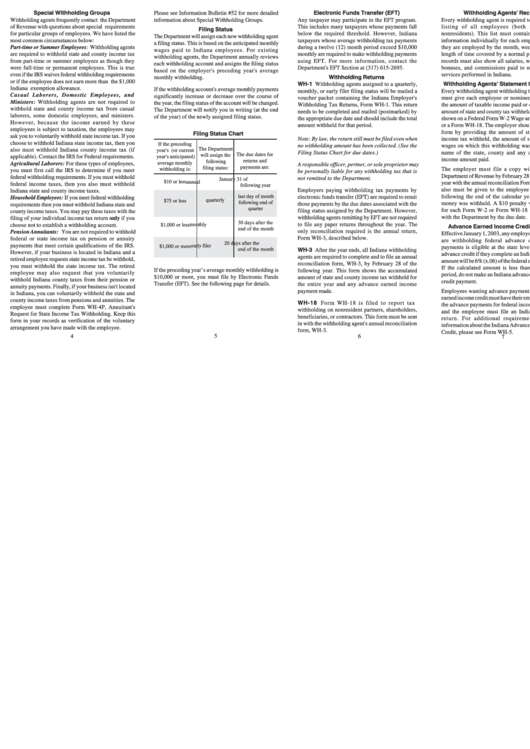

Filing Status Chart

ask you to voluntarily withhold state income tax. If you

Note: By law, the return still must be filed even when

income tax withheld, the amount of state and county

choose to withhold Indiana state income tax, then you

If the preceding

no withholding amount has been collected. (See the

wages on which this withholding was made, and the

The Department

also must withhold Indiana county income tax (if

year's (or current

Filing Status Chart for due dates.)

name of the state, county and any advance earned

The due dates for

will assign the

applicable). Contact the IRS for Federal requirements.

year's anticipated)

income amount paid.

returns and

following

average monthly

Agricultural Laborers: For these types of employees,

A responsible officer, pertner, or sole proprietor may

payments are:

filing status:

The employer must file a copy with the Indiana

withholding is:

you must first call the IRS to determine if you meet

be personally liable for any withholding tax that is

Department of Revenue by February 28 of the following

federal withholding requirements. If you must withhold

not remitted to the Department.

January 31 of

$10 or less

annual

year with the annual reconciliation Form WH-3. A copy

federal income taxes, then you also must withhold

following year

also must be given to the employee by January 31

Employers paying withholding tax payments by

Indiana state and county income taxes.

following the end of the calendar year in which the

last day of month

electronic funds transfer (EFT) are required to remit

Household Employees: If you meet federal withholding

quarterly

$75 or less

following end of

money was withheld. A $10 penalty will be assessed

those payments by the due dates associated with the

requirements then you must withhold Indiana state and

quarter

filing status assigned by the Department. However,

for each Form W-2 or Form WH-18 that is not filed

county income taxes. You may pay these taxes with the

with the Department by the due date.

withholding agents remitting by EFT are not required

filing of your individual income tax return only if you

30 days after the

monthly

to file any paper returns throughout the year. The

choose not to establish a withholding account.

$1,000 or less

Advance Earned Income Credit Payment

end of the month

only reconciliation required is the annual return,

Pension Annuitants: You are not required to withhold

Effective January 1, 2003, any employee for whom you

Form WH-3, described below.

federal or state income tax on pension or annuity

are withholding federal advance earned income

20 days after the

payments that meet certain qualifications of the IRS.

early filer

$1,000 or more

payments is eligible at the state level to receive the

end of the month

WH-3 After the year ends, all Indiana withholding

However, if your business is located in Indiana and a

advance credit if they complete an Indiana WH-5. This

agents are required to complete and to file an annual

retired employee requests state income tax be withhold,

amount will be 6% (x.06) of the federal advance amount.

reconciliation form, WH-3, by February 28 of the

you must withhold the state income tax. The retired

If the calculated amount is less than $1.00 per pay

If the proceding year’s average monthly withholding is

following year. This form shows the accumulated

employee may also request that you voluntarily

period, do not make an Indiana advance earned income

$10,000 or more, you must file by Electronic Funds

amount of state and county income tax withheld for

withhold Indiana county taxes from their pension or

credit payment.

Transfer (EFT). See the following page for details.

the entire year and any advance earned income

annuity payments. Finally, if your business isn't located

payment made.

Employees wanting advance payments of the Indiana

in Indiana, you can voluntarily withhold the state and

earned income credit must have their employer withhold

county income taxes from pensions and annuities. The

WH-18 Form WH-18 is filed to report tax

the advance payments for federal income tax purposes

employee must complete Form WH-4P, Annuitant's

withholding on nonresident partners, shareholders,

and the employee must file an Indiana income tax

Request for State Income Tax Withholding. Keep this

beneficiaries, or contractors. This form must be sent

return. For additional requirements and more

form in your records as verification of the voluntary

in with the withholding agent's annual reconciliation

information about the Indiana Advance Earned Income

arrangement you have made with the employee.

form, WH-3.

Credit, please see Form WH-5.

4

5

6

7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2