Transmission Form

ADVERTISEMENT

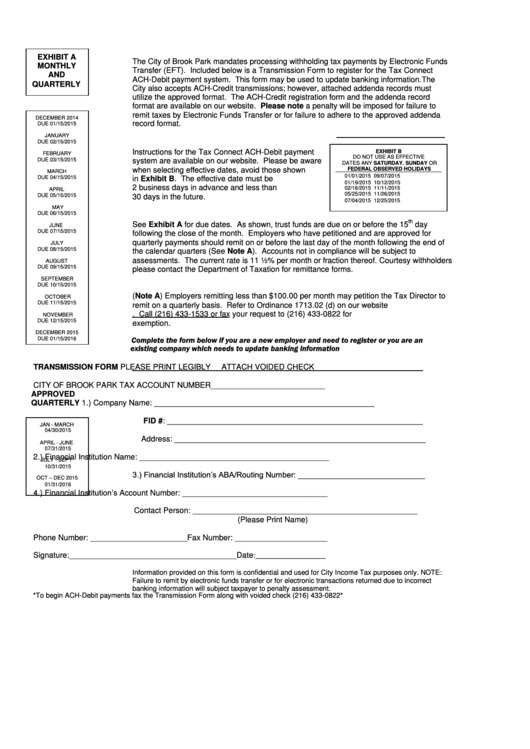

EXHIBIT A

The City of Brook Park mandates processing withholding tax payments by Electronic Funds

MONTHLY

Transfer (EFT). Included below is a Transmission Form to register for the Tax Connect

AND

ACH-Debit payment system. This form may be used to update banking information. The

QUARTERLY

City also accepts ACH-Credit transmissions; however, attached addenda records must

utilize the approved format. The ACH-Credit registration form and the addenda record

format are available on our website. Please note a penalty will be imposed for failure to

remit taxes by Electronic Funds Transfer or for failure to adhere to the approved addenda

DECEMBER 2014

record format.

DUE 01/15/2015

JANUARY

DUE 02/15/2015

Instructions for the Tax Connect ACH-Debit payment

EXHIBIT B

FEBRUARY

DO NOT USE AS EFFECTIVE

DUE 03/15/2015

system are available on our website. Please be aware

DATES ANY SATURDAY, SUNDAY OR

when selecting effective dates, avoid those shown

FEDERAL OBSERVED HOLIDAYS

MARCH

01/01/2015

09/07/2015

DUE 04/15/2015

in Exhibit B. The effective date must be

01/19/2015

10/12/2015

2 business days in advance and less than

02/16/2015

11/11/2015

APRIL

05/25/2015

11/26/2015

DUE 05/15/2015

30 days in the future.

07/04/2015

12/25/2015

MAY

DUE 06/15/2015

th

See Exhibit A for due dates. As shown, trust funds are due on or before the 15

day

JUNE

DUE 07/15/2015

following the close of the month. Employers who have petitioned and are approved for

quarterly payments should remit on or before the last day of the month following the end of

JULY

DUE 08/15/2015

the calendar quarters (See Note A). Accounts not in compliance will be subject to

assessments. The current rate is 11 ½% per month or fraction thereof. Courtesy withholders

AUGUST

DUE 09/15/2015

please contact the Department of Taxation for remittance forms.

SEPTEMBER

DUE 10/15/2015

(Note A) Employers remitting less than $100.00 per month may petition the Tax Director to

OCTOBER

DUE 11/15/2015

remit on a quarterly basis. Refer to Ordinance 1713.02 (d) on our website

. Call (216) 433-1533 or fax your request to (216) 433-0822 for

NOVEMBER

DUE 12/15/2015

exemption.

DECEMBER 2015

Complete the form below if you are a new employer and need to register or you are an

DUE 01/15/2016

existing company which needs to update banking information

TRANSMISSION FORM

PLEASE PRINT LEGIBLY

ATTACH VOIDED CHECK

CITY OF BROOK PARK TAX ACCOUNT NUMBER__________________________

APPROVED

QUARTERLY

1.) Company Name: __________________________________________________

FID #: __________________________________________________________

JAN - MARCH

04/30/2015

Address: _________________________________________________________

APRIL - JUNE

07/31/2015

2.) Financial Institution Name: ___________________________________________

JULY - SEPT

10/31/2015

3.) Financial Institution’s ABA/Routing Number: _____________________________

OCT – DEC 2015

01/31/2016

4.) Financial Institution’s Account Number: _________________________________

Contact Person: ___________________________________________________

(Please Print Name)

Phone Number: ______________________Fax Number: _____________________

Signature:______________________________________Date:__________________

Information provided on this form is confidential and used for City Income Tax purposes only. NOTE:

Failure to remit by electronic funds transfer or for electronic transactions returned due to incorrect

banking information will subject taxpayer to penalty assessment.

*To begin ACH-Debit payments fax the Transmission Form along with voided check (216) 433-0822*

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1