Form 6212-B - 2003 - Instructions For Completing Checksheet B - Employee Retirement Income Security

ADVERTISEMENT

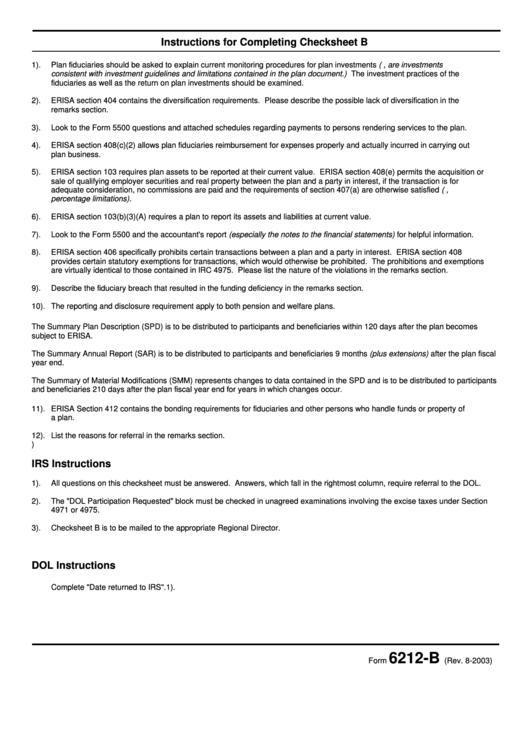

Instructions for Completing Checksheet B

1).

Plan fiduciaries should be asked to explain current monitoring procedures for plan investments (e.g., are investments

consistent with investment guidelines and limitations contained in the plan document.) The investment practices of the

fiduciaries as well as the return on plan investments should be examined.

2).

ERISA section 404 contains the diversification requirements. Please describe the possible lack of diversification in the

remarks section.

3).

Look to the Form 5500 questions and attached schedules regarding payments to persons rendering services to the plan.

4).

ERISA section 408(c)(2) allows plan fiduciaries reimbursement for expenses properly and actually incurred in carrying out

plan business.

5).

ERISA section 103 requires plan assets to be reported at their current value. ERISA section 408(e) permits the acquisition or

sale of qualifying employer securities and real property between the plan and a party in interest, if the transaction is for

adequate consideration, no commissions are paid and the requirements of section 407(a) are otherwise satisfied (i.e.,

percentage limitations).

6).

ERISA section 103(b)(3)(A) requires a plan to report its assets and liabilities at current value.

7).

Look to the Form 5500 and the accountant's report (especially the notes to the financial statements) for helpful information.

8).

ERISA section 406 specifically prohibits certain transactions between a plan and a party in interest. ERISA section 408

provides certain statutory exemptions for transactions, which would otherwise be prohibited. The prohibitions and exemptions

are virtually identical to those contained in IRC 4975. Please list the nature of the violations in the remarks section.

9).

Describe the fiduciary breach that resulted in the funding deficiency in the remarks section.

10).

The reporting and disclosure requirement apply to both pension and welfare plans.

The Summary Plan Description (SPD) is to be distributed to participants and beneficiaries within 120 days after the plan becomes

subject to ERISA.

The Summary Annual Report (SAR) is to be distributed to participants and beneficiaries 9 months (plus extensions) after the plan fiscal

year end.

The Summary of Material Modifications (SMM) represents changes to data contained in the SPD and is to be distributed to participants

and beneficiaries 210 days after the plan fiscal year end for years in which changes occur.

11).

ERISA Section 412 contains the bonding requirements for fiduciaries and other persons who handle funds or property of

a plan.

12).

List the reasons for referral in the remarks section.

)

IRS Instructions

1).

All questions on this checksheet must be answered. Answers, which fall in the rightmost column, require referral to the DOL.

2).

The "DOL Participation Requested" block must be checked in unagreed examinations involving the excise taxes under Section

4971 or 4975.

3).

Checksheet B is to be mailed to the appropriate Regional Director.

DOL Instructions

1).

Complete "Date returned to IRS".

6212-B

Form

(Rev. 8-2003)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1